Is CVR Partners Set for Growth After Fertilizer Industry Rally and 60% Stock Surge?

- Wondering whether CVR Partners stock could be undervalued, overvalued, or finally primed for something big? You are definitely not alone in wanting to figure out whether now is the right time to take a closer look.

- The stock has not just stayed afloat but surged, climbing 1.3% in the last week, 5.0% over the past month, and a staggering 60.2% in the past year. This performance has made many investors sit up and pay attention.

- Recent news around the fertilizer industry, such as shifting global commodity prices and tightening supply chains, has put the spotlight on companies like CVR Partners. These headlines have fueled both optimism about future profits and concerns about how long current trends will last.

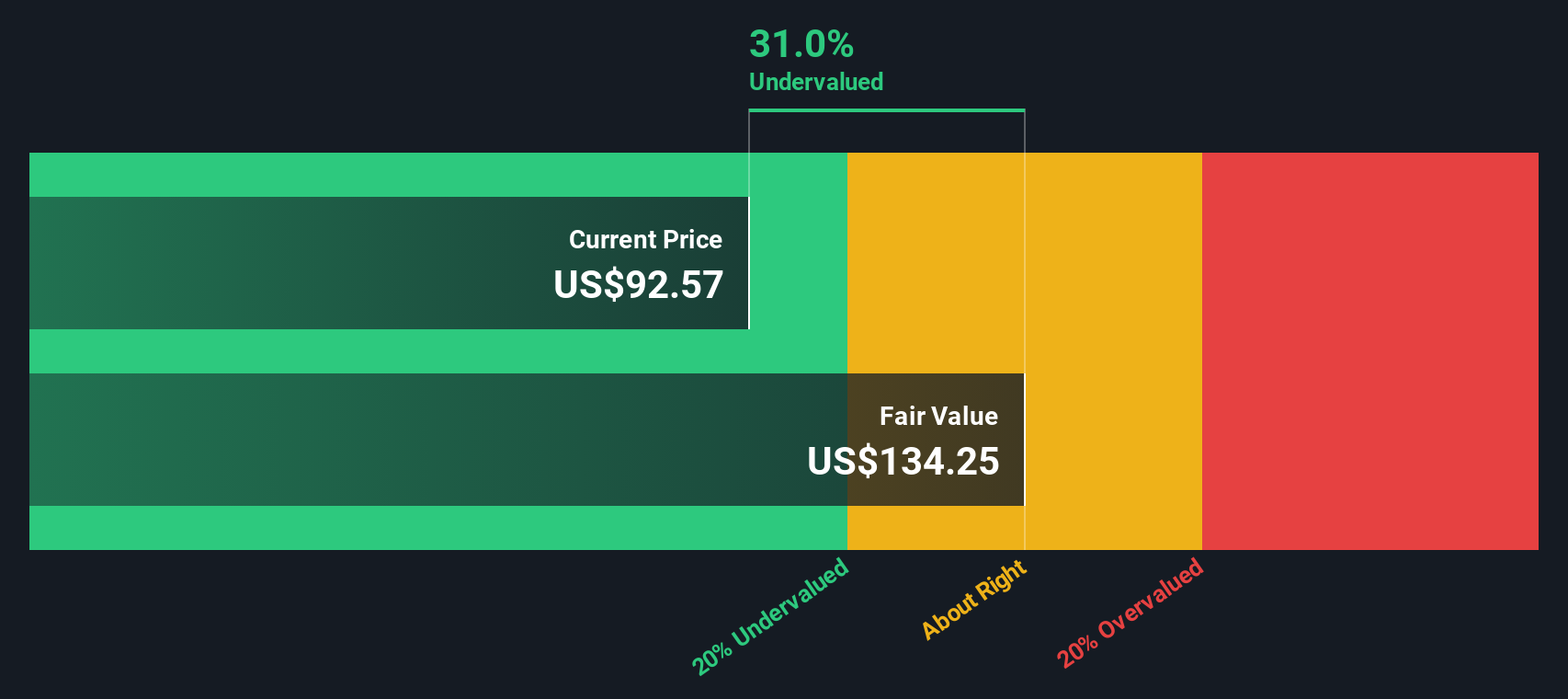

- According to our valuation checks, CVR Partners scores a 4 out of 6 for being undervalued. There is definitely more to unpack here about how this score is calculated, and the real story behind valuation could be even more interesting by the time we are done.

Approach 1: CVR Partners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach gives investors a sense of what the business could be worth based on its ability to generate cash over time.

