Coca-Cola Consolidated (COKE) Is Up 5.7% After Buyback and Q3 Beat Has The Bull Case Changed?

- Coca-Cola Consolidated recently reported third quarter 2025 results, with sales of US$1.89 billion and net income of US$142.33 million, both higher than the prior year, and completed a share repurchase of 1.93% of its total shares for US$199.86 million.

- The company's combination of better operating performance and a completed buyback signals management confidence and likely draws investor interest.

- We'll explore how Coca-Cola Consolidated's completed share repurchase program could impact the company's long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Coca-Cola Consolidated's Investment Narrative?

To see value as a Coca-Cola Consolidated shareholder, you need to believe in the business’s ability to maintain operational strength and return capital to shareholders despite evolving industry pressures. The latest quarterly results showed increased sales and earnings, which could reassure those tracking profitability trends, while the completion of a nearly 2% share buyback might further boost confidence in management’s outlook. These events put recent catalysts in sharper focus: continued revenue growth and efficient capital use could support the investment case in the near term, especially following management’s substantial buybacks and steady dividends earlier this year. Risks tied to executive transitions and any effects from rapidly growing leverage, which has influenced key financial metrics, are worth tracking as these could impact momentum going forward. Overall, the most recent news reinforces management’s confidence but doesn’t fundamentally change the priority risks or short-term drivers that were present before this update.

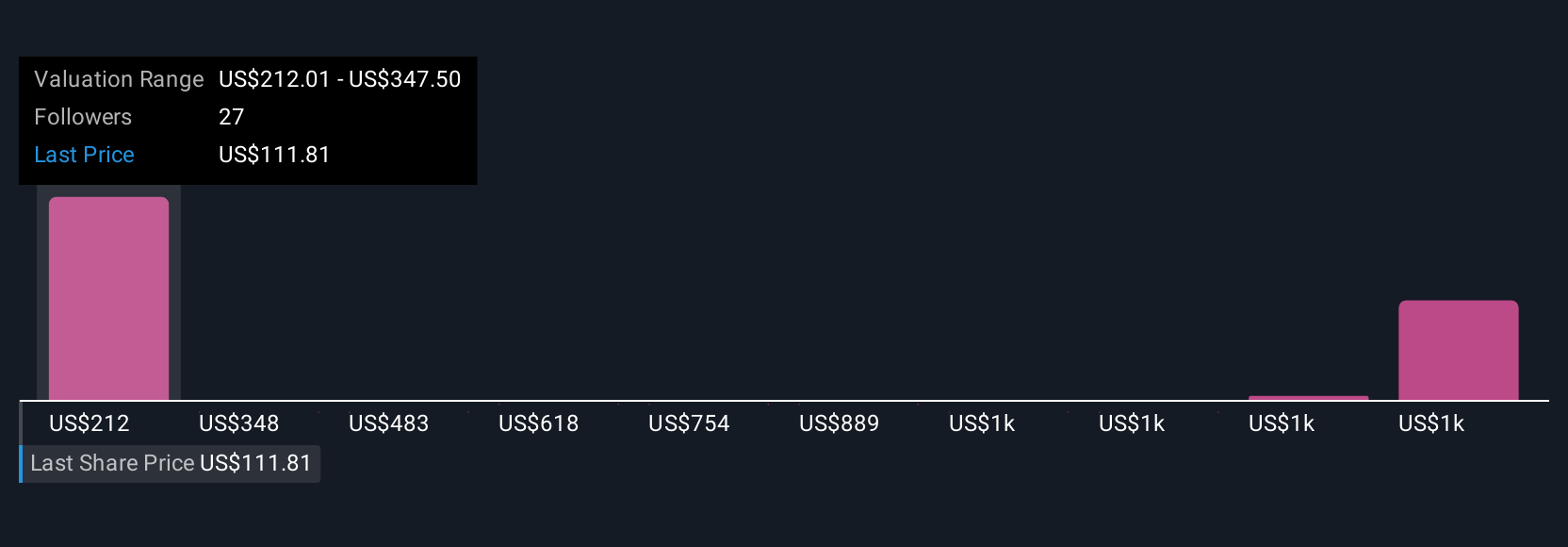

But debt levels compared to earnings remain an important consideration for anyone following the company. Coca-Cola Consolidated's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore 8 other fair value estimates on Coca-Cola Consolidated - why the stock might be a potential multi-bagger!

Build Your Own Coca-Cola Consolidated Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola Consolidated research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Coca-Cola Consolidated research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola Consolidated's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com