Does Option Care Health's (OPCH) Shift Toward Targeted M&A Reveal a New Capital Allocation Playbook?

- Option Care Health recently reported third quarter results, issued new 2025 revenue guidance, and shared updates on its acquisition strategy and completed share buybacks.

- Management emphasized a continued focus on targeted acquisitions and integration success, highlighting an intent to prioritize strategic investments over larger, more transformative deals or immediate increases in capital returns.

- We'll examine how Option Care Health's renewed M&A priority and successful integration of prior acquisitions could influence its long-term investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Option Care Health Investment Narrative Recap

Shareholders in Option Care Health tend to believe in the sustained expansion of infusion therapies, favoring targeted M&A and efficient integration to drive long-term earnings, while recognizing that payer and pharma contract risks could affect growth. The recent focus on strategic "tuck-in" acquisitions and integration of deals like Intramed Plus does not materially change the biggest short-term catalyst, which remains the volume and mix of higher-margin therapies, nor does it immediately offset the ongoing risk of reimbursement pressure from payers. The updated 2025 revenue guidance, projecting US$5.60 billion to US$5.65 billion, is especially relevant in light of recent M&A activity, as it suggests management’s confidence in integrating new assets while maintaining top-line momentum, an underpinning for near-term investor optimism. In contrast, investors should be aware of potential contract renegotiations with payers that could impact future reimbursement rates...

Read the full narrative on Option Care Health (it's free!)

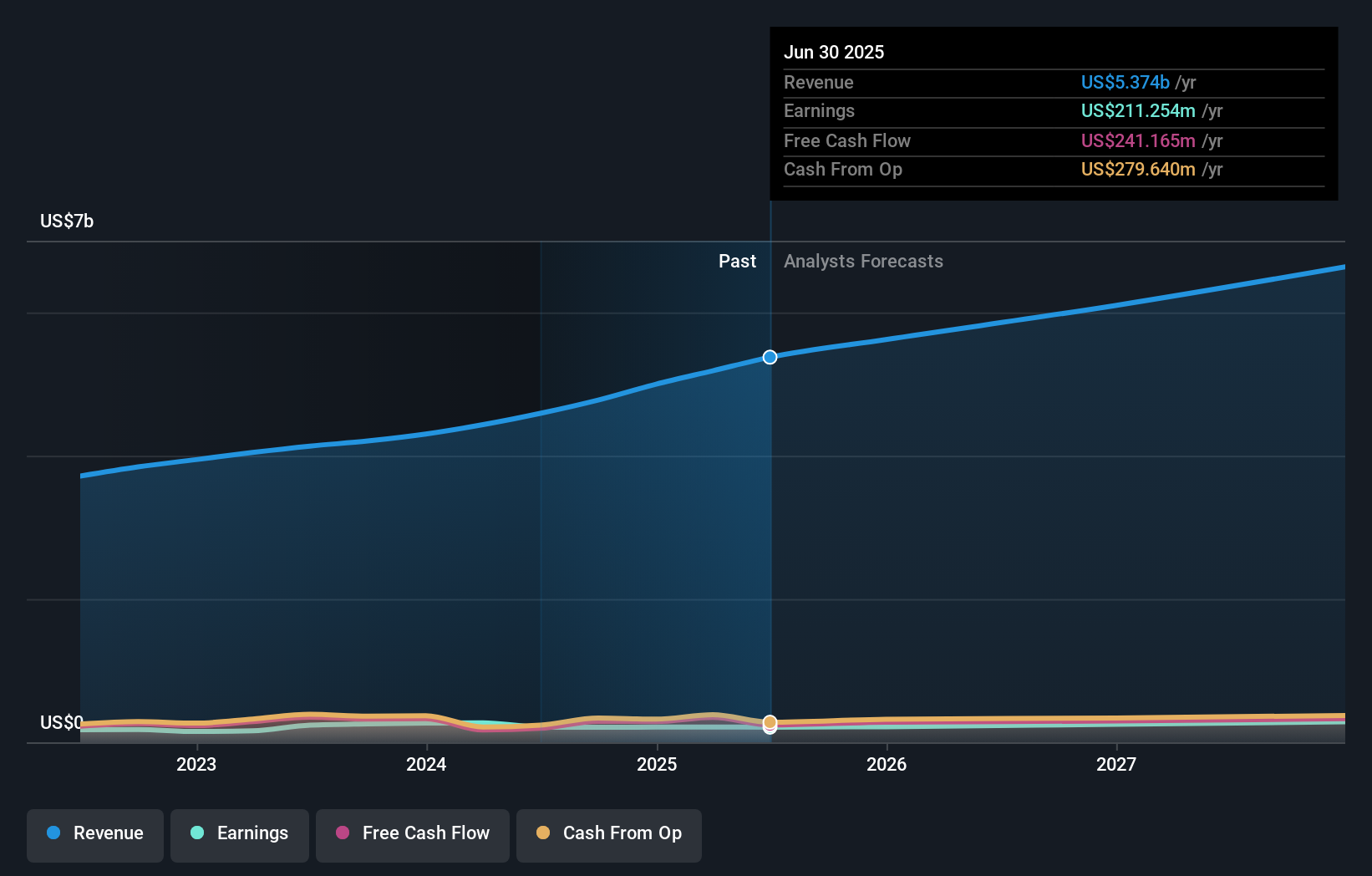

Option Care Health's narrative projects $6.9 billion in revenue and $306.2 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $94.9 million earnings increase from the current earnings of $211.3 million.

Uncover how Option Care Health's forecasts yield a $35.70 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate fair value for Option Care Health between US$35.70 and US$69.08, reflecting two distinct perspectives. While integration of new acquisitions is in focus, future reimbursement pressure remains a concern for long-term performance, and you can consider several other viewpoints on this topic below.

Explore 2 other fair value estimates on Option Care Health - why the stock might be worth just $35.70!

Build Your Own Option Care Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Option Care Health research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Option Care Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Option Care Health's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com