ZipRecruiter (ZIP) Losses Deepen 37.9% Annually, Unprofitability Challenges Value Narrative

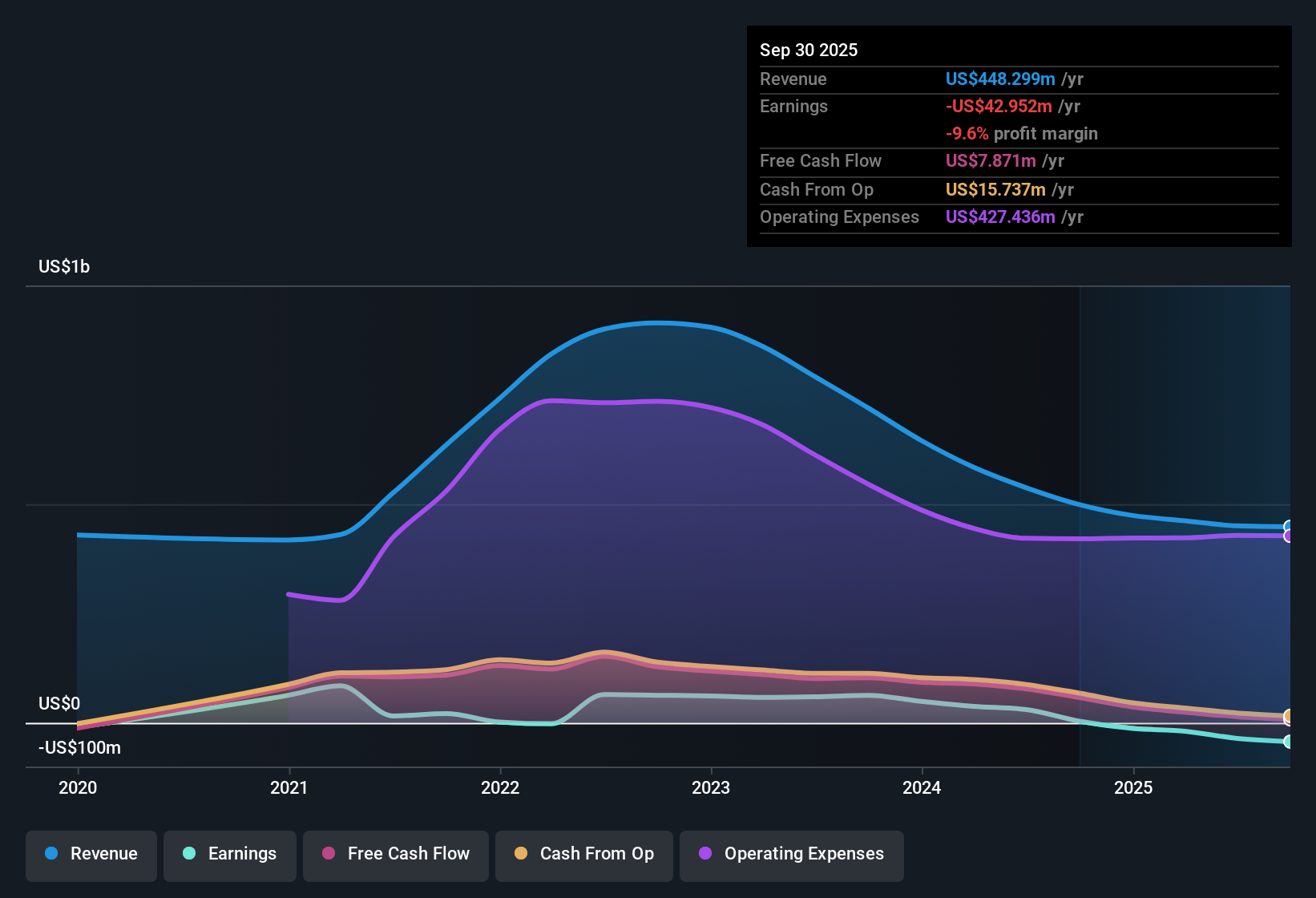

ZipRecruiter (ZIP) saw its losses deepen at a 37.9% annual rate over the past five years, with the company remaining unprofitable throughout this period. Revenues are projected to grow at 7.4% per year, noticeably slower than the US market average of 10.4% per year. This keeps net profit margins and earnings growth comparisons off the table for now. For investors, the key takeaway is that while shares trade below both industry price-to-sales averages and an indicated fair value of $6.05, persistent operating losses and tepid revenue growth continue to frame the investment debate around ZIP.

See our full analysis for ZipRecruiter.Now, let's see how the latest numbers compare with the most widely held narratives about ZipRecruiter. Where do expectations align, and where do they diverge?

See what the community is saying about ZipRecruiter

AI-Powered Tools Boost Engagement

- ZipRecruiter is accelerating the rollout of generative AI recruiting products like ZipIntro and automated candidate matching for SMBs. This is expected to enhance user outcomes and help the company capture more market share as talent acquisition shifts toward digital solutions.

- Analysts' consensus view highlights AI integration and new product features as a key catalyst for future growth.

- Consensus narrative notes that increased integration with generative AI engines and platforms is expanding ZipRecruiter’s user base and driving up engagement from both job seekers and employers.

- Stabilizing growth and ongoing innovation are seen as factors that position ZipRecruiter for margin recovery and improved revenue durability as labor market demand returns.

See how analysts rate ZipRecruiter's AI-fueled growth and what the consensus story means for its comeback prospects. 📊 Read the full ZipRecruiter Consensus Narrative.

Profitability Hurdles Remain

- Despite revenue forecasts of 7.4% growth per year, ZipRecruiter has not reported positive earnings and is not expected to achieve profitability within the next three years according to analyst projections.

- Consensus narrative flags a material challenge in ongoing unprofitability.

- Prolonged revenue per paid employer declines and increasing reliance on user growth over pricing put pressure on margins and profits.

- Heavy investments in product development and compliance continue to compress adjusted EBITDA margins from 23% to mid-single digits, which could persist if revenue growth remains muted.

Valuation Discount vs Industry

- ZipRecruiter's price-to-sales ratio of 0.8x is significantly below the US Interactive Media and Services industry average of 1.4x and the peer average of 1.3x. The current share price of $4.27 is trading at a 29% discount to its DCF fair value of $6.05.

- According to the analysts' consensus perspective, this low valuation offers potential upside if ZipRecruiter demonstrates sustained revenue growth and margin improvement.

- Analysts have established a price target of $5.00, which implies share price appreciation without assuming immediate profitability.

- The relatively small gap between the current share price and the average price target reflects a market perception that ZipRecruiter's risk profile is largely balanced by its value proposition and upside optionality.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ZipRecruiter on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these figures give you a different perspective? Put your own spin on the story and share your view in just a few minutes. Do it your way

A great starting point for your ZipRecruiter research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

ZipRecruiter’s persisting losses, muted revenue growth, and ongoing profitability challenges highlight the risks of weaker performance in unpredictable markets.

If you’d rather select companies with consistent financial progress, prioritize stability with stable growth stocks screener (2078 results) so you can focus on businesses delivering reliable results through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com