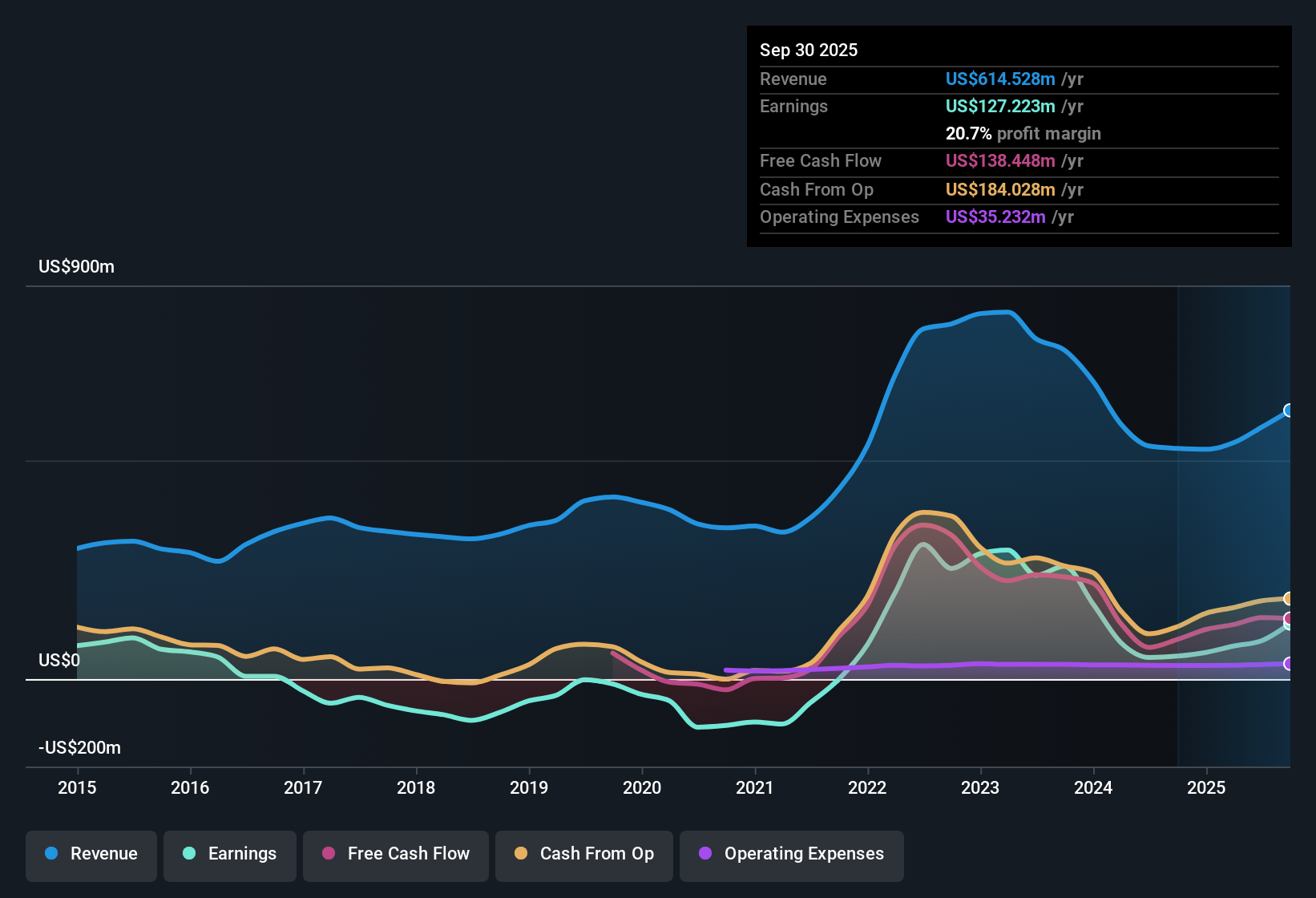

For CVR Partners, the DCF model starts with its latest free cash flow of $154.43 million. Over the next five years, analysts expect free cash flow to decline slightly each year, with additional projections by Simply Wall St extending out to 2035. By 2035, free cash flow is estimated to reach $117.80 million, following several years of modest declines and a return to low growth in the later years. All projections are in dollars and based on the 2 Stage Free Cash Flow to Equity model.

After all these projections are discounted back to their present value, the model estimates CVR Partners' fair value at $166.22 per share. Given the calculations, this reflects a 43.0% discount, suggesting the stock is materially undervalued relative to its intrinsic value based on current forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CVR Partners is undervalued by 43.0%. Track this in your watchlist or portfolio, or discover 831 more undervalued stocks based on cash flows.

