Why Ingevity (NGVT) Is Down 9.9% After Lowered Full-Year Outlook and Sale of Key Business

- Ingevity Corporation recently reported third-quarter 2025 results, with net income of US$43.5 million compared to a net loss a year ago, and announced the sale of its industrial specialties business for US$110 million expected to close in early 2026.

- Although the company posted stronger performance in Performance Materials and generated significant free cash flow, it also revised its full-year guidance downward due to competitive pressures and tariff impacts in the Advanced Polymer Technologies segment.

- We'll examine how the downward revision of earnings guidance amid tariff headwinds may influence Ingevity's investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ingevity Investment Narrative Recap

To own Ingevity shares, you need to believe in the company's ability to reposition its portfolio away from legacy, lower-margin operations and persistently grow its Performance Materials and specialty chemicals divisions, despite the cyclical swings in its industrial and automotive end-markets. The recent downward earnings guidance revision reinforces that the single most important near-term catalyst, margin recovery from portfolio changes, faces ongoing risks from tariff headwinds and delayed industrial demand; these impacts are material and remain the core risk today.

Among recent company updates, the planned sale of the Industrial Specialties business for US$110 million stands out as the most relevant, as it is expected to close in early 2026 and could accelerate the margin improvement Ingevity needs to offset APT segment headwinds. Executing this divestiture is integral to supporting free cash flow priorities and refocusing capital toward higher-value, less cyclical businesses that underpin future performance catalysts.

However, investors should also be mindful that persistent tariff-related uncertainty and competitive pressures in Advanced Polymer Technologies remain unresolved and could continue to impact...

Read the full narrative on Ingevity (it's free!)

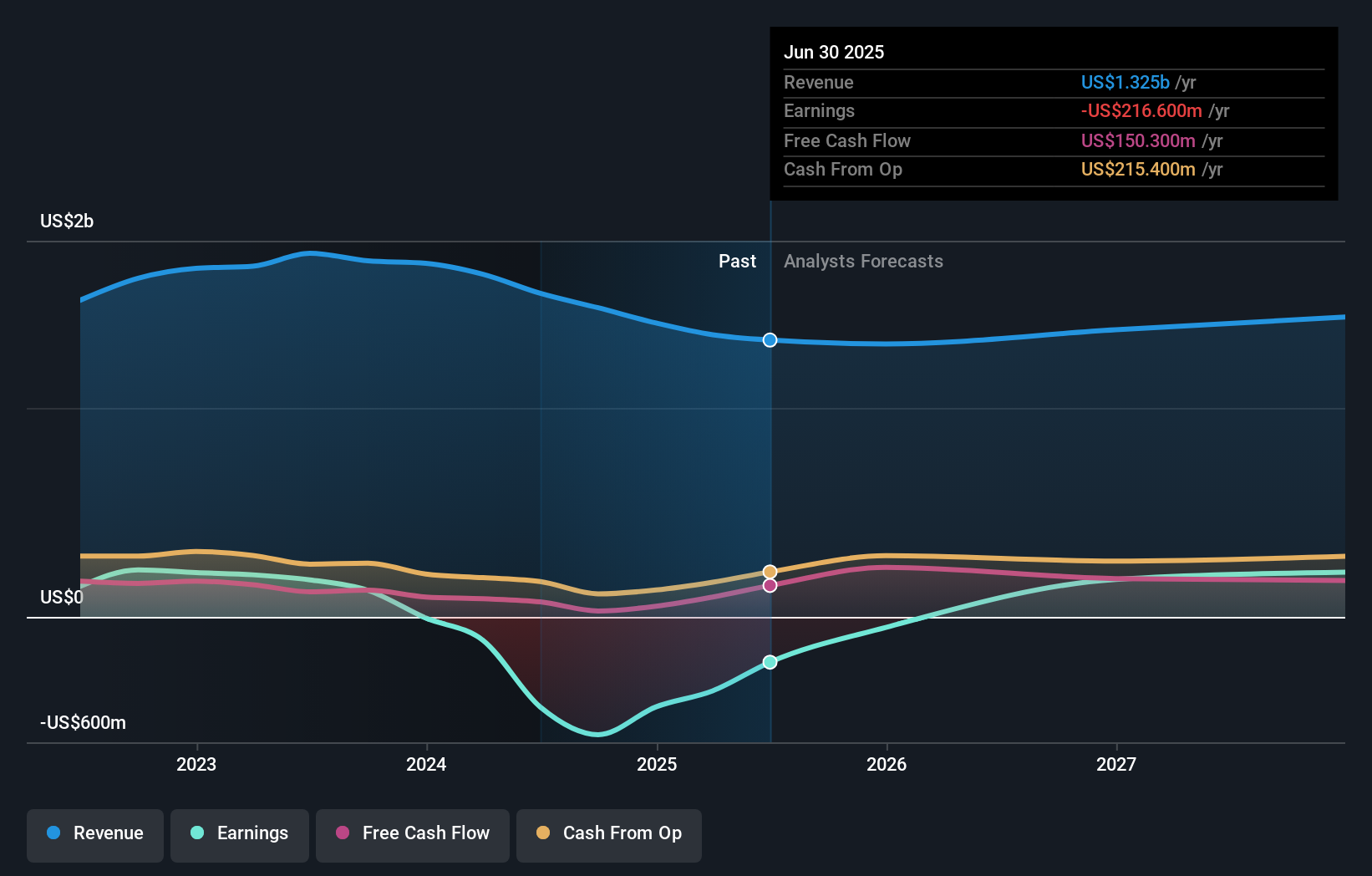

Ingevity's narrative projects $1.5 billion revenue and $412.8 million earnings by 2028. This requires 3.1% yearly revenue growth and a $629.4 million increase in earnings from the current -$216.6 million.

Uncover how Ingevity's forecasts yield a $65.25 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community is available, placing Ingevity's stock at US$65.25. With ongoing tariff headwinds weighing on the Advanced Polymer Technologies segment, broader confidence in future performance remains mixed, consider reviewing different viewpoints to get a fuller picture.

Explore another fair value estimate on Ingevity - why the stock might be worth just $65.25!

Build Your Own Ingevity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingevity research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingevity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingevity's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com