Forrester Research (FORR): Deep Losses and 0.6% Revenue Growth Challenge Valuation Discount Narratives

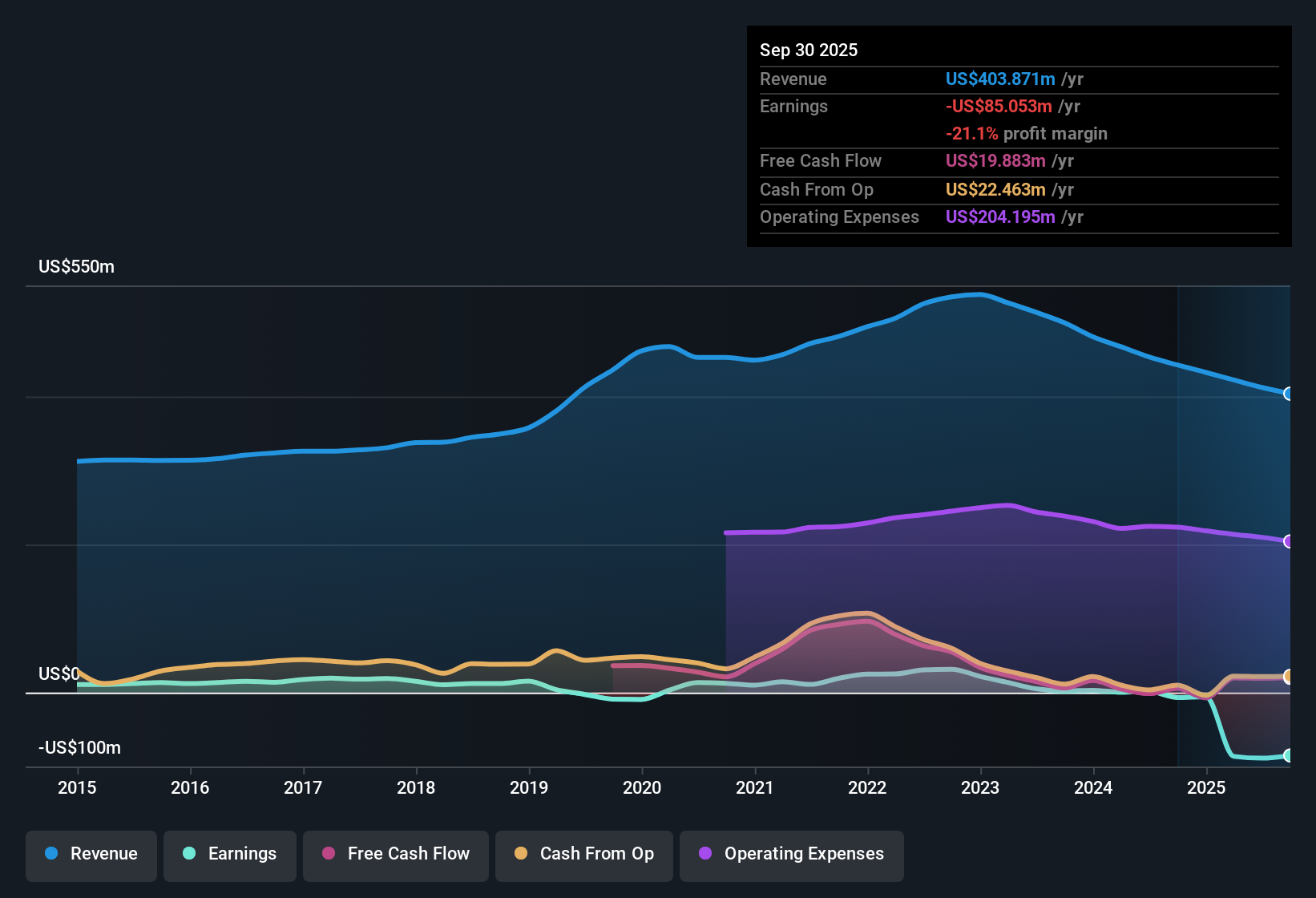

Forrester Research (FORR) is currently unprofitable, with losses increasing at a steep annual rate of 72.5% over the past five years. Forecasts show the company is not expected to return to profitability within the next three years, and revenue growth is projected at just 0.6% per year. This lags well behind the broader US market’s 10.3% annual rate. In this challenging environment, investors are left weighing the slow growth and deepening losses as key signals in the latest earnings cycle.

See our full analysis for Forrester Research.Now let’s see how these numbers compare to the broader narratives that have shaped market expectations. It is time to put the figures up against the community’s view and see where perceptions get confirmed or challenged.

See what the community is saying about Forrester Research

AI Research and Multiyear Deals Bolster Stability

- 72% of Forrester’s contract value now comes from multiyear agreements. This supports cash flow stability and reduces churn risk, even as the company faces top-line pressures.

- Analysts' consensus view highlights that the accelerating adoption of generative AI research tools and deeper coverage of digital transformation topics are giving Forrester increased leverage with clients. This has led to improved subscription growth and pricing power.

- Consensus narrative notes that innovative frameworks like the Total Experience Score have enabled longer contracts and stronger client retention.

- At the same time, new government contract wins and a 15% quarter-over-quarter increase in the sales pipeline point to revenue diversification and potential future stability, despite near-term declines.

Deep Relative Discount Signals Value Disconnect

- Forrester trades at a 0.3x price-to-sales ratio. This is well below the US professional services industry average of 1.3x and the peer average of 5.4x, suggesting the market reflects pessimism about future prospects.

- Analysts' consensus view underscores that while Forrester's DCF fair value is estimated at $14.55 and the analyst price target sits at $12.00, the current share price is just $7.13. This indicates a wide perceived discount. Consensus expects profitability and stability to improve if retention efforts and operational shifts are successful.

- The fair value gap is especially notable given the sector’s 10.3% annual growth benchmark, compared to Forrester’s much lower 0.6% forecasted pace.

- Consensus narrative suggests investors must consider whether deep discounts sufficiently compensate for slower growth, given analyst hopes for a turnaround in client engagement and margins.

Operational Pressures Continue to Weigh

- Operating expenses have declined by 6%, primarily due to a 12% reduction in headcount, as Forrester seeks to control losses and protect margins during ongoing sales and client retention challenges.

- Analysts' consensus view draws attention to sustained revenue declines across research, consulting, and events, including an 8% overall revenue drop year-over-year. This highlights substantial pressures on topline stability and raises important questions about the speed of potential recovery.

- Critics note that wallet retention and contract value have also slipped, down 1% and 7%, respectively, signaling ongoing client budget tightening driven by macroeconomic factors.

- Consensus narrative also notes that while the company's cost management efforts have supported margins, these measures could constrain capacity for innovation and limit long-term upside if trends do not reverse.

Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Forrester Research on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? Shape your own narrative in just a few minutes and share your perspective: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Forrester Research.

See What Else Is Out There

Forrester continues to struggle with falling revenue, deepening losses, and lagging growth. This makes its recovery prospects uncertain compared to stable industry peers.

If you’d prefer more predictable results, use our stable growth stocks screener (2102 results) to spot companies with a proven track record of steady gains through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com