Why St. Joe (JOE) Is Up 11.5% After Dividend Hike and Record Real Estate Earnings

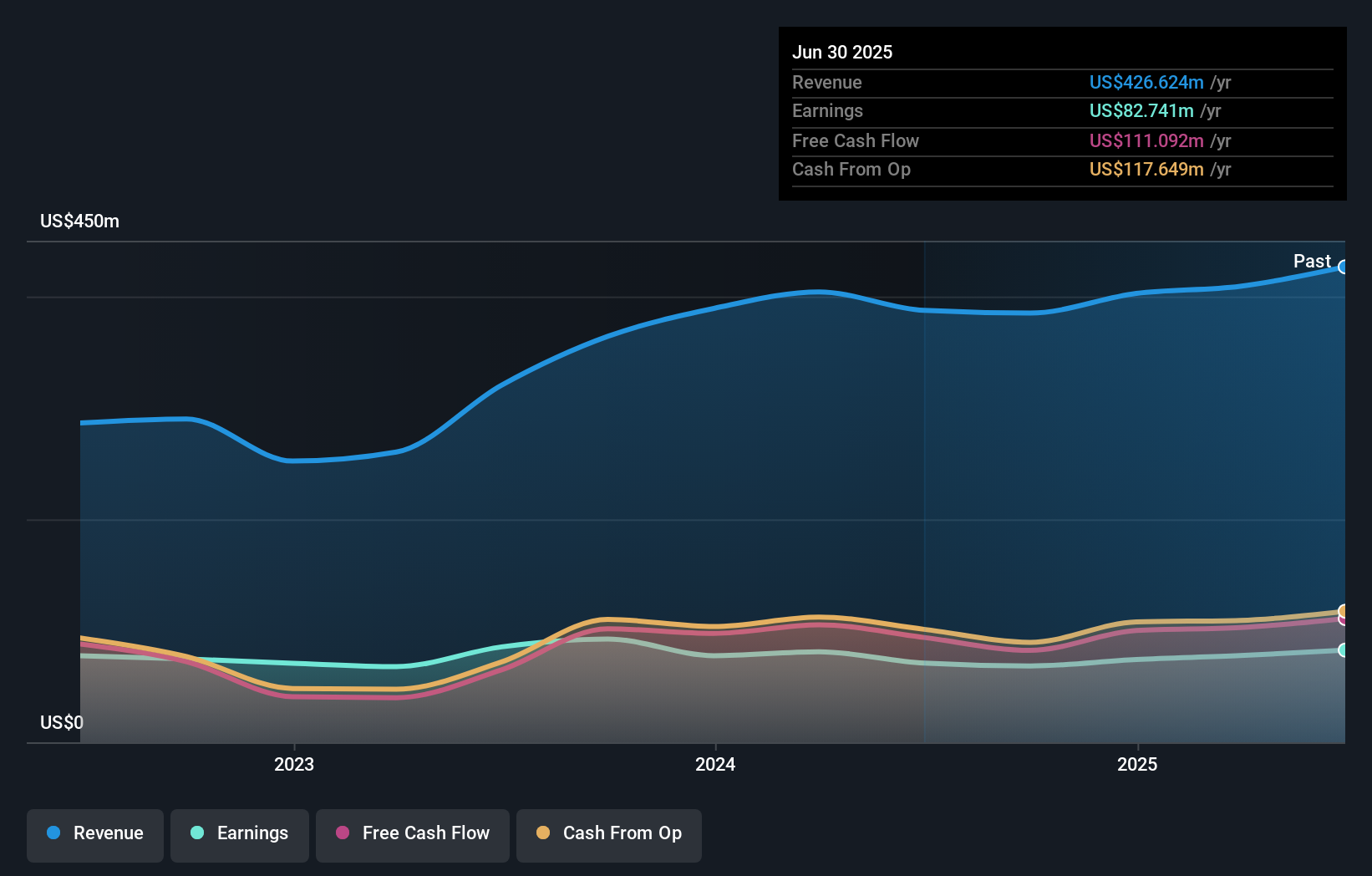

- The St. Joe Company recently reported third quarter 2025 earnings, highlighting strong revenue of US$161.08 million and net income of US$38.71 million, alongside a 14% increase in its quarterly dividend to US$0.16 per share.

- An interesting aspect of this announcement is the significant growth in residential real estate revenue and record hospitality and leasing performance, supported by active capital management including share buybacks and strategic property sales.

- We'll explore how robust earnings growth and a higher dividend influence St. Joe Company's investment narrative, especially given its residential real estate momentum.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is St. Joe's Investment Narrative?

For a shareholder in St. Joe Company, the core idea is believing in the long-term value of its diversified real estate and hospitality assets throughout Northwest Florida, as well as management’s ability to unlock this value through disciplined capital allocation. The most recent results mark an upward shift in short-term catalysts: surging residential real estate revenue, a record quarter for leasing and hospitality, and visible returns to shareholders with a 14% dividend boost and further share repurchases provide tangible evidence of operational momentum. The announcement of strong revenue and net income growth, combined with active capital management, might ease immediate concerns about the company’s high valuation and debt levels, at least in the near term. However, the shares’ price surge after earnings implies that execution risk remains front and center. With ambitious growth plans, St. Joe is still sensitive to interest rate movements, Florida-specific risks, and the sustainability of migration into its core geographies, all of which could reshape outcomes if conditions change. This recent performance narrows some risks but doesn’t remove them, and the drivers of future growth still hinge on these underlying trends proving resilient.

On the flip side, concentrated exposure to the Northwest Florida region is still a real consideration for shareholders.

Exploring Other Perspectives

Explore another fair value estimate on St. Joe - why the stock might be worth just $80.19!

Build Your Own St. Joe Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St. Joe research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free St. Joe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St. Joe's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com