Is Margin Pressure at PLPC Hinting at a Shift in Its Long-Term Profit Model?

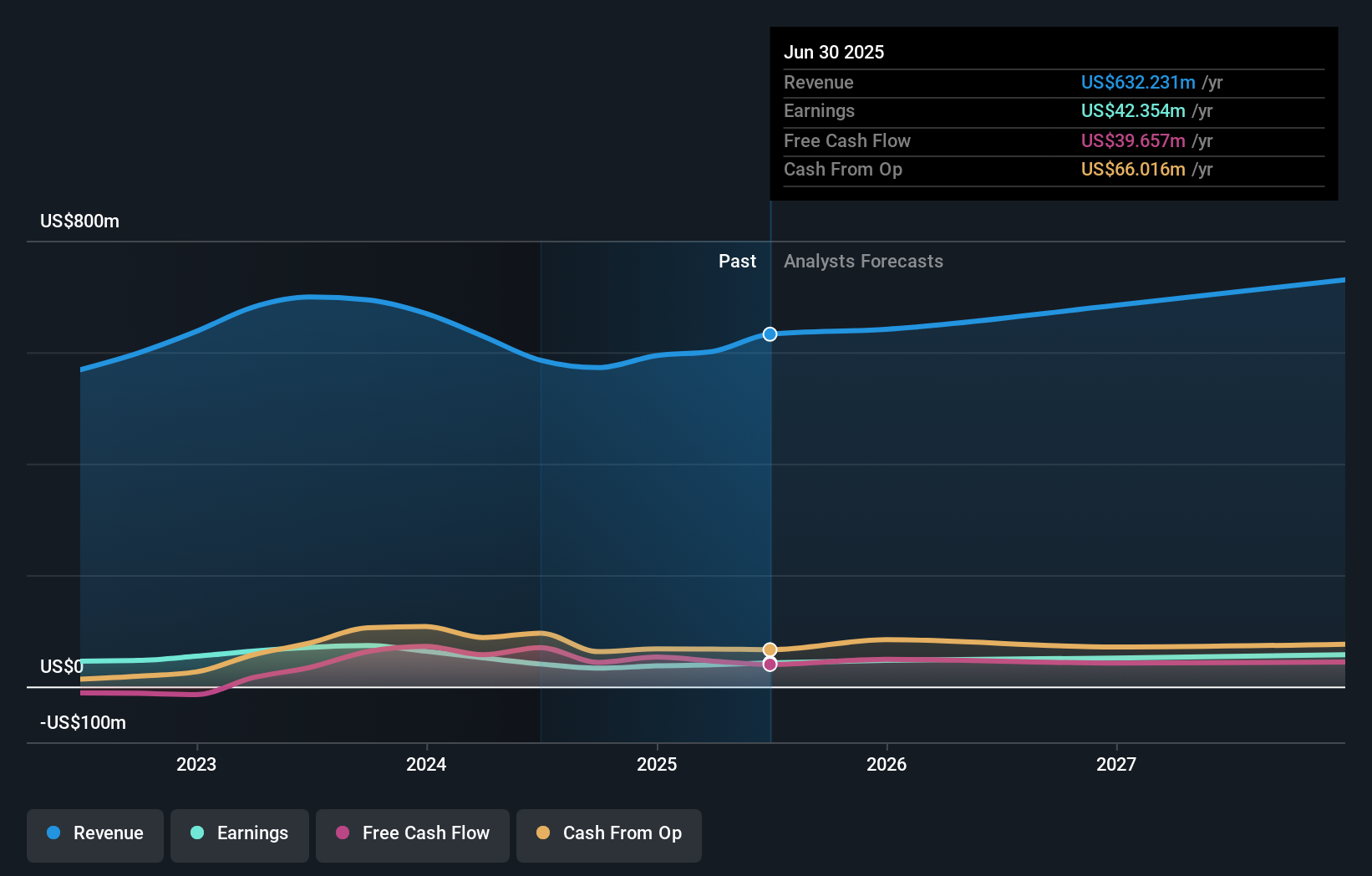

- Preformed Line Products announced its third quarter 2025 results on October 29, reporting sales of US$178.09 million and net income of US$2.63 million, compared to US$146.97 million and US$7.68 million respectively for the same period last year.

- While year-to-date earnings remained steady, a sharp drop in third-quarter profit despite revenue growth highlights recent margin pressures facing the company.

- We'll explore how these margin changes and stable year-to-date performance shape Preformed Line Products' current investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Preformed Line Products' Investment Narrative?

To be a shareholder in Preformed Line Products, you really need to believe in the company’s ability to turn consistent sales growth into sustainable bottom-line gains, even when margins come under pressure. The latest quarterly results are a reminder that higher revenue doesn’t always mean higher profits, as the company reported a sharp drop in net income despite strong top-line growth. This margin squeeze may prompt investors to re-evaluate the short-term outlook and key catalysts, such as ongoing European expansion and product collaborations, especially if cost management or input prices remain a concern. The sustained dividend and continued operational initiatives offer support, but today’s results mean margin resilience becomes a bigger focus than before. If the profit pressure is just a blip, PLPC’s recent track record and price moves may remain relevant, but if margins stay tight, the risk profile has certainly shifted.

But margin pressure isn’t the only risk shareholders need to keep an eye on.

Exploring Other Perspectives

Explore 2 other fair value estimates on Preformed Line Products - why the stock might be worth 13% less than the current price!

Build Your Own Preformed Line Products Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Preformed Line Products research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Preformed Line Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Preformed Line Products' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com