A Look at Preformed Line Products's Valuation Following Q3 Sales Surge and Balance Sheet De-Risking (PLPC)

Preformed Line Products (PLPC) just posted a 21% jump in third quarter net sales, fueled by gains in energy and communications markets and a boost from the JAP Telecom acquisition. The company’s results reflect real operational momentum.

See our latest analysis for Preformed Line Products.

The momentum in Preformed Line Products’ core business helped fuel a 65% year-to-date share price return, with its 1-year total shareholder return climbing to 69%. After a volatile week, the long-term trajectory shows accelerating performance and renewed investor confidence.

If the recent earnings surge got you thinking about tomorrow’s leaders, it is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

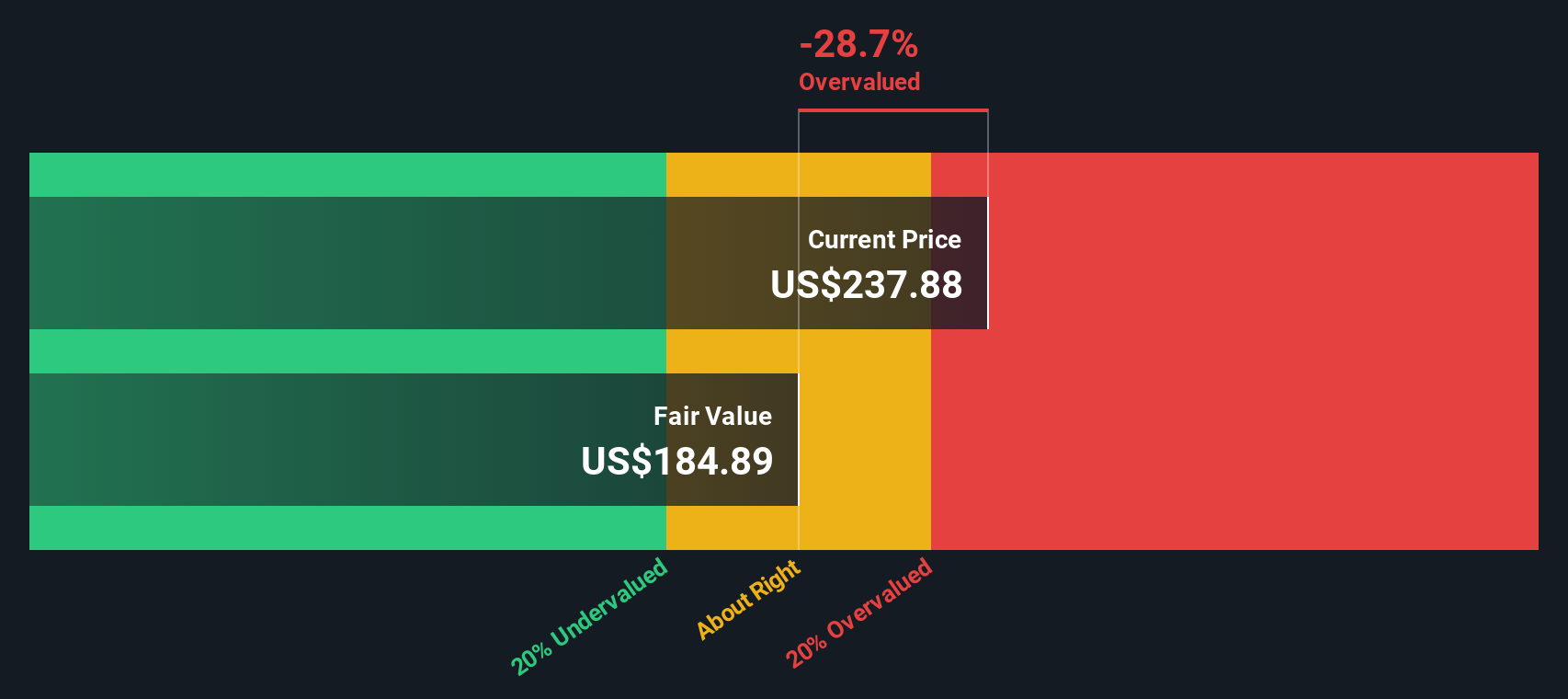

With shares soaring and strong revenue growth on the books, investors now face a critical question: is Preformed Line Products still undervalued, or has the market already priced in its future growth prospects?

Price-to-Earnings of 27.9x: Is it justified?

Preformed Line Products is currently trading at a price-to-earnings (P/E) ratio of 27.9x, which puts its valuation below the US Electrical industry average of 31.8x. At a last close of $212.11, the market values PLPC at a discount to its sector on this metric.

The price-to-earnings ratio measures how much investors are paying for each dollar of the company’s earnings. For a business like PLPC, which has shown consistent profit growth, the P/E provides a snapshot of how the market values that growth potential relative to peers.

With PLPC’s P/E below the industry average, the market is placing a lower value on each dollar of its current earnings than on its peers. This could suggest PLPC is undervalued compared to similar companies, especially given its strong year-over-year earnings momentum. The peer comparison supports the idea that there may be more headroom for the stock if earnings projections are met. When comparing to the estimated fair P/E of 25.3x, the current multiple is still somewhat ahead, which could act as a ceiling or a magnet for future valuation shifts.

Explore the SWS fair ratio for Preformed Line Products

Result: Price-to-Earnings of 27.9x (UNDERVALUED)

However, investor enthusiasm could cool if earnings momentum slows or if PLPC misses targets because of changing market conditions in the coming quarters.

Find out about the key risks to this Preformed Line Products narrative.

Another View: What Does the SWS DCF Model Say?

Looking through the lens of our DCF model, a different picture emerges. Based on estimated future cash flows, Preformed Line Products is trading above our fair value estimate of $182.70. This suggests the shares appear overvalued from this perspective. Does this signal caution, or are current growth trends enough to justify the premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Preformed Line Products for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Preformed Line Products Narrative

If you want to dig deeper or chart your own course with the numbers, it's quick and easy to do your own analysis and shape your perspective. So why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Preformed Line Products.

Looking for More Investment Ideas?

Ready to seize your next opportunity? Don’t let potential winners pass you by. Use these handpicked tools to spot fresh stocks and sectors on the move.

- Uncover unique value by scanning for companies that could be trading below their true worth through these 839 undervalued stocks based on cash flows. This gives you an edge on hidden bargains.

- Target passive income by selecting these 22 dividend stocks with yields > 3%, focusing on firms with robust dividend yields to potentially strengthen your portfolio’s cash flow.

- Get ahead of trends in artificial intelligence and healthcare with these 33 healthcare AI stocks. This reveals innovative businesses driving the medical technology frontier.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com