Can Avient’s (AVNT) Margin Gains Reveal New Strengths in Its Specialty Materials Portfolio?

- Avient Corporation recently reported its third-quarter 2025 financial results, posting sales of US$806.5 million and net income of US$32.6 million, both slightly below the previous year, alongside margins that improved due to effective cost controls.

- The company expects fourth-quarter sales to show modest improvement over the third quarter, supported by growth in its Specialty Engineered Materials segment and new product innovations.

- We'll explore how Avient’s improved profit margins and positive guidance update could shape its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Avient Investment Narrative Recap

To be a shareholder in Avient, one needs to believe that the company's specialty material innovation and cost control initiatives can offset ongoing market headwinds and deliver long-term earnings growth. The latest quarterly update shows adjusted margins improving even as sales and net income declined, and management’s guidance for slightly better Q4 sales suggests the main near-term catalyst, Specialty Engineered Materials growth, remains intact. The biggest risk, a broad-based decline in demand for traditional polymer products, has not fundamentally shifted on these results, so the overall investment thesis remains mostly unchanged.

Among recent announcements, the appointment of David N. Schneider as President of Specialty Engineered Materials stands out. This move directly supports Avient’s emphasis on innovation in higher-value segments, aligning with management’s positive outlook for new product launches that are expected to drive Q4’s modest improvement. With fresh leadership and a focused strategy in this division, the company is reinforcing the most important short-term growth catalyst while maintaining cost controls to sustain profit margins.

However, investors should not overlook that, at the same time, persistent weakness in core consumer and industrial end-markets...

Read the full narrative on Avient (it's free!)

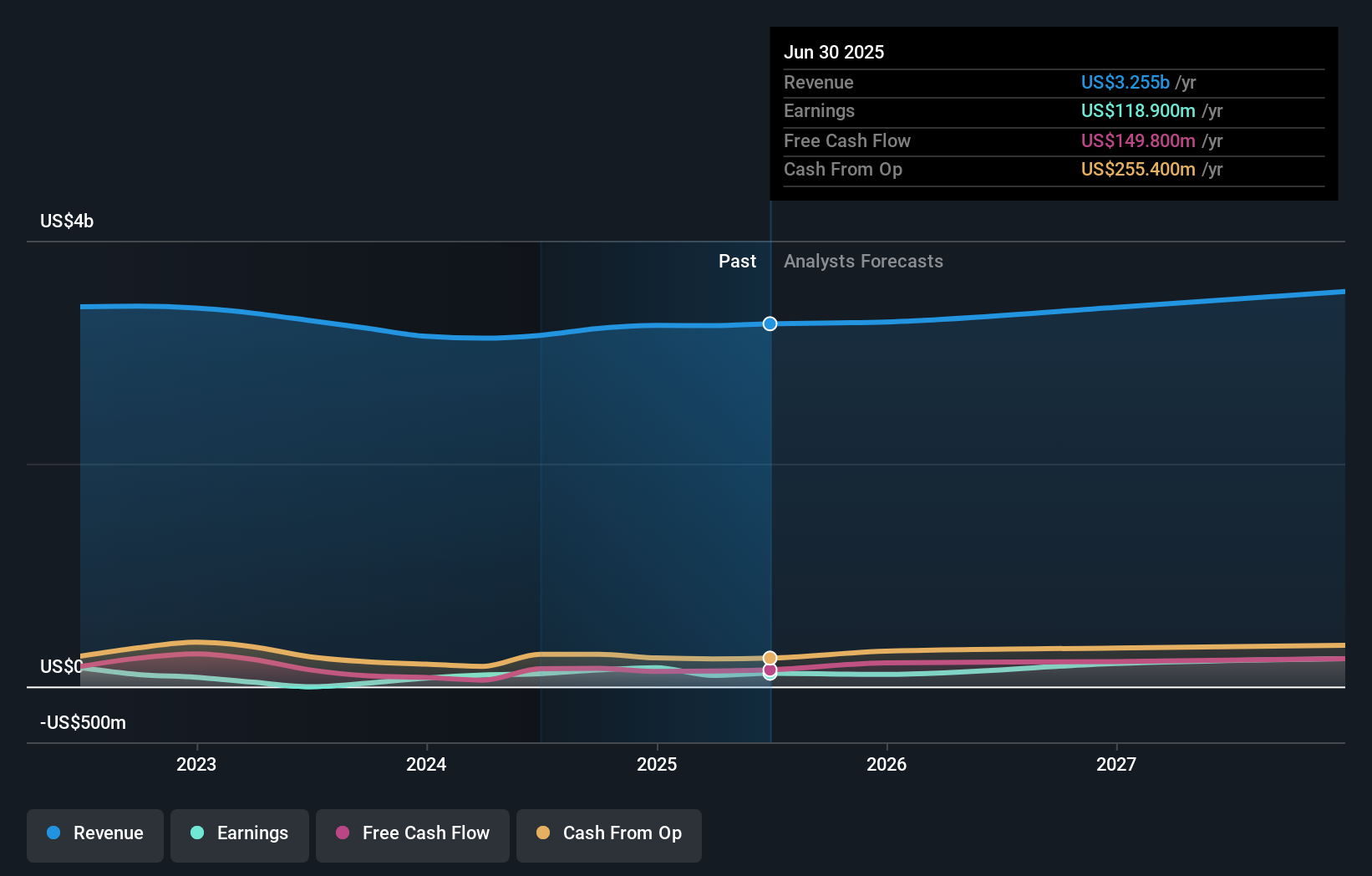

Avient's narrative projects $3.6 billion revenue and $309.5 million earnings by 2028. This requires 3.3% yearly revenue growth and a $190.6 million increase in earnings from the current $118.9 million.

Uncover how Avient's forecasts yield a $42.12 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Avient's fair value estimates stretching from US$25.95 to US$55.66, reflecting a broad range of views based on individual forecasts. Against this backdrop, the focus on margins and specialty materials innovation takes on greater significance as you compare differing outlooks on where the company could go next.

Explore 2 other fair value estimates on Avient - why the stock might be worth 12% less than the current price!

Build Your Own Avient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avient research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avient's overall financial health at a glance.

No Opportunity In Avient?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com