Utah Medical Products (UTMD): Profit Margin Decline Tests Defensive Bull Narratives

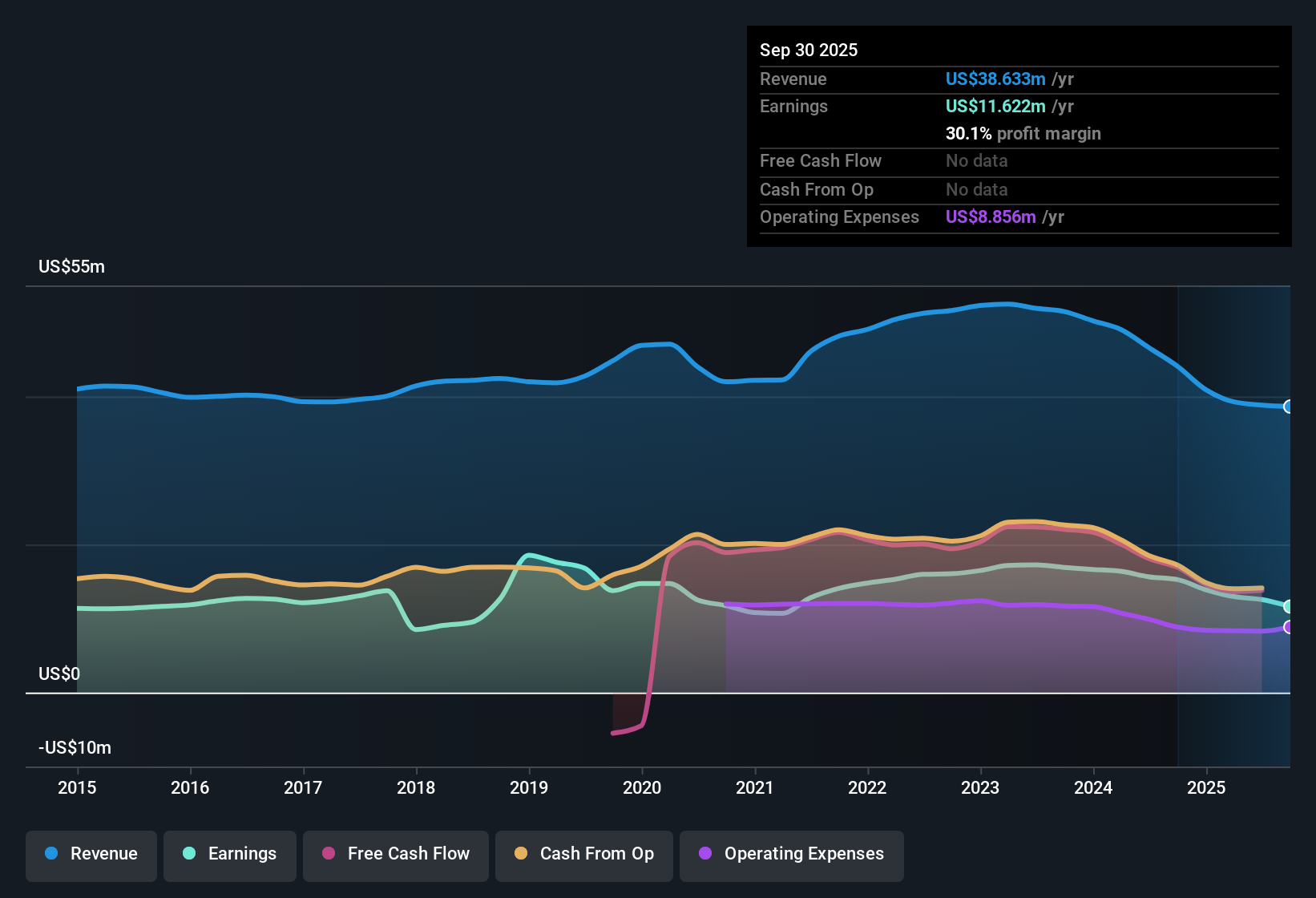

Utah Medical Products (UTMD) posted net profit margins of 30.1%, a step down from 34.6% last year, while average annual EPS growth over the past five years stands at 2.2%. The latest earnings cycle came in negative for growth, but the underlying quality of earnings remains strong and the stock trades at $60.43, well below its assessed fair value of $112.61.

See our full analysis for Utah Medical Products.Next up, we’ll see how these reported results stack up against the key narratives investors and the Simply Wall St community have been following, highlighting where perceptions meet reality and where surprises might emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Are Still High by Industry Standards

- Utah Medical Products' net profit margin lands at 30.1%, putting it significantly ahead of most medical device peers and well above the broader industry average, even after the fall from last year's 34.6%.

- The latest analysis underscores how such sustained margins support a steady, lower-risk approach, as the company is described as a stable and reliable medical device name with appealing fundamentals.

- Strong earnings quality helps back the case for those looking for resilience rather than high speculation in the sector.

- This defensive profile fits with what’s valued in the current medical device environment, with steady performance prized over short bursts of growth.

Valuation Gap: Market Price Lags DCF Fair Value

- The current share price of $60.43 is notably below the calculated DCF fair value of $112.61, suggesting a wide discount even after modest long-term EPS growth of 2.2% annually.

- Such a price gap heavily supports the angle that value-driven investors might see room for upside, as the company is recognized for trading well under its intrinsic valuation, in contrast to the industry trend where the average sector P/E is much higher at 30.3x.

- This tension between discounted market pricing and strong margin durability may act as a catalyst for renewed investor interest if sector sentiment remains stable.

- The fact that no material risks are identified further enhances the sense of a favorable risk-reward equation at these price levels.

Dividends Boost Defensive Appeal

- An attractive dividend, called out in the EDGAR summary, reinforces Utah Medical Products’ position as a good value within the sector, especially as the stock trades at a premium to a peer group average P/E of 12.3x but is cheaper than the industry overall.

- What’s surprising is how the blend of yield and low risk keeps drawing interest from defensively minded investors, with the company’s reputation for quality earnings making it a useful anchor during market turbulence.

- No major risks have been flagged, letting the defensive dividend appeal stand out even more against sector peers.

- Analysts highlight that steady dividends coupled with sustained profit margins create a compelling story amidst less predictable small-cap stocks.

Sentiment and numbers both suggest Utah Medical Products' combination of high profit margins, strong valuation support, and steady dividends aligns well with what many investors are seeking in today's defensive market environment.

Why Utah Medical Products could be great valueNext Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Utah Medical Products's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Utah Medical Products offers defensive appeal and robust margins, its earnings growth has lagged peers. This signals that long-term expansion may be more limited.

If consistent, reliable gains matter to you, use our stable growth stocks screener (2099 results) to find companies delivering steady growth in revenue and earnings year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com