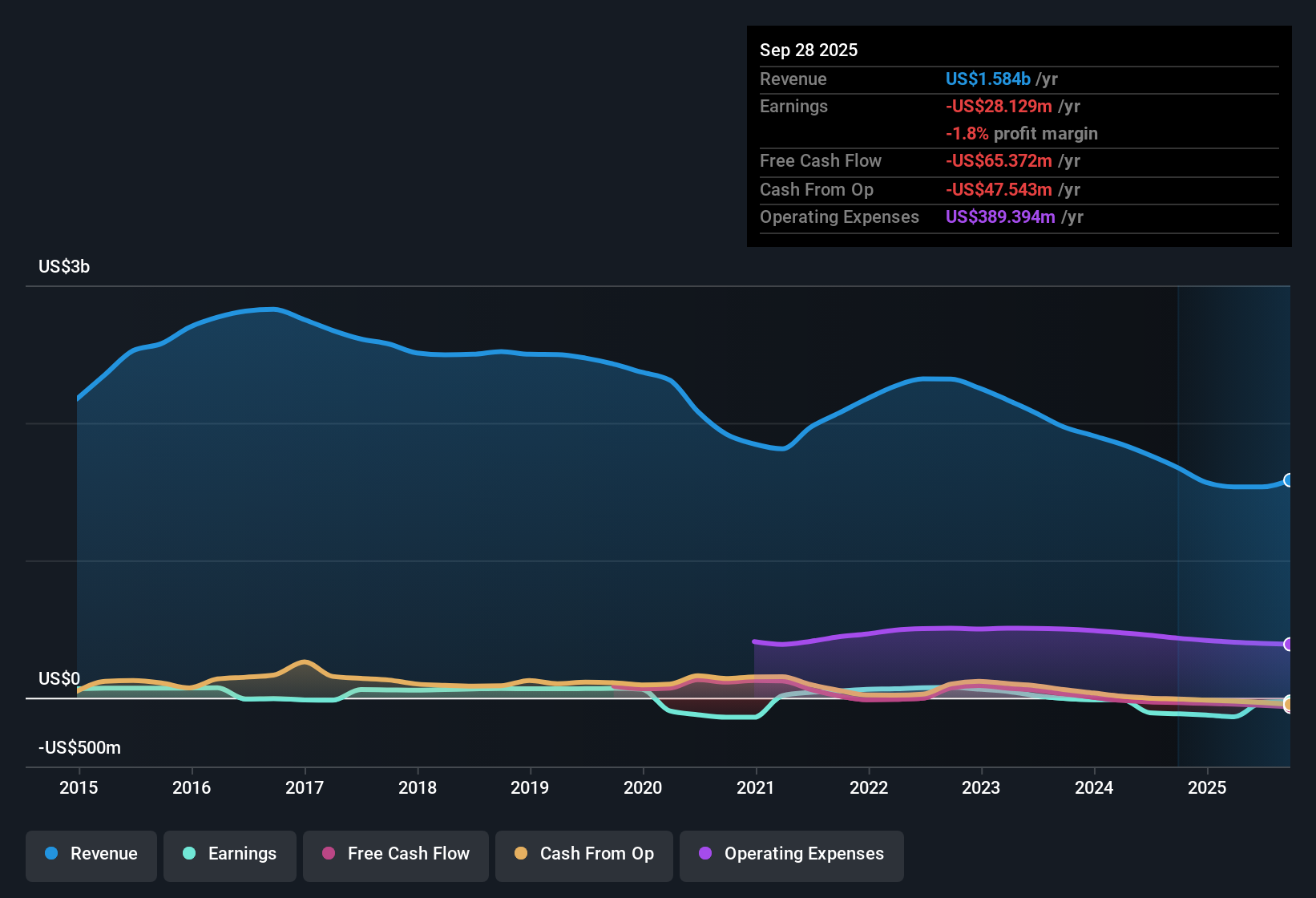

TrueBlue (TBI): Losses Worsen 23.3% Annually, Discounted Valuation Fuels Turnaround Debate

TrueBlue (TBI) remains unprofitable, with losses mounting at an average rate of 23.3% per year over the past five years and no signs of improvement in its net profit margin. Revenue is forecast to grow at 5.3% per year, which trails the broader US market’s expected growth of 10.5% per year. Despite recent struggles, analysts project that TrueBlue could swing to profitability within three years, with earnings forecast to surge by an eye-catching 175.42% annually. This could set the stage for a possible turnaround story.

See our full analysis for TrueBlue.Next, we put these earnings results to the test against the narratives that have shaped market sentiment. Let’s see which numbers back up expectations and which might stir debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Average 23.3% Per Year

- TrueBlue's net profit margin has stayed negative, with annual losses increasing at an average rate of 23.3% over the last five years. This highlights a persistent challenge to sustainable profitability.

- What’s notable is that despite the company staying in the red, the upbeat outlook centers on potential upside from an expected annual earnings growth of 175.42%.

- This ambitious turnaround targets profitability within the next three years and leans on top-line growth, which, while only 5.3% annually, could fuel a dramatic recovery.

- The prevailing expectation is that operational leverage could drive a significant swing if the cost structure can be managed, which contrasts sharply with the recent historic trend of mounting losses.

Price-to-Sales Ratio at Just 0.1x

- TrueBlue trades at a price-to-sales multiple of just 0.1x, far below the US Professional Services industry average of 1.3x. This points to a major discount relative to sector peers.

- The bullish case rests heavily on this discount, suggesting that if earnings forecasts are met, the current valuation gap could close rapidly.

- The sizable difference in multiples means even modest progress toward profitability could trigger outsized share price gains compared to more expensive competitors.

- With the stock priced considerably below the DCF fair value of $79.62, the upside potential appears much greater than the downside risk if TrueBlue delivers.

DCF Fair Value Implies Huge Upside

- DCF fair value is estimated at $79.62, nearly fifteen times the current share price of $5.49, which suggests a substantial intrinsic value gap.

- Instead of racing ahead, the market’s caution is shaped by TrueBlue’s track record of unprofitability, and the future reward depends on its ability to quickly reverse margin trends.

- The gap between current price and DCF fair value underscores how much the next few years’ execution will matter for closing this valuation disconnect.

- Investors may weigh the historical pattern of losses against the prospect of dramatically accelerating earnings before bidding up the stock to fair value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TrueBlue's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite promising forecasts, TrueBlue’s persistent losses and inconsistent top-line growth raise concerns about its ability to deliver reliable performance year after year.

If you want to focus on companies with a proven record of stability, check out stable growth stocks screener (2083 results) so you can invest with more confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com