Custom Truck One Source (CTOS): Evaluating Valuation Following Improved Revenue and Updated Full-Year Outlook

Custom Truck One Source (CTOS) just posted its latest quarterly earnings, reporting higher revenue and a smaller net loss compared to last year. The company also reaffirmed its outlook for full-year revenue, keeping investors focused on what lies ahead.

See our latest analysis for Custom Truck One Source.

After a strong jump in revenue and a tightening net loss, Custom Truck One Source’s stock has seen some dramatic swings. The share price has gained 21.7% year-to-date, but experienced a sharp pullback over the past week. While the momentum may have cooled recently, the 1-year total shareholder return of 46.2% shows that patient investors have been well rewarded, even as short-term traders navigate more volatility.

If you’re looking for what else might be gathering steam among capital goods stocks, consider broadening your search and discover fast growing stocks with high insider ownership

With shares recently pulling back and the company trading close to analysts’ price targets, the big question for investors is whether Custom Truck One Source remains undervalued or if the market has already accounted for expected growth.

Most Popular Narrative: 22.3% Undervalued

The most widely followed narrative puts Custom Truck One Source’s fair value at $7.58 per share, which is over 20% above the last close of $5.89. The story hinges on ambitious growth and margin recovery, setting expectations for a re-rating that few stocks in this sector can match.

Strategic and ongoing investments expanding the rental fleet and maintaining high utilization rates (above 75%) are increasing recurring revenue and providing margin stability, supporting consistent adjusted EBITDA growth and improved free cash flow generation.

Want to see what is powering this valuation? The narrative is banking on a sharp earnings turnaround, a bold profit margin recovery, and a future multiple usually reserved for tech darlings. Which key business drivers and financial forecasts are behind these expectations? Click through to uncover the full story and see where the real value might lie.

Result: Fair Value of $7.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin pressures from lower rental asset sales and potential setbacks in utility infrastructure demand could disrupt profit growth for Custom Truck One Source.

Find out about the key risks to this Custom Truck One Source narrative.

Another View: Multiples Tell a Different Story

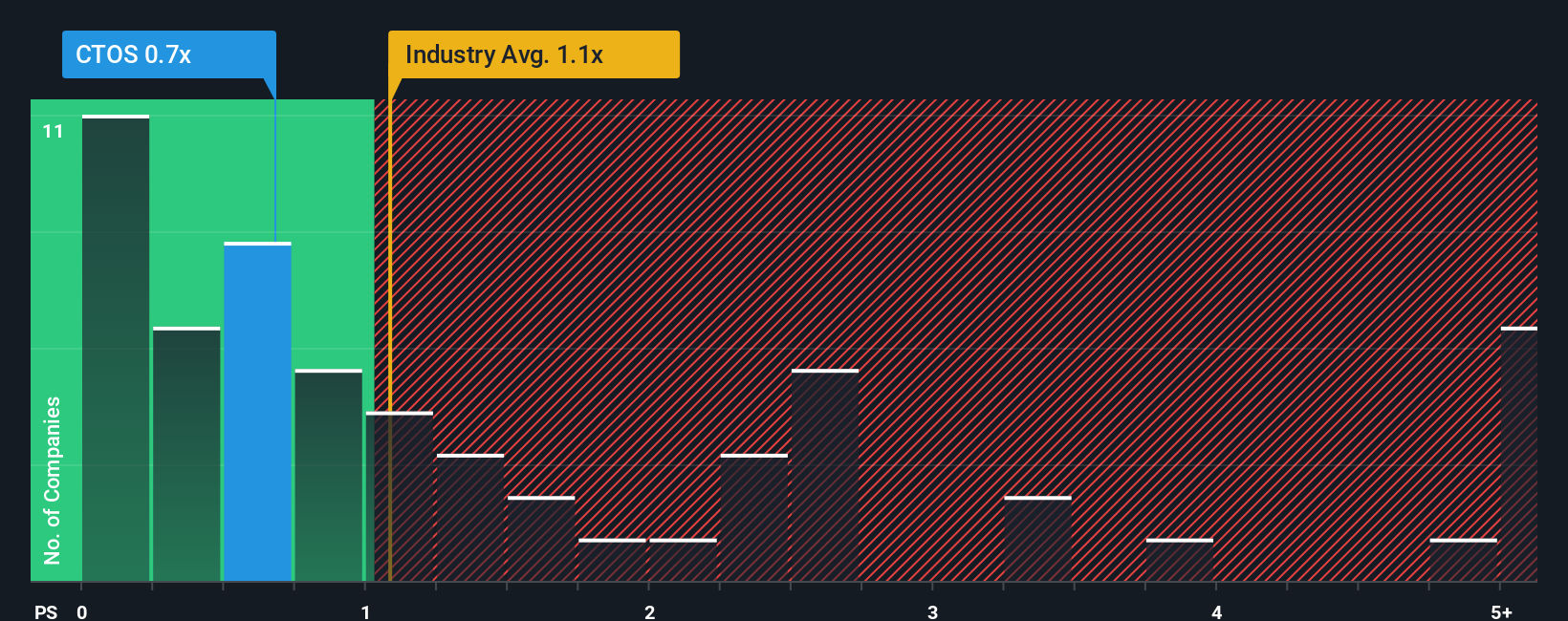

Looking at Custom Truck One Source through its price-to-sales ratio of 0.7x, the company appears better valued than the US Trade Distributors industry average of 1.1x and aligns closely with its fair ratio of 1x. This gap hints at a value opportunity, but will the market recognize it?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Custom Truck One Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Custom Truck One Source Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can easily construct your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Custom Truck One Source.

Looking for more investment ideas?

Don’t let your next great opportunity slip by. Use these expert tools to target sectors and trends other investors are missing out on.

- Target strong returns from market inefficiencies when you analyze these 840 undervalued stocks based on cash flows with cash flow metrics most overlook.

- Spot rising stars in medicine and biotech by jumping into these 33 healthcare AI stocks already using artificial intelligence to transform patient outcomes.

- Lock in stable income streams as you review these 22 dividend stocks with yields > 3%, highlighting companies yielding over 3% and rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com