PAR Technology (PAR): Assessing Valuation After Q3 Earnings Drive Revenue Gains and Smaller Net Loss

PAR Technology (PAR) released its third quarter earnings, highlighting notable operational improvements. The company delivered increased revenue and a narrower net loss compared to the same period last year, providing fresh insights for investors this earnings season.

See our latest analysis for PAR Technology.

PAR Technology’s latest earnings report appears to have given its share price a serious jolt, with a remarkable 16.6% one-day increase taking it to $38.67. Despite this surge, momentum has struggled to build over the longer term. This is reflected by a year-to-date share price return of -45.9% and a 12-month total shareholder return of -47.9%. A 41% total return over the last three years reminds investors that periods of strong performance are possible, even through some volatility. As market sentiment shifts, these operational gains could be a catalyst for renewed attention from growth-oriented investors.

If PAR's turnaround story has you wondering what else is gaining momentum, this could be the perfect time to discover fast growing stocks with high insider ownership

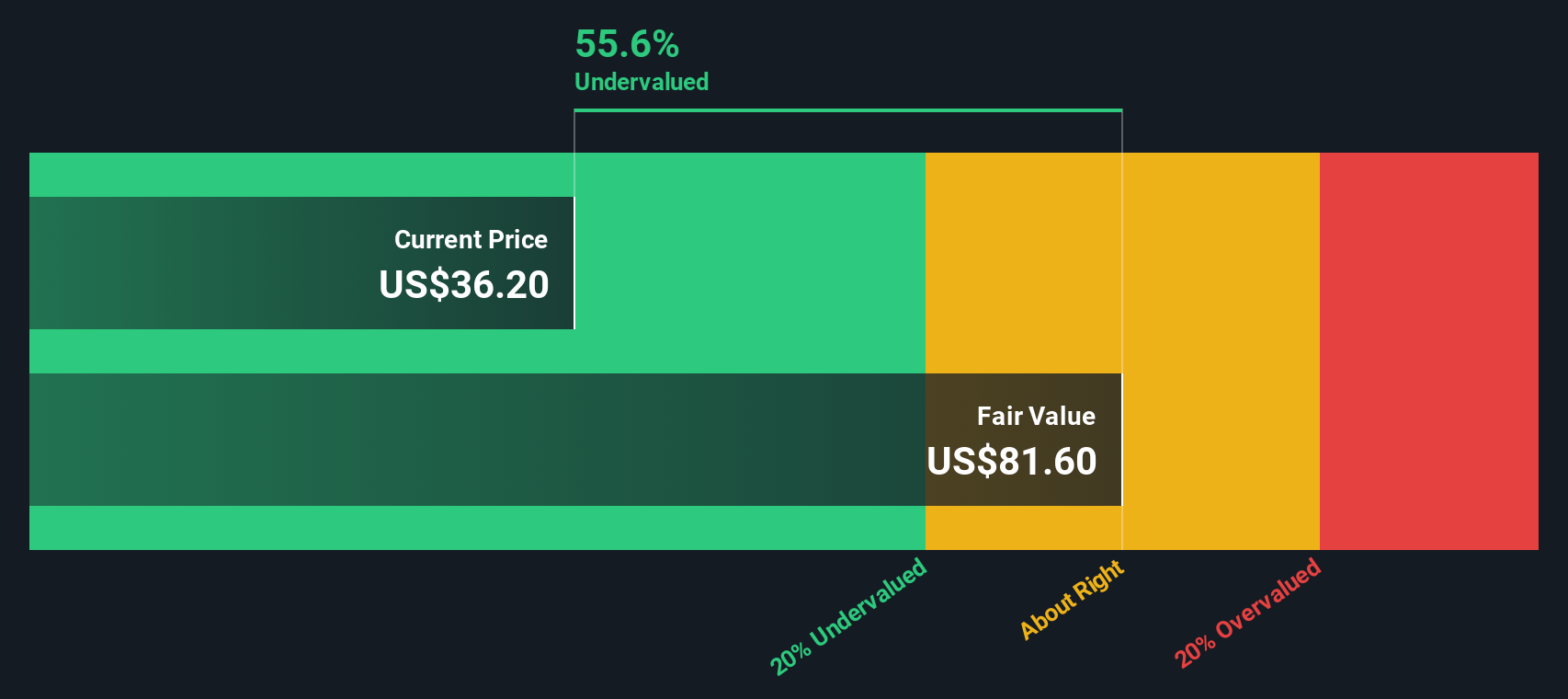

With shares still trading well below analyst price targets despite a sharp earnings rally, the big question is whether PAR Technology is undervalued at current levels or if the market has already priced in all future growth potential.

Most Popular Narrative: 45.8% Undervalued

PAR Technology’s most widely followed narrative points to a fair value far above the current $38.67 share price. This invites questions about whether the market is missing the company’s potential. This substantial gap has investors talking and could be a focal point for those searching for strong upside stories.

PAR's expanded, unified, cloud-native platform (including PAR OPS, Engagement Cloud, and AI-driven tools like Coach AI) is positioned to benefit from industry-wide modernization and demand for operational efficiency, automation, and actionable analytics. These secular drivers should support sustained ARR and earnings growth.

Curious what powers this bullish outlook? There is a hidden engine of recurring revenue, strategic client wins, and a bold bet on expanding SaaS margins. The narrative hinges on aggressive growth, ambitious profitability leaps, and taking market share through cloud innovation. Want to see which financial projections really shape this high valuation? Read on for the eye-opening numbers and the dramatic forecast behind the story.

Result: Fair Value of $71.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delayed contract rollouts or intensified competition could quickly undermine the bullish outlook and challenge expectations for PAR's continued rapid growth.

Find out about the key risks to this PAR Technology narrative.

Another View: Our DCF Model Comes to a Different Conclusion

While analyst narratives suggest PAR Technology is significantly undervalued, our SWS DCF model tells a different story. According to this method, the stock is currently trading above its estimated fair value, which may indicate a potential downside risk. How much faith should investors put in pure earnings power versus future growth hopes?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PAR Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PAR Technology Narrative

If you want a fresh perspective on PAR Technology’s story or prefer to build your own view from the numbers, it only takes a few minutes to get started. Do it your way

A great starting point for your PAR Technology research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big opportunity slip by. Give yourself an edge by hunting for stocks at the forefront of today’s hottest themes and value trends.

- Unlock rapid growth potential by starting with these 3590 penny stocks with strong financials for under-the-radar companies showing financial strength and momentum.

- Target long-term rewards and income with these 16 dividend stocks with yields > 3% that pay yields above 3% for a dependable boost to your portfolio.

- Capitalize on the AI revolution’s winners by zeroing in on these 24 AI penny stocks as they pave the path for tomorrow’s tech breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com