Global Partners (GLP): Assessing Valuation After Disappointing Q3 2025 Earnings and Margin Pressures

Global Partners (GLP) saw its stock price react after releasing third quarter 2025 results that fell short of expectations. Both revenue and earnings declined, particularly in its gasoline distribution and retail businesses.

See our latest analysis for Global Partners.

It has been a challenging stretch for Global Partners, with the 1-year total shareholder return down 9.5%, which mirrors a steady fade in momentum after a difficult third quarter. Although management recently marked its 16th consecutive quarterly distribution increase, the stock touched a new low as investors weighed the dip in retail margins against wholesale segment growth and notable expansion moves.

If you’re wondering where else opportunity may be emerging, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and fresh distribution increases on the books, it raises an important question: Is the current weakness an entry point for value-seekers, or is the market signaling that future growth is already factored in?

Most Popular Narrative: 20.4% Undervalued

Compared to the latest closing price of $42.17, the most popular narrative assigns a fair value of $53, which is notably higher. This suggests perceived upside for patient investors if the narrative projections play out.

Ongoing portfolio optimization, with the recent divestment of underperforming retail sites and annual review processes, is likely to focus capital on higher-return assets. This may support better margin performance and earnings consistency.

Wondering what’s fueling such robust optimism? The narrative’s fair value hinges on a bold combination: aggressive revenue growth, leaner profit margins, and a future earnings multiple that stands out from industry averages. Which financial lever makes the difference? The full breakdown is just a click away.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if ongoing fossil fuel declines or leadership changes reduce fuel volumes and future earnings more than expected.

Find out about the key risks to this Global Partners narrative.

Another View: High Price Tag on Earnings

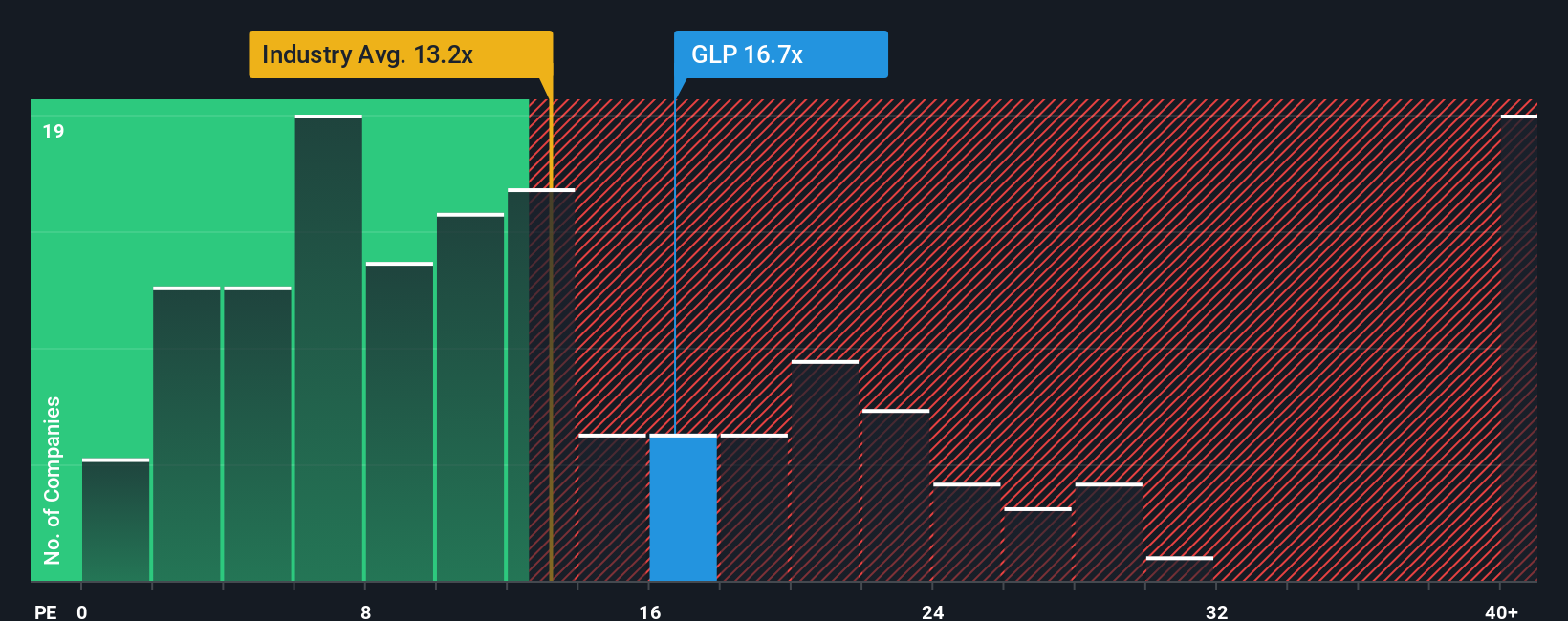

Taking a different angle, Global Partners is currently valued at 20.7 times its earnings, which is noticeably higher than both its industry peers (13.5x) and the fair ratio the market could gravitate toward (19.8x). This steeper multiple suggests that some optimism is already priced in, which may limit upside if earnings growth stalls. Are investors overlooking risk or simply betting on a faster recovery?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Global Partners Narrative

Keep in mind, if these perspectives don’t fully align with your outlook, you have the tools to dig into the data and build your own narrative in just a few minutes. Do it your way

A great starting point for your Global Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your portfolio and spot hidden gems before the crowd. Amazing opportunities await if you’re willing to look beyond the obvious picks.

- Tap into the momentum of innovative healthcare with these 32 healthcare AI stocks as artificial intelligence brings gains to a rapidly evolving industry.

- Catch the wave of digital transformation by accessing these 82 cryptocurrency and blockchain stocks, which is shaping the future of finance and payment systems.

- Recharge your potential with these 16 dividend stocks with yields > 3% that offer steady income and attractive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com