Lindsay's (LNN) New Buyback Plan Might Change The Case For Investing In Its Capital Strategy

- Lindsay Corporation recently announced a new share repurchase program authorizing up to US$150 million in common stock buybacks with no expiration date, following the completion of a previous buyback initiative.

- This move underscores the company's ongoing focus on capital returns and signals management’s continued confidence in Lindsay’s long-term outlook.

- We’ll explore how the newly unveiled buyback plan strengthens Lindsay’s investment narrative, especially regarding its approach to capital allocation.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Lindsay Investment Narrative Recap

Lindsay shareholders are typically aligned with the belief in long-term growth from a blend of infrastructure and irrigation projects, supported by disciplined capital allocation. The new US$150 million buyback announcement reinforces this focus and may provide incremental support to the stock, but it does not materially change the outlook for the company’s main short-term catalyst, which remains the execution and timing of large infrastructure projects, nor does it fully address the ongoing risk of tariff and input cost uncertainties affecting margins.

One of the most relevant recent announcements is Lindsay’s completion of its previous US$250 million buyback program, retiring nearly a quarter of its outstanding shares over the past decade. This sits alongside stable dividend growth and solid earnings, illustrating the company’s ongoing commitment to returning capital to shareholders and suggesting confidence in underlying cash flows, even as exposure to tariffs and international market headwinds remains a consideration for the investment case.

On the other hand, investors should be aware that the risk from rising interest rates and tightening credit in Brazil may still...

Read the full narrative on Lindsay (it's free!)

Lindsay's outlook suggests revenues of $751.5 million and earnings of $86.5 million by 2028. This is based on analysts forecasting a 3.5% annual revenue growth rate and an earnings increase of $10.5 million from the current $76.0 million.

Uncover how Lindsay's forecasts yield a $127.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

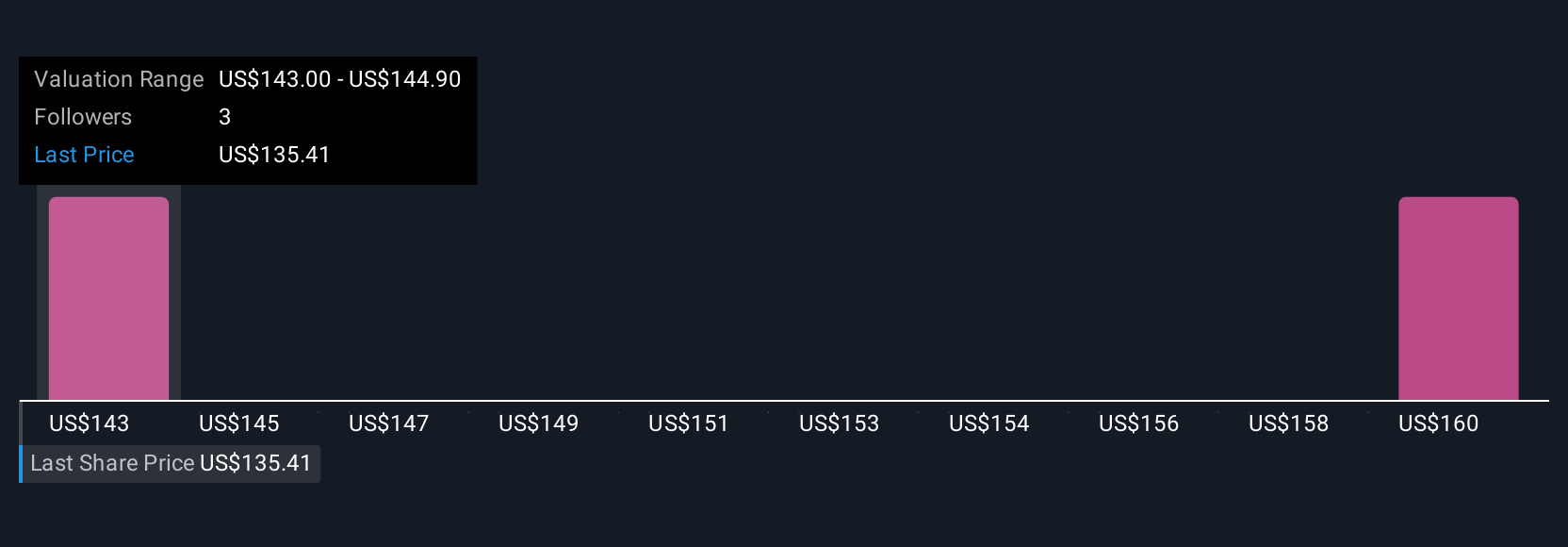

Simply Wall St Community fair value estimates for Lindsay range from US$127 to US$161.83, reflecting two different perspectives on future earnings potential. While views diverge, keep in mind that earnings remain closely tied to project timing and global demand shifts, so exploring several viewpoints is essential.

Explore 2 other fair value estimates on Lindsay - why the stock might be worth as much as 41% more than the current price!

Build Your Own Lindsay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lindsay research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lindsay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lindsay's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com