Douglas Elliman (DOUG) Losses Accelerate 54.2% Annually, Deepening Narrative of Prolonged Unprofitability

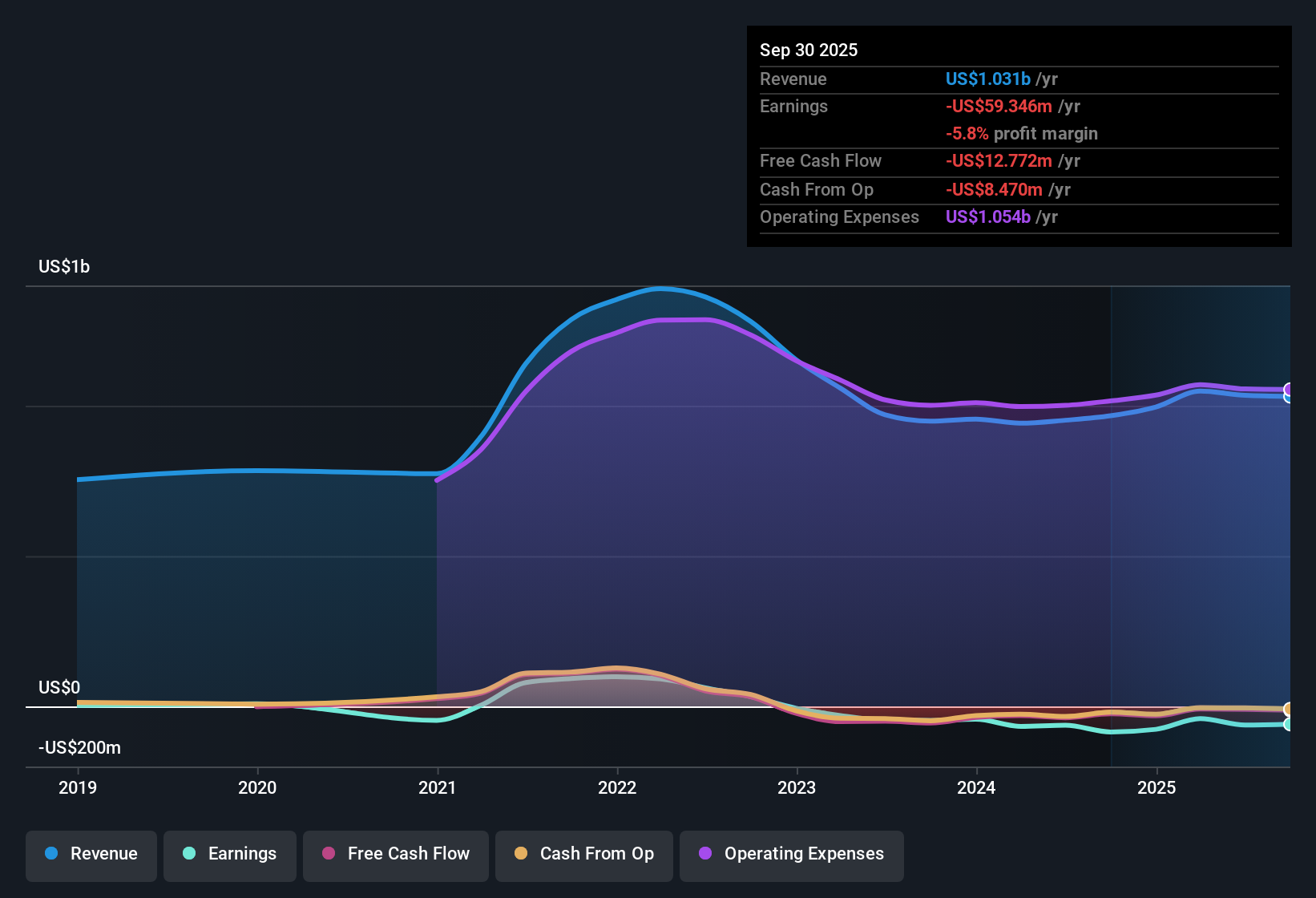

Douglas Elliman (DOUG) remains in the red this year, with losses compounding by an annualized 54.2% over the last five years and no turnaround in net profit margin. Its price-to-sales ratio sits at 0.2x, a significant discount to the 3.3x peer average and 2.6x industry mark. This places shares at the lower end of sector valuation. With revenue and earnings showing no signs of growth, investors face few immediate reasons for optimism beyond the company’s comparatively low sales multiple.

See our full analysis for Douglas Elliman.Next, we’ll compare Douglas Elliman’s financial report to the wider stories and narratives circulating in the market. This is where numbers and sentiment collide, and where some assumptions might get reinforced or questioned.

Curious how numbers become stories that shape markets? Explore Community Narratives

Persistent Net Losses Deepen

- Douglas Elliman’s losses have grown at an annualized rate of 54.2% over the last five years, signaling a prolonged and widening trajectory of unprofitability despite ongoing sector challenges.

- The prevailing market view sharply underscores this trend, highlighting that the company remains unprofitable this year with no turnaround in net profit margin, and notes there is currently no evidence of high-quality past earnings.

- The continued lack of improvement in net profit margin directly contradicts the idea that disciplined cost management or strategic shifts have so far delivered tangible financial upside.

- No mention of new revenue sources or profit drivers emerging from recent filings supports the broader view that downside risks dominate the short-term financial picture.

Revenue Stagnation Poses Ongoing Risk

- Recent filings specify that both revenue and earnings are not expected to grow, removing near-term catalysts for financial improvement or investor optimism.

- The prevailing market view notes that, with transaction volumes and commission structures remaining under pressure, Douglas Elliman faces headwinds that further limit upside potential.

- In the absence of signals of positive macro shifts or management commentary highlighting recovery plans, the company is exposed to sector-wide weakness and falling transaction activity.

- The risk of persistent commission competition and declining sales continues to weigh heavily on future earnings prospects, highlighting a cautious path ahead.

Sales Multiple Sits Far Below Peers

- The company trades at a price-to-sales ratio of 0.2x, which is well below both the peer average of 3.3x and the US real estate industry average of 2.6x. This places Douglas Elliman shares at a pronounced valuation discount.

- The prevailing analysis suggests this low sales multiple could reflect both skepticism around the company's turnaround prospects and broader sector challenges that are keeping valuations depressed.

- Rather than signaling untapped value, the steep discount versus peers appears to reinforce market caution as negative income trends persist without visible growth levers.

- Investors may remain sidelined until there is a material shift in either company performance or macro conditions that would justify a narrowing of this valuation gap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Douglas Elliman's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Douglas Elliman’s persistent losses, stagnant revenue, and lack of clear growth drivers suggest limited near-term upside and ongoing financial challenges compared to sector peers.

If steady performance matters to you, use stable growth stocks screener (2077 results) to focus on companies with reliable revenue and earnings expansion instead of hoping for a turnaround.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com