Is Widening Losses and Shrinking Revenue Altering the Investment Case for Brookfield Business (BBUC)?

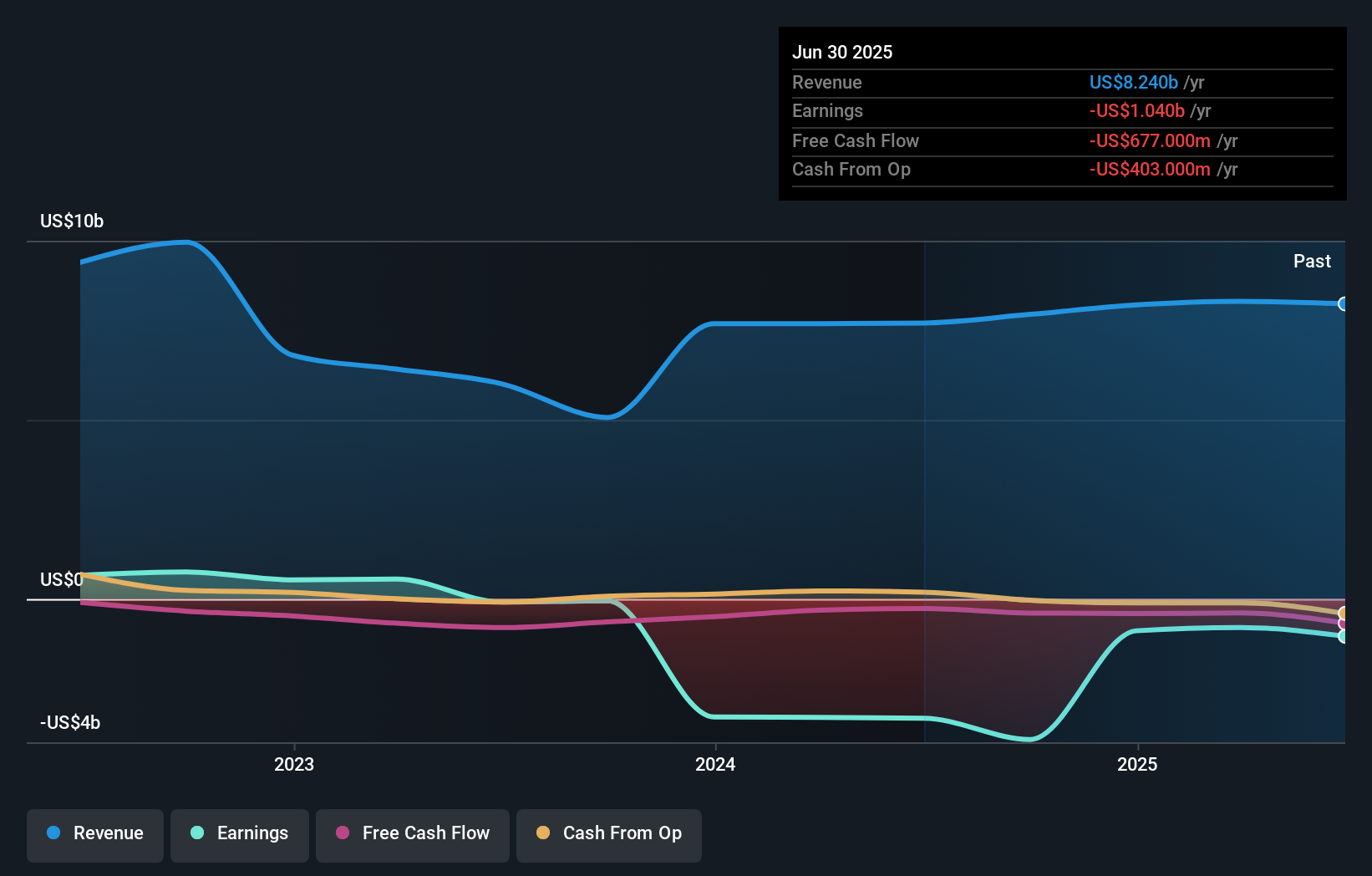

- Brookfield Business Corporation has reported its third quarter 2025 results, showing a decline in sales to US$1.68 billion from US$2.21 billion in the prior year, with net losses widening to US$500 million from US$466 million.

- This continued trend of shrinking revenues and deeper losses over nine months highlights unresolved challenges within the company's operations and broader market pressures.

- We'll examine how the increasing net losses shape Brookfield Business Corporation's investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Brookfield Business' Investment Narrative?

For Brookfield Business Corporation, the case for ownership centers on a belief that management can stabilize ongoing losses and reverse shrinking revenues seen again in the third quarter, where net losses hit US$500 million on US$1.68 billion in sales. The drop in topline and expanding losses now mark a persistent challenge rather than a one-off, pushing operational execution and balance sheet strength to the front of the investment thesis. Short term, attention often pivots to asset sales such as the potential divestiture of La Trobe Financial Services or further share buybacks and index inclusions, both of which could provide catalysts to sentiment or value realization. However, this latest disappointing performance may undermine confidence in near-term turnaround catalysts and intensify concerns about cash runway and the risk of prolonged unprofitability. Given the scale of the third quarter setback, many investors will likely be watching upcoming announcements for signs of financial stabilization or restructuring. But with losses expanding and under one year's cash runway, funding risk looms larger now than before.

Brookfield Business' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business - why the stock might be worth as much as $0.824!

Build Your Own Brookfield Business Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Business research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Brookfield Business research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com