Why Clover Health (CLOV) Is Down 24.4% After Larger Q3 Loss Despite Higher Revenue Guidance

- Clover Health Investments recently reported third quarter 2025 results, showing a US$24.38 million net loss, wider than the previous year, while also raising its full-year insurance revenue guidance to US$1.85 billion–US$1.88 billion.

- This combination of deeper losses but higher expected revenue highlights the company’s evolving approach to balancing top-line growth with profitability challenges.

- We'll now explore how the raised revenue outlook following a larger quarterly loss may influence Clover Health's long-term investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Clover Health Investments Investment Narrative Recap

To be a shareholder in Clover Health Investments, you need to believe in its ability to convert strong revenue growth and technology-driven care into eventual profitability, despite persistent losses. The recent wider net loss, paired with raised revenue guidance, does not materially alter the short-term catalyst, which remains successful cost control and margin stabilization; however, it does highlight how closely revenue expansion and profit sustainability are now intertwined as the headline risk. Among recent company announcements, the launch of enhanced Medicare Advantage offerings for 2026 ties directly into revenue growth ambitions and is particularly relevant. Expanding these plans to reach over 5.2 million Medicare beneficiaries underlines the near-term catalyst: leveraging product innovation to boost enrollment and insurance revenues, even as margin pressures and medical costs continue to present tough challenges. Yet, in contrast to ambitious revenue guidance, investors should remain alert to the persistent challenge of controlling medical cost ratios if...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments is forecast to achieve $3.0 billion in revenue and $10.7 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 22.8% and represents a $52.8 million increase in earnings from the current level of -$42.1 million.

Uncover how Clover Health Investments' forecasts yield a $3.37 fair value, a 26% upside to its current price.

Exploring Other Perspectives

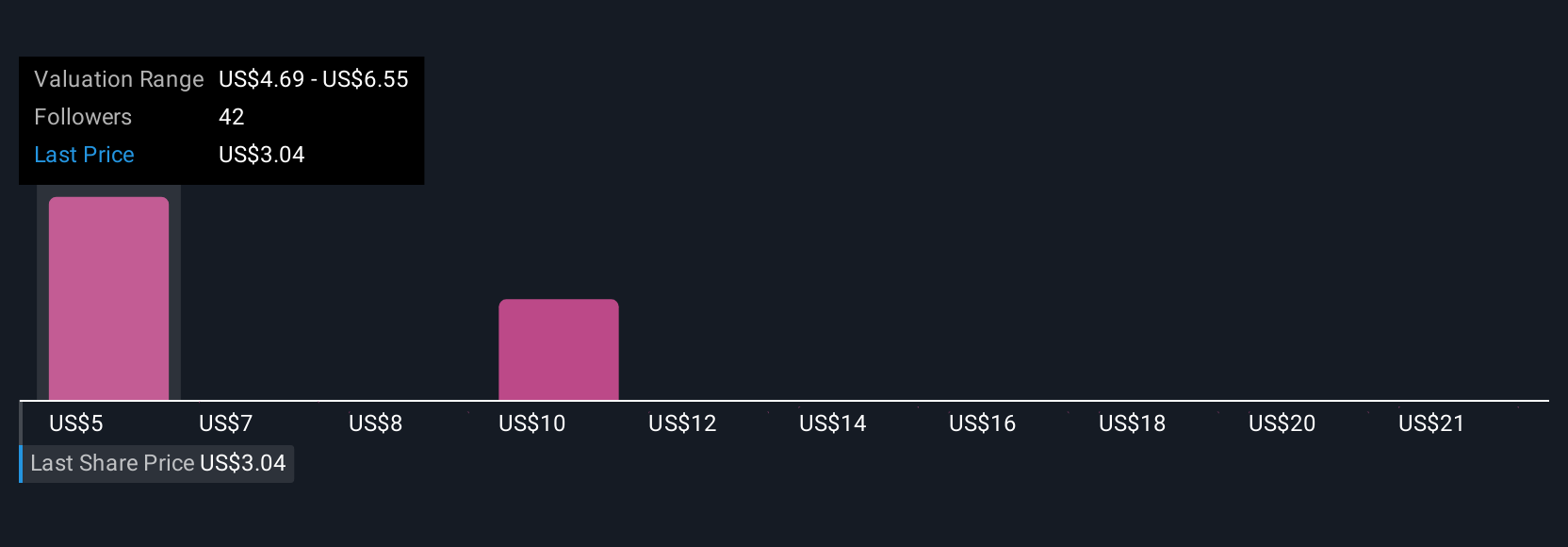

Ten Simply Wall St Community members provided company valuations in a wide range from US$3.37 to US$23.32 per share. While many focus on future revenue growth, persistent net losses weigh heavily on the company's earnings outlook and could affect confidence until profitability improves.

Explore 10 other fair value estimates on Clover Health Investments - why the stock might be worth over 8x more than the current price!

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

No Opportunity In Clover Health Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com