Will CTOS's Reaffirmed Outlook Outweigh Q3 Miss and Shape Investor Confidence in Custom Truck One Source?

- Custom Truck One Source reported its third quarter and nine-month results for the period ended September 30, 2025, showing third-quarter revenue of US$482.06 million and a net loss of US$5.76 million from continuing operations.

- Despite lower-than-expected third-quarter results, the company reaffirmed its full-year 2025 revenue outlook, indicating management's confidence in its operating trajectory.

- We will now examine how missing analyst expectations for the quarter may reshape the company’s investment narrative and outlook for earnings recovery.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Custom Truck One Source Investment Narrative Recap

To be a shareholder in Custom Truck One Source today, you need to believe in the company’s ability to capture growing demand for utility infrastructure and grid modernization, despite its uneven profitability and high leverage. The recent third-quarter miss weighed on short-term sentiment, but management’s reaffirmed 2025 revenue outlook suggests they still view their core growth drivers as intact. The immediate catalyst remains visibility into sustained top-line growth, while the key risk is persistent gross margin pressure, particularly given the recent shift toward lower-margin rental asset sales.

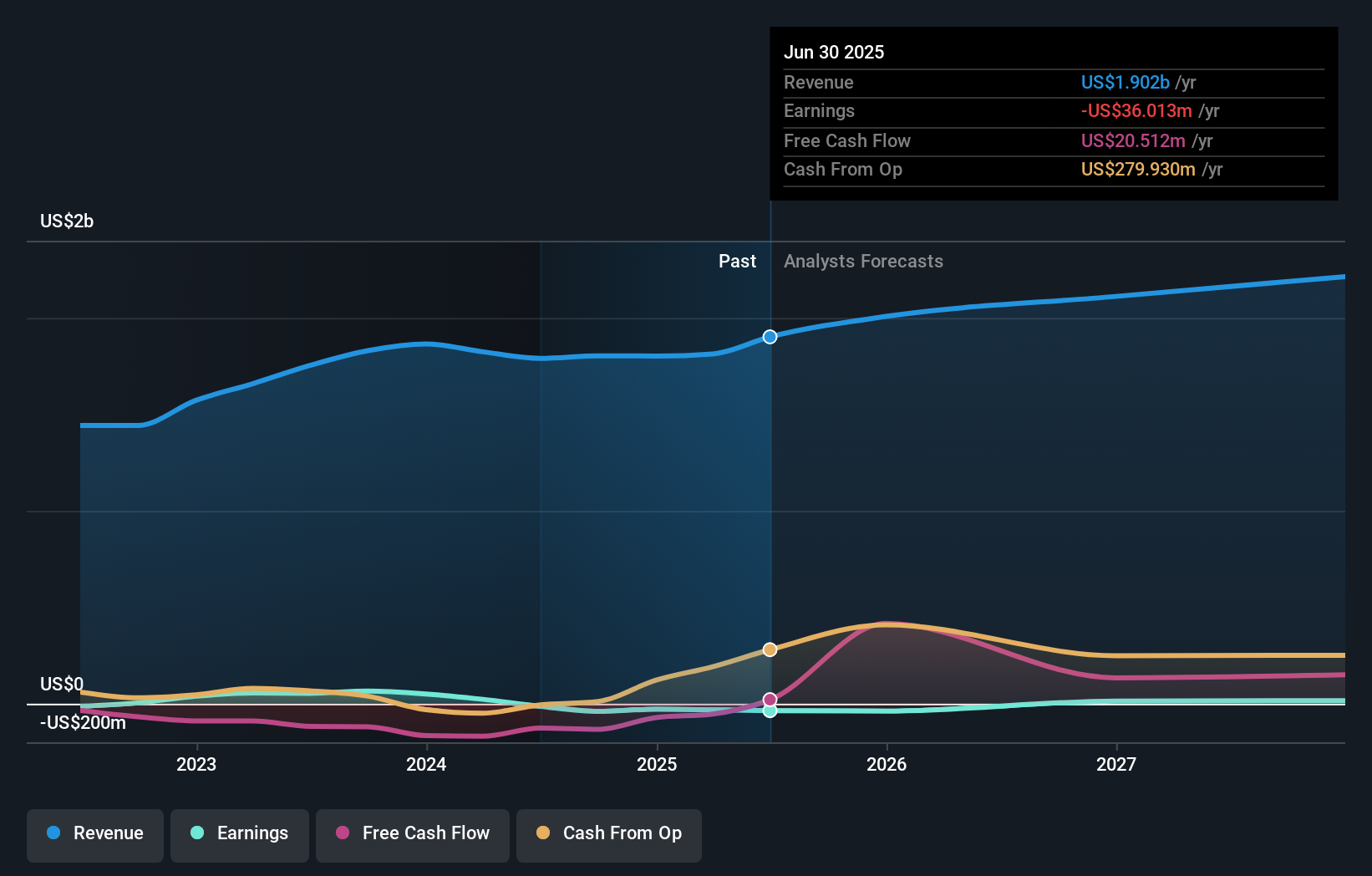

The most relevant announcement in the context of the earnings miss is the reaffirmation of full-year revenue guidance at US$1,970 million to US$2,060 million. This signals that, at least for now, the weaker quarter has not prompted management to alter its official view of the company’s full-year revenue trajectory, keeping investors’ focus on whether margin trends and order flow can support a return to profitability.

In contrast, investors should be aware that backlog declines are emerging as a potential risk factor...

Read the full narrative on Custom Truck One Source (it's free!)

Custom Truck One Source's narrative projects $2.3 billion in revenue and $28.6 million in earnings by 2028. This requires 6.6% yearly revenue growth and a $64.6 million increase in earnings from the current -$36.0 million.

Uncover how Custom Truck One Source's forecasts yield a $7.58 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates ranging from US$5.50 to US$7.58 per share. This spread comes as margin pressures remain a key focus for Custom Truck One Source, which could affect long-term returns; explore how other individual investors are interpreting these challenges and opportunities.

Explore 2 other fair value estimates on Custom Truck One Source - why the stock might be worth as much as 31% more than the current price!

Build Your Own Custom Truck One Source Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Custom Truck One Source research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Custom Truck One Source research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Custom Truck One Source's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com