JAKKS Pacific (JAKK) Margin Decline Challenges Bullish Narratives Despite Strong Earnings Outlook

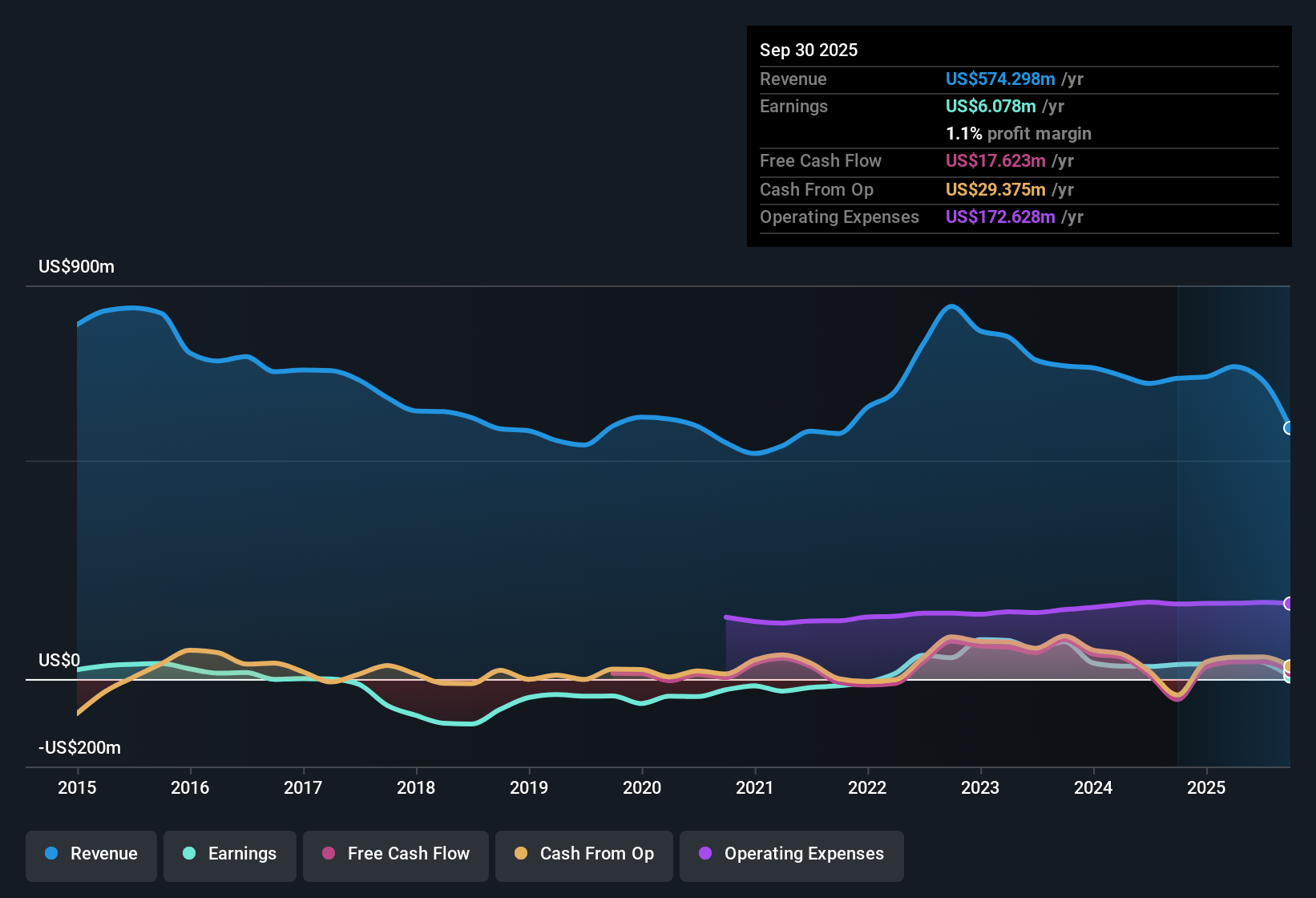

JAKKS Pacific (JAKK) reported net profit margins at 1.3%, a sharp pullback from last year’s 4.8%, as recent profitability turned negative year-on-year despite strong 31% average annual earnings growth over the past five years. Looking ahead, analysts are betting on a rebound with earnings forecast to jump 138.5% annually over the next three years, although revenue is only expected to grow 5.7% per year, trailing the broader US market. Margins have compressed and valuation is looking rich, with the stock trading at 25.7x earnings, above peer averages and fair value estimates. Investors are weighing that against the prospects of a major earnings recovery.

See our full analysis for JAKKS Pacific.The next section will break down how these headline numbers compare to the most widely held market narratives and where the recent results might upend expectations.

See what the community is saying about JAKKS Pacific

International Sales Surge 33% Year-to-Date

- International revenue grew 33% in the first half, far outpacing total company revenue growth and unlocking new avenues for geographic diversification.

- Analysts' consensus view highlights how expansion into Europe, which was up 65%, and new global markets aligns with JAKKS’ increasing partnerships with major entertainment licensors, such as Disney and Sega. This supports top-line growth even as US market growth cools.

- Consensus narrative notes supply chain flexibility and product innovation provide a buffer for international gains, helping mitigate some of the trade and cost risks the company faces.

- Even with US market headwinds, analysts believe this expansion helps diversify both revenue and margins, reducing exposure to single-market slowdowns.

See how JAKKS’ product lineup and global expansion stack up against consensus expectations. 📊 Read the full JAKKS Pacific Consensus Narrative.

Profit Margins Under Pressure from Licensing and Tariffs

- Analysts are projecting profit margins to shrink from 5.6% today to 2.2% over the next three years, reflecting persistent cost pressures from tariffs and higher royalties tied to licensed IP.

- Consensus narrative cautions that reliance on major brands and volatile cost structures remains a central risk for JAKKS, questioning whether supply chain diversification and operational discipline can fully offset external headwinds.

- Rising royalty rates for blockbuster titles and unpredictable global trade conditions have already contributed to the decline in net margin from 4.8% last year to 1.3% now.

- Bears argue that unless JAKKS can establish stronger proprietary brands and further stabilize costs, sustained margin compression may limit earnings visibility long term.

Premium Valuation Despite DCF Fair Value Gap

- With shares trading at 25.7x earnings, above both the global leisure sector average of 20.4x and JAKKS’ peer group at 25.3x, the stock commands a notable premium. The current price of $17.0 sits more than double the DCF fair value of $7.92.

- Consensus narrative raises the point that while analysts set a price target at $28.5, expectations for rapid international growth and effective cost management must be realized to justify the rich multiples, especially since modest revenue growth and margin pressure could challenge future upside.

- What’s surprising is that despite consensus forecasts for declining profits, the market and analysts still assign a higher value than fundamentals currently suggest.

- Industry optimism appears focused on JAKKS’ ability to adapt and capture global demand, though valuation risk increases if execution falls short of consensus projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for JAKKS Pacific on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the results? Share your outlook and shape your own story in just a few minutes. Do it your way

A great starting point for your JAKKS Pacific research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

JAKKS Pacific faces valuation concerns, with profit margins shrinking and shares trading at a notable premium, even as revenue growth remains modest and margin pressure continues.

If you’re looking for stronger value, use our these 833 undervalued stocks based on cash flows to discover companies that offer a better balance of fundamentals and future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com