Upbound Group (UPBD): $44 Million One-Off Loss Clouds Earnings Quality Despite Margin Growth Narrative

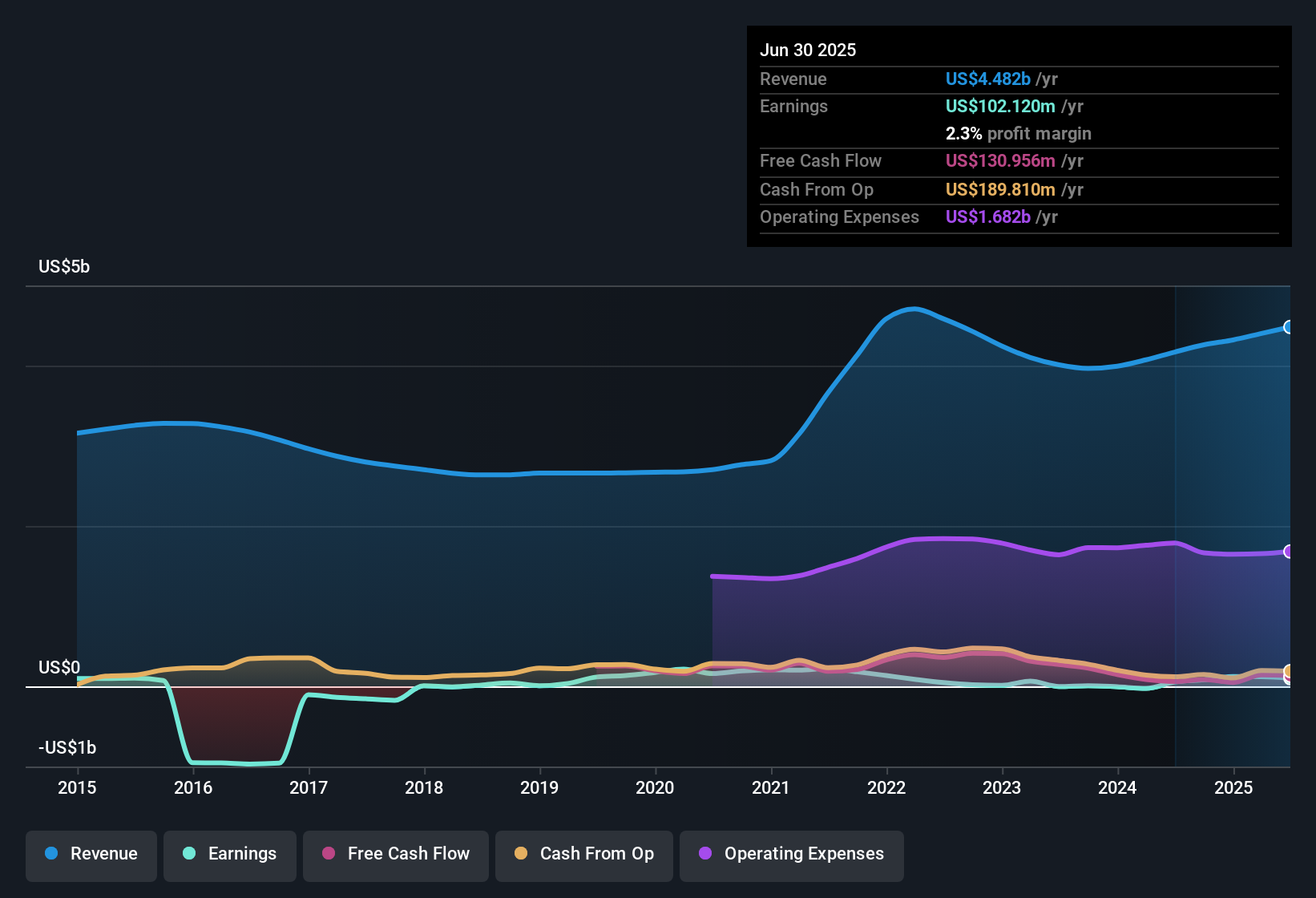

Upbound Group (UPBD) saw its earnings grow 4% over the past year, with a net profit margin of 1.8%, slightly below last year’s 1.9%. The latest period included a one-off loss of $44.2 million, which impacted reported EPS and earnings quality. While revenue is expected to grow 5.8% per year, slower than the broader US market forecast of 10.3%, analysts see annual earnings growth accelerating to 33.4%, outpacing the US market’s 15.9%. Shares are trading at $19.38, notably below the estimated fair value of $61.24 and at a price-to-earnings ratio of 13.3x, offering potential relative value versus peers.

See our full analysis for Upbound Group.Now, let’s see how these headline numbers measure up against the widely held narratives, where expectations match reality and where surprises emerge.

See what the community is saying about Upbound Group

Merchant Partnership Growth Drives Positive Margin Outlook

- Merchant partner expansion jumped 10% year over year, supported by new signings like Purple mattress and iFIT, which reinforces Upbound Group’s integration push and improves gross merchandise volume.

- Analysts' consensus view expects the broader merchant network and technology upgrades to widen both the customer base and underwriting accuracy.

- Recent additions of Acima’s Mastercard and Private Label cards through Concora are cited as catalysts for expanding financial access, which could accelerate revenue per merchant if adoption remains strong.

- Consensus narrative stresses that integrating Acceptance Now into Acima’s decision engine aims to lower lease charge-off rates. Analysts see this as critical for future margin improvement.

One-Off $44 Million Loss Clouds Dividends and Financial Health

- The latest year included a non-recurring $44.2 million loss, a rare charge that weighed on reported earnings and introduces caution over ongoing earnings quality.

- Analysts' consensus view draws attention to the impact of this one-time event, flagging risks around dividend sustainability and the company’s less-than-robust financial position.

- Consensus notes that persistent legal and regulatory challenges, most notably the Acima leasing lawsuit against the CFPB, may drive up costs and reduce operating flexibility, deepening pressure if further losses occur.

- Analysts worry that deterioration in macroeconomic conditions, such as rising unemployment, could amplify lease charge-offs, especially when paired with already thin net profit margins.

Valuation: Deep Discount to DCF Fair Value

- Shares are currently priced at $19.38, sitting well below the DCF fair value estimate of $61.24 and representing a significant discount versus both industry (16.5x) and peer (17.8x) average P/E ratios.

- Analysts' consensus view argues that the discounted price reflects a blend of uncertainty over steady profit margin gains and sharply accelerating annual earnings growth expectations of 33.4%, far above the US market’s 15.9%.

- Consensus stresses that for Upbound to meet the analyst price target of 32.38, earnings must climb from $81.2 million to $278.5 million by 2028, with sustained margin expansion. Both are considered achievable but depend on continued operational execution and partnership momentum.

- The current market pricing suggests skepticism; however, if profit and margin forecasts play out, the upside could be considerable given the 1.8% net margin today compared to the 5.8% targeted by analysts in three years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Upbound Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your viewpoint and shape the conversation in just a few minutes. Do it your way

A great starting point for your Upbound Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Upbound Group faces pressure from one-off losses, legal risks, and thin profit margins. These factors cast doubt over ongoing dividend reliability and financial resilience.

If you want peace of mind with sturdier finances, discover companies with stronger foundations and robust balance sheets by starting your search with solid balance sheet and fundamentals stocks screener (1984 results) today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com