What Ally Financial (ALLY)'s Capital Strength and Strategic Refocus Mean for Shareholders

- Ally Financial Inc. recently reported its Q3 2025 results, emphasizing improvements in its capital ratios, robust growth in dealer financial services, and a renewed focus on digital banking and higher-yielding core businesses while exiting less profitable operations.

- Additionally, the company appointed Allan Merrill, CEO of Beazer Homes, and Gunther Bright, a former American Express executive, to its board, signaling further emphasis on leadership expertise and business diversification.

- We’ll now explore how Ally’s enhanced capital position and shift toward higher-yield businesses may influence its investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ally Financial Investment Narrative Recap

To make the case for being an Ally Financial shareholder today, you need to believe in the company's ability to drive long-term value by doubling down on digital banking, growing its core auto and dealer finance platform, and using improved capital buffers to support disciplined growth, while managing exposure to credit cycles. The addition of two experienced board members highlights a focus on operational expertise and diversification, but does not materially shift the most immediate catalyst, which remains sustained strength in dealer financial services and net interest margin, or the key risk: credit quality as consumer and auto cycles evolve.

Among recent announcements, Ally’s Q3 2025 earnings stood out, with reported net income jumping to US$398 million and a 25 percent year-on-year surge in auto originations; these results speak to the strong momentum in its dealer services segment, currently the engine for both growth potential and greater concentration risk if auto credit conditions worsen. Yet, even with impressive origination volumes, investors will need to weigh how Ally’s reliance on auto lending could heighten sensitivity to shifts in credit or automotive sector trends...

Read the full narrative on Ally Financial (it's free!)

Ally Financial's outlook forecasts $9.6 billion in revenue and $1.8 billion in earnings by 2028. This assumes a 12.0% annual revenue growth rate and a $1.48 billion increase in earnings from the current $324.0 million.

Uncover how Ally Financial's forecasts yield a $48.06 fair value, a 22% upside to its current price.

Exploring Other Perspectives

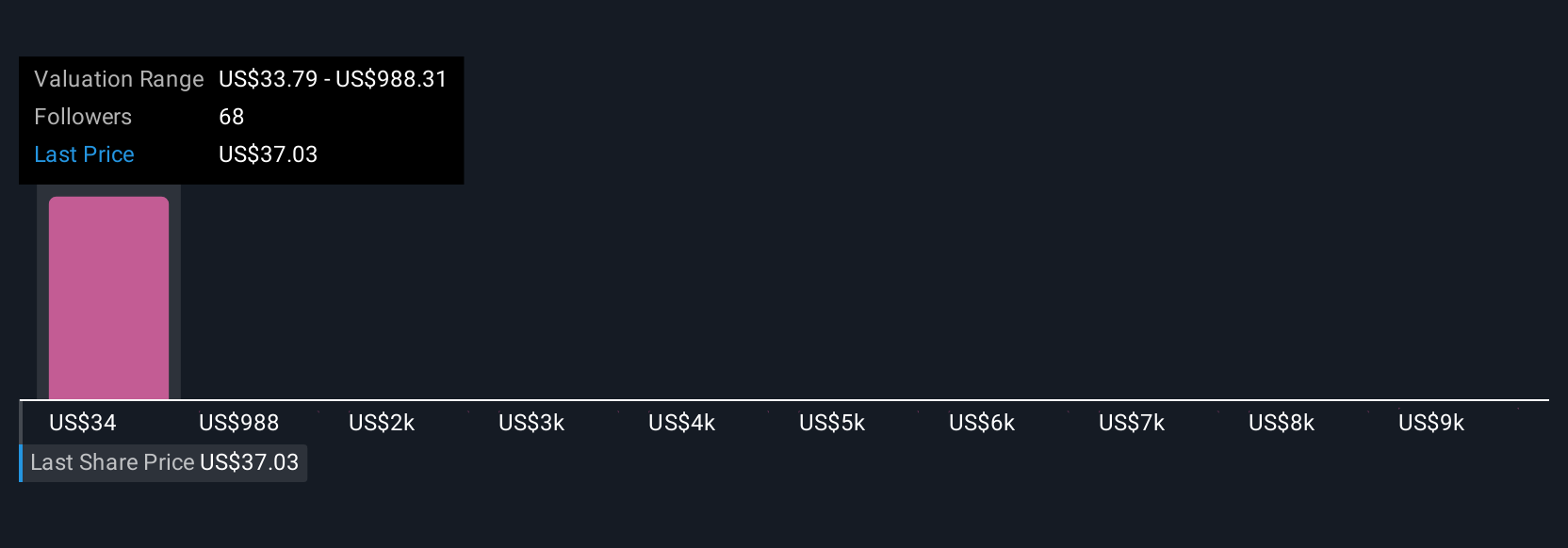

Private investors in the Simply Wall St Community estimated fair values for Ally Financial ranging from US$33.79 up to US$9,578.94, based on 11 distinct analyses. While these opinions vary widely, brisk growth in dealer originations and net income remains central to many future expectations, making it essential to explore multiple viewpoints when assessing the company’s outlook.

Explore 11 other fair value estimates on Ally Financial - why the stock might be a potential multi-bagger!

Build Your Own Ally Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ally Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ally Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ally Financial's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com