Oportun Financial (OPRT): Losses Widen 28.7% Annually, Valuation Discount Shapes Turnaround Debate

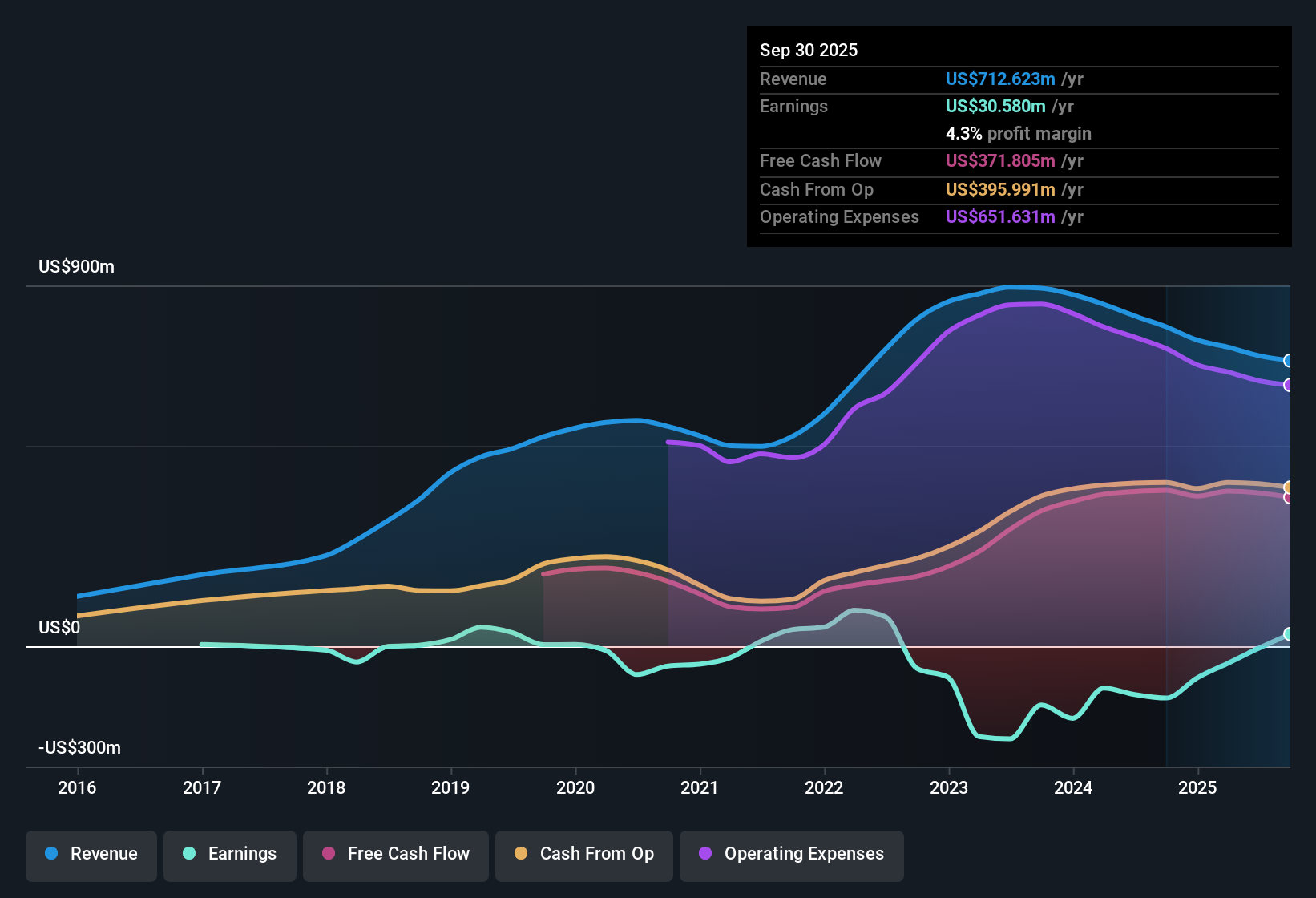

Oportun Financial (OPRT) remains unprofitable, with losses widening at an average annual rate of 28.7% over the past five years. Looking ahead, however, analysts project earnings growth of 40.72% per year and expect the company to cross into profitability within the next three years, while revenue is forecast to grow by 4.5% per year, which is slower than the broader US market’s pace of 10.5%.

See our full analysis for Oportun Financial.Next up, we’ll set the latest numbers against prevailing narratives to see which stories get reinforced and where the perspectives from Simply Wall St’s community might be challenged.

See what the community is saying about Oportun Financial

Margins Projected to Swing from -0.6% to 10.2%

- Analysts expect profit margins to shift from -0.6% today up to 10.2% over the next three years, signaling a major turnaround in Oportun Financial’s core profitability expectations.

- According to analysts' consensus view, enhanced data analytics and investments in digital infrastructure are credited as key drivers behind the anticipated margin boost.

- Operational efficiencies through automation and AI are expected to lower operating expenses and reinforce this projected margin expansion.

- However, elevated net charge-off rates remain a drag and could challenge margin gains if macro pressures mount. The pace of this improvement is central to the consensus debate.

Declining Net Charge-Offs Still High at 11.9%

- Guidance for full-year 2025 points to net charge-off rates of 11.9%, only a modest improvement over 2024 and still notably elevated, highlighting credit quality concerns that remain front and center for investors.

- Bears continue to focus on the persistence of high charge-offs and the risks associated with potential macroeconomic headwinds.

- Even as repeat borrower rates grow and portfolio mix shifts, new borrower losses and industry competition could keep net losses above the critical 12% mark. This puts pressure on earnings stability.

- Management’s optimistic signals around underwriting improvements are, for now, offset by guidance that shows only incremental progress and not a dramatic drop in loss rates.

Price-to-Sales at 0.3x Signals Deep Discount vs. Peers

- Oportun Financial trades at a Price-To-Sales Ratio of 0.3x, far below the US Consumer Finance industry average of 1.4x and the peer average of 1.8x. This suggests the market is pricing in caution despite margin improvement forecasts.

- Analysts' consensus narrative contends that the company’s relative discount reflects both skepticism about future risks and conviction around the upside potential if planned profitability gains materialize.

- The current share price of $5.21 sits at a steep discount to the analyst target of $8.67. This indicates either a potential opportunity if consensus estimates play out or a warning sign if execution stumbles.

- This wide valuation gap will likely remain a key focus for both value hunters and cautious investors as new results are digested in the coming quarters.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Oportun Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the numbers in a new way? In just a few minutes, you can add your own unique perspective and shape the narrative. Do it your way.

A great starting point for your Oportun Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite forecasts for a turnaround, Oportun Financial’s persistently high net charge-offs and thin margins point to ongoing instability in its financial fundamentals.

If you want to focus on companies with stronger balance sheets and fewer credit risk concerns, check out solid balance sheet and fundamentals stocks screener (1979 results) that could offer more financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com