Why Integer Holdings (ITGR) Is Up 5.7% After Announcing a $200 Million Share Buyback Plan

- Integer Holdings Corporation announced that its Board of Directors has authorized a share repurchase program for up to US$200 million of common stock, to be funded mainly through cash on hand and free cash flows, with no expiration date.

- This initiative reflects management’s confidence in the company’s financial position and commitment to returning value to shareholders, which is often regarded positively by investors.

- We’ll explore how Integer Holdings’ decision to commit significant capital to a share buyback could influence its investment outlook and earnings growth assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Integer Holdings Investment Narrative Recap

Being a shareholder in Integer Holdings means having conviction in the company’s ability to leverage strong demand in cardiac and neuro markets while navigating a concentrated OEM client base and evolving end-market dynamics. The US$200 million share buyback program may support short-term share price stability and signal confidence, but it is unlikely to materially change the central challenge of replacing lost revenue from exited markets, which remains the most significant near-term risk to growth.

Among recent developments, the transition to a new CEO, Payman Khales, stands out as highly relevant. Leadership continuity and fresh perspective could affect Integer’s operational execution and its response to shifting customer needs, an important factor, given ongoing efforts to mitigate customer concentration risk and sustain momentum behind new product introductions.

However, as management aims to reassure investors with its financial initiatives, it is important not to lose sight of the risk that revenue volatility could increase if major customer contracts shift or sunset...

Read the full narrative on Integer Holdings (it's free!)

Integer Holdings is projected to reach $2.2 billion in revenue and $306.5 million in earnings by 2028. This outlook reflects a 7.0% annual revenue growth rate and a $222.7 million increase in earnings from the current $83.8 million.

Uncover how Integer Holdings' forecasts yield a $84.86 fair value, a 24% upside to its current price.

Exploring Other Perspectives

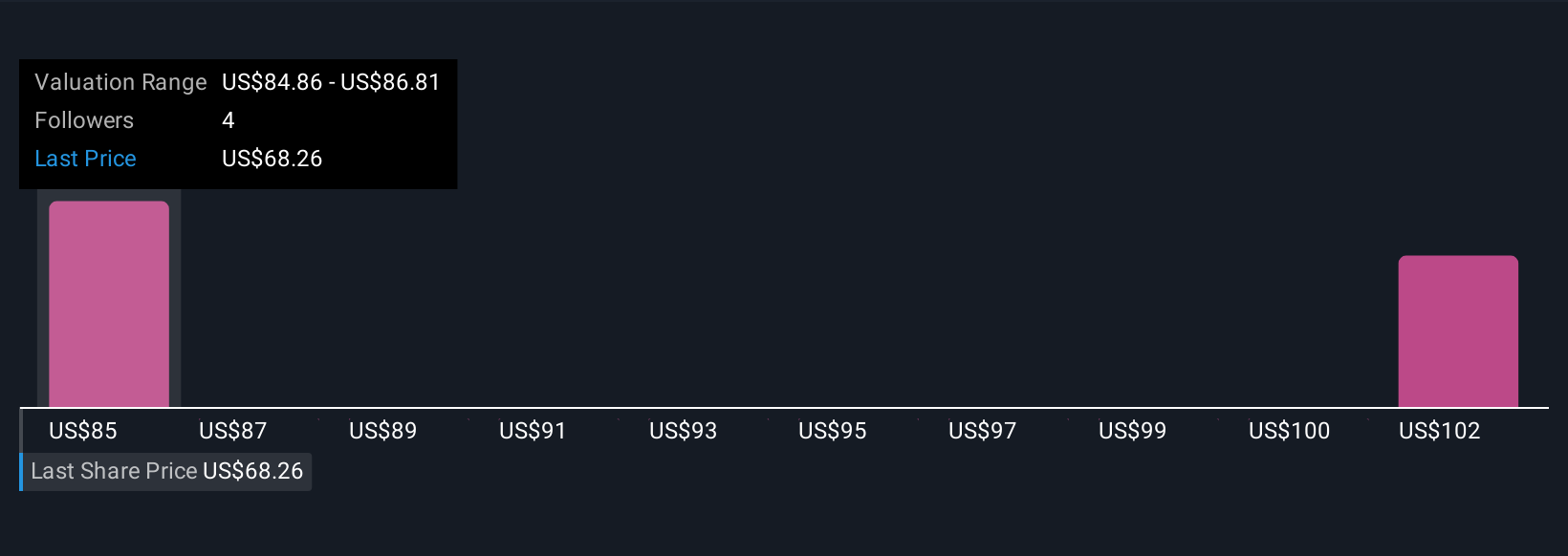

Simply Wall St Community members provided two fair value estimates for Integer ranging from US$84.86 to US$103.84 per share. While many expect substantial earnings growth, customer concentration remains a limiting factor for longer-term returns and is worth weighing if you want to see how your view compares.

Explore 2 other fair value estimates on Integer Holdings - why the stock might be worth just $84.86!

Build Your Own Integer Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integer Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Integer Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integer Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com