Does Strong Q3 and New CEO Appointment Signal a New Chapter for Credit Acceptance (CACC)?

- Credit Acceptance Corporation reported strong third-quarter 2025 results, with revenue reaching US$582.4 million and net income climbing to US$108.2 million, while also announcing the upcoming CEO transition to Vinayak R. Hegde, effective November 13, 2025.

- Hegde brings deep expertise in digital transformation and leadership from his previous roles with T-Mobile, Amazon, Airbnb, and Wheels Up, positioning the company for technology-driven growth and customer-focused strategies.

- We will explore how the combination of robust earnings growth and Hegde's appointment as CEO could influence Credit Acceptance's investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Credit Acceptance Investment Narrative Recap

To be a Credit Acceptance shareholder today, you need confidence in the company's ability to manage credit risk and rebound in loan origination volumes, particularly among subprime borrowers. While the recent quarterly results and the CEO transition to Vinayak Hegde may support short-term optimism, the most pressing catalyst remains stabilization in loan performance, whereas the main risk continues to be persistent underperformance from 2022-2024 loan vintages, both of which remain largely unaffected by these announcements.

Among recent company actions, the completion of a significant share buyback stands out. Credit Acceptance repurchased 230,064 shares in the latest quarter, signaling ongoing efforts to drive per-share earnings growth even as the company navigates operational headwinds and competition that could impact future revenue and loan volumes.

However, investors should be aware that, despite upbeat earnings, the challenge of credit risk from prior years’ loans is far from resolved and...

Read the full narrative on Credit Acceptance (it's free!)

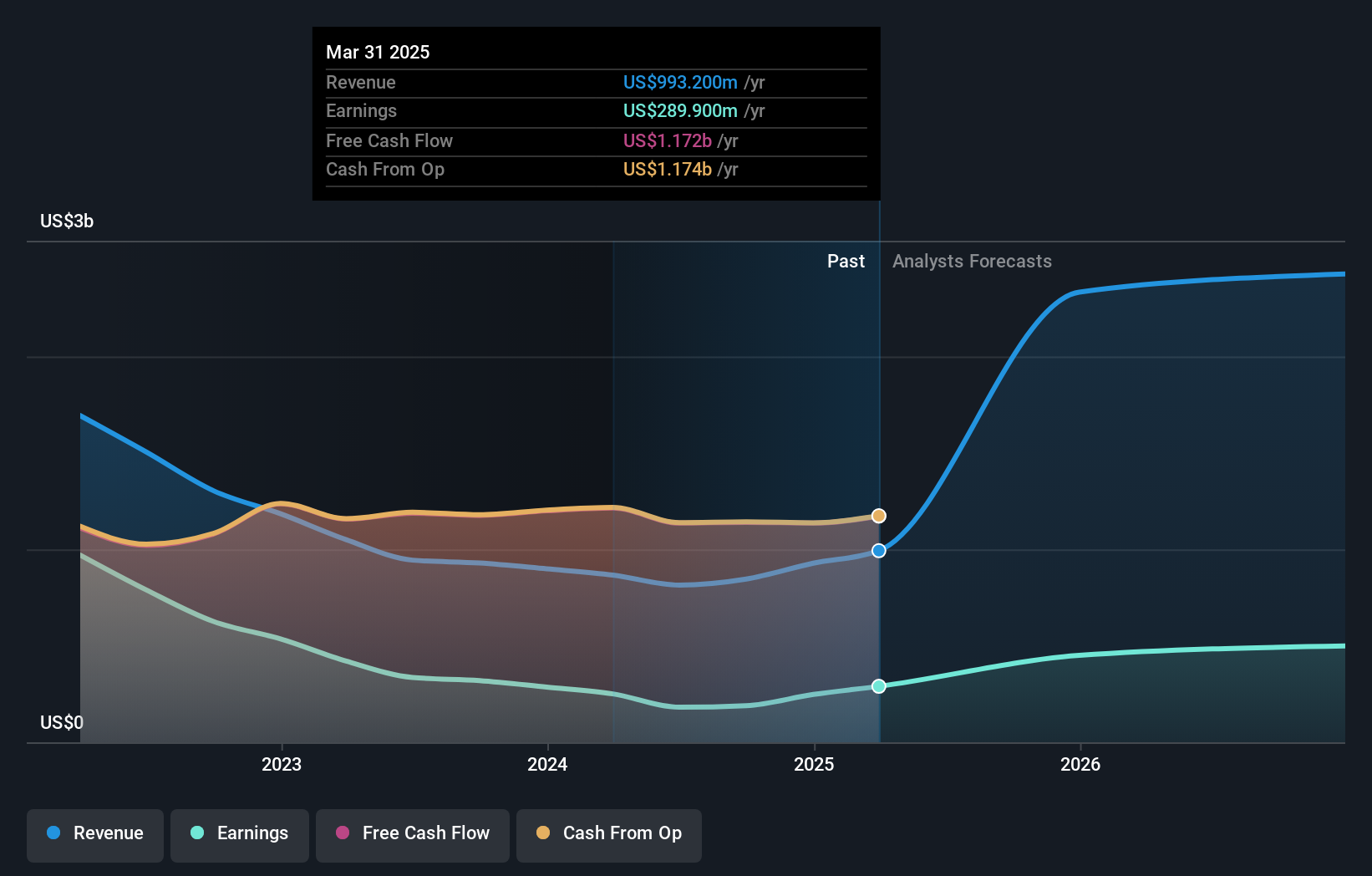

Credit Acceptance's outlook anticipates $4.5 billion in revenue and $504.0 million in earnings by 2028. This is based on a projected 56.2% annual revenue growth and a $79.6 million increase in earnings from the current $424.4 million level.

Uncover how Credit Acceptance's forecasts yield a $446.25 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community valuations for Credit Acceptance range from US$284 to US$446 based on two independent models. While many see improved technology supporting margin recovery, others point to ongoing credit risk as a key concern shaping the path ahead.

Explore 2 other fair value estimates on Credit Acceptance - why the stock might be worth 37% less than the current price!

Build Your Own Credit Acceptance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com