Does Novanta’s (NOVT) Latest Capital Raise Reveal a Shift in Its Growth Ambitions?

- Novanta Inc. recently completed a public offering of US$550 million in 6.5% tangible equity units at US$50 per unit, with net proceeds intended for debt repayment, working capital, acquisitions, and other corporate purposes.

- An important takeaway is that Novanta plans to use a substantial portion of the proceeds to repay about US$317 million in debt, which may support financial flexibility for future investments.

- We’ll explore how this significant capital raise and focus on acquisition funding could influence Novanta’s investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Novanta Investment Narrative Recap

To be a shareholder in Novanta right now, you need to believe the company can capture accelerating demand for robotics, precision medicine, and smart factory automation by leveraging acquisitions and innovation, even as organic revenue grows modestly in the near term. The recent US$550 million tangible equity unit offering, with proceeds earmarked for acquisitions and debt repayment, potentially boosts Novanta’s ability to secure inorganic growth, but does not materially change the biggest near-term catalyst: successful acquisition execution and integration. The most important risk remains the company’s reliance on acquisitions rather than organic expansion, which could pressure both revenue and earnings growth if acquisition activity falters.

Among recent announcements, Novanta’s third quarter 2025 earnings report is most relevant. The update showed only slight year-on-year sales growth alongside a significant drop in net income, highlighting why inorganic growth is essential to the company’s narrative. With organic revenue trending flat to slightly up and challenged segment performance, investor attention is likely to remain focused on whether new capital can accelerate acquisition-driven expansion and offset margin pressure from ongoing external headwinds.

But while these moves show confidence, investors should be aware that if Novanta’s pipeline of accretive acquisitions slows or integration proves challenging…

Read the full narrative on Novanta (it's free!)

Novanta's narrative projects $1.1 billion revenue and $135.3 million earnings by 2028. This requires 5.8% yearly revenue growth and a $73.9 million increase in earnings from $61.4 million today.

Uncover how Novanta's forecasts yield a $154.00 fair value, a 44% upside to its current price.

Exploring Other Perspectives

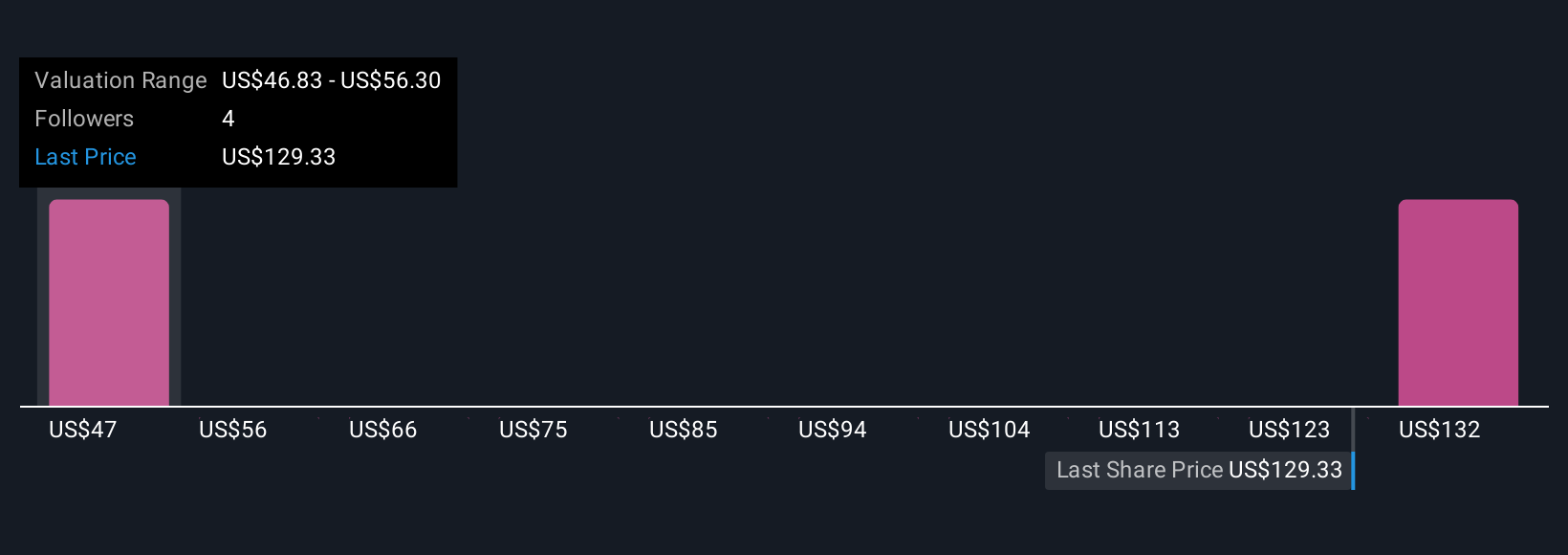

Three fair value estimates from the Simply Wall St Community range from as low as US$45.86 to as high as US$154. With such varied opinions, at a time when Novanta’s acquisition strategy is crucial for future growth, the difference in expectations highlights why ongoing business execution may shape sentiment going forward. Explore how your outlook compares with other individual investors.

Explore 3 other fair value estimates on Novanta - why the stock might be worth as much as 44% more than the current price!

Build Your Own Novanta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Novanta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novanta's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com