Can Hawkins (HWKN) Balance Rising Sales and Falling Profits to Support Its Dividend Strategy?

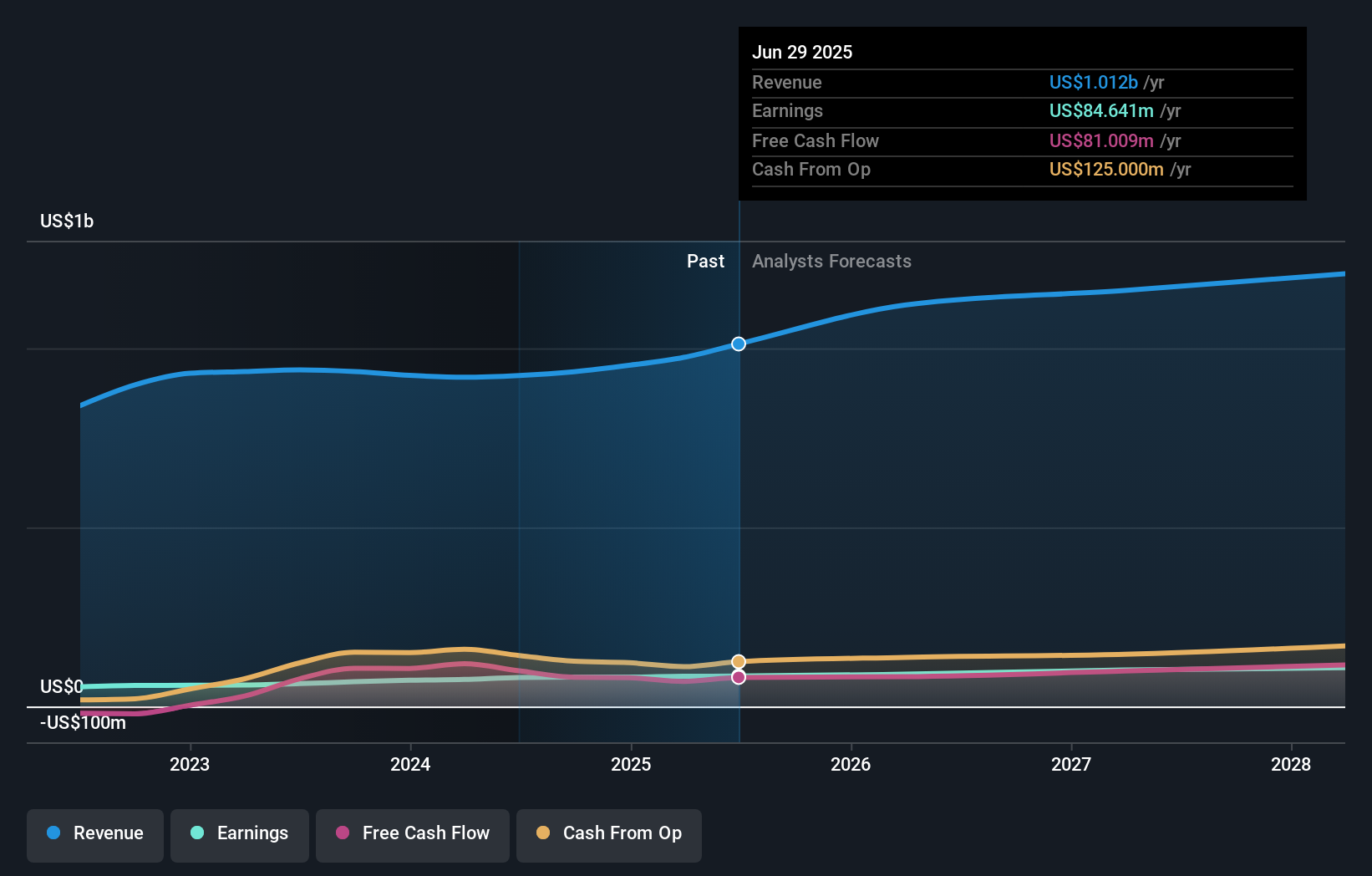

- Hawkins, Inc. recently reported its second quarter and six-month results, with sales rising to US$280.43 million for the quarter, while net income and earnings per share declined compared to the previous year.

- The Board also declared a quarterly cash dividend of US$0.19 per share, emphasizing the company’s ongoing commitment to shareholder returns.

- We’ll examine how sustained sales growth alongside lower earnings shapes Hawkins’ current investment narrative for shareholders.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Hawkins' Investment Narrative?

To be a shareholder in Hawkins right now, you’d want to see continued sales growth supporting the company’s story, even as the most recent results show a dip in earnings per share and net income for the quarter. The declared dividend signals ongoing confidence in cash flow and willingness to return capital to shareholders, which might reassure some given the current share price pullback. That said, the contraction in margins is something to keep an eye on since it could influence both short-term sentiment and longer-term catalysts like improved profitability or operational leverage. Previously, key risks included the company’s valuation premium and slower forecasted growth compared to the broader market. The latest earnings don’t substantially change those bigger-picture risks or catalysts, but the recent price weakness may reflect rising concerns about margin pressure in a competitive chemicals sector. The risk of sustained lower profitability is not off the table.

But with profitability trends shifting, it’s worth understanding the margin pressure Hawkins faces. Hawkins' share price has been on the slide but might be up to 30% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Hawkins - why the stock might be worth 23% less than the current price!

Build Your Own Hawkins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hawkins research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hawkins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hawkins' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com