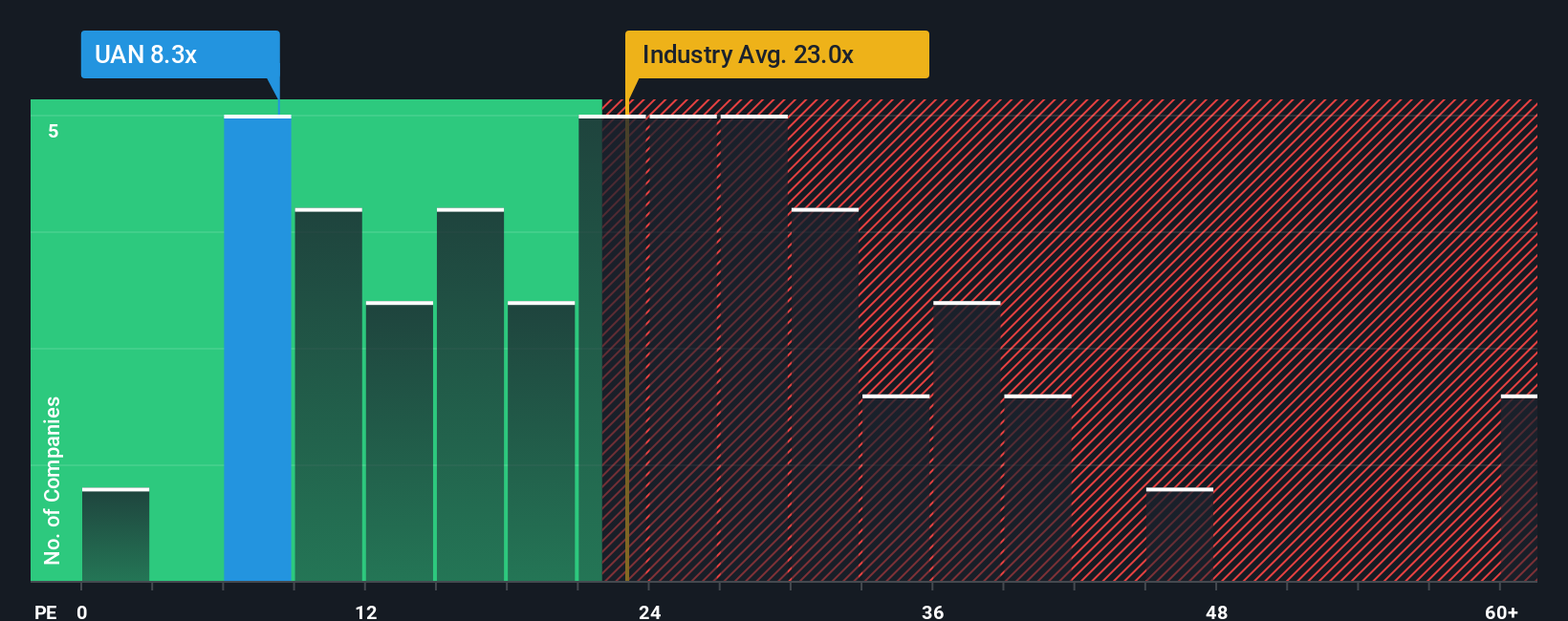

Approach 2: CVR Partners Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it directly connects a firm’s stock price to its earnings power. For investors, a lower PE often means the stock could be trading at a bargain, while a higher PE suggests the market has strong growth expectations or sees lower risks.

CVR Partners currently trades at a PE ratio of 7.87x. This stands out against the Chemicals industry average of 25.85x and the company’s peer average of 25.19x. Such a significant discount may reflect cautious market expectations or company-specific risks, but it also catches the eye of value-seeking investors.

Simply Wall St introduces the “Fair Ratio” as a more nuanced benchmark. Unlike a straight peer or industry comparison, the Fair Ratio weighs multiple factors including a company’s earnings growth, profit margins, risk profile, industry characteristics, and market size. This means it adapts to the real-world context in which CVR Partners operates, aiming to reflect what would be a rational multiple for the stock given its specific circumstances. By focusing on the Fair Ratio rather than just averages, investors can make more informed decisions that account for unique strengths and risks.

Comparing CVR Partners’ actual PE of 7.87x to its Fair Ratio, the difference between the two is less than 0.10, suggesting the stock is trading almost precisely in line with what might be expected based on its risk and growth profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CVR Partners Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Think of a Narrative as your personalized investment story—a way to connect your view of a company’s future to the numbers, by combining your assumptions about revenue, earnings, and margins with your own fair value estimate.

Narratives make investing more meaningful by linking the company’s story to real financial forecasts and a calculated fair value. This approach is built into Simply Wall St’s platform on the Community page, making it easy and accessible for anyone to create, share, and compare Narratives, just as millions of investors already do.

The power of Narratives lies in helping you decide when to buy or sell by clearly comparing your fair value to the current share price. They automatically update in response to new information, such as news or earnings, keeping your investment thesis relevant and actionable.

For CVR Partners, one investor’s Narrative might foresee robust demand and future upside, leading to the highest fair value projections. Another may be concerned about industry risks and forecast a much lower value, all expressed transparently and ready for comparison.

Do you think there's more to the story for CVR Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com