What Otter Tail (OTTR)'s Dividend Hike and Upgraded Earnings Outlook Mean for Shareholders

- On November 3, 2025, Otter Tail Corporation's board declared a quarterly dividend of US$0.525 per share, payable on December 10, 2025, and raised its full-year 2025 diluted earnings guidance to US$6.32–US$6.62 per share after announcing third-quarter results.

- This guidance increase signals management's confidence in operational prospects, despite a year-over-year decline in third-quarter earnings per share.

- We'll assess how Otter Tail's increased 2025 earnings outlook affects the company's investment narrative and future growth assumptions.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Otter Tail Investment Narrative Recap

Investors who see Otter Tail as a long-term holding are typically betting on the company's ability to drive stable earnings growth from regulated utility operations, disciplined capital investment, and steady demand across its diversified businesses. The board's recent move to raise full-year earnings guidance, even after a year-over-year drop in third-quarter profits, preserves near-term confidence but doesn't materially alter the largest current risk: the potential negative effects of rising interest rates on funding its major capital plans.

The most relevant recent announcement is Otter Tail's updated 2025 earnings guidance, raised to US$6.32–US$6.62 per share. This increase signals management's optimism about core operations and rate recovery, but the outlook remains sensitive to cost of capital pressures as the company progresses on its US$1.4 billion investment pipeline.

In contrast, investors should be aware that higher financing costs could threaten earnings growth if more projects require...

Read the full narrative on Otter Tail (it's free!)

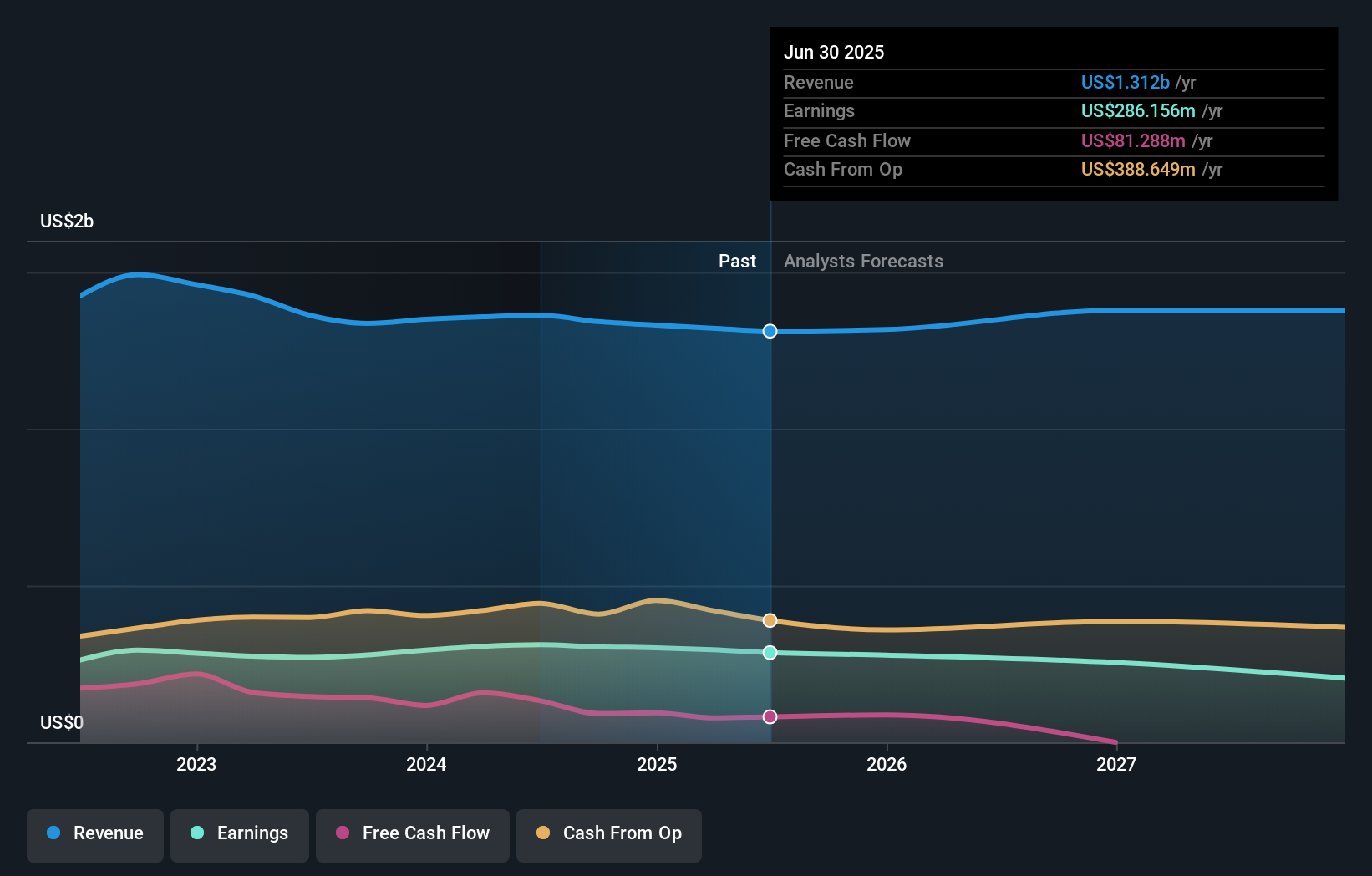

Otter Tail's outlook anticipates $1.4 billion in revenue and $195.9 million in earnings by 2028. This reflects a 2.5% annual revenue growth and an earnings decrease of $90.3 million from the current $286.2 million.

Uncover how Otter Tail's forecasts yield a $83.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates span a huge range from US$0.01 to US$83 per share. As you consider the possibility that steady dividend increases and earnings guidance could be offset by higher capital costs, explore several member viewpoints to inform your outlook.

Explore 4 other fair value estimates on Otter Tail - why the stock might be worth less than half the current price!

Build Your Own Otter Tail Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otter Tail research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Otter Tail research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otter Tail's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com