Will GLP's Dividend Commitment Reflect Enduring Strength or Reveal Pressure Points in Its Core Operations?

- Global Partners LP reported its third-quarter 2025 earnings, posting sales of US$4.69 billion and net income of US$24.23 million, both changes from the previous year, along with a long-lived asset impairment of US$20,000.

- Despite year-over-year declines in net income and earnings per share, the company maintained its dividend and cited solid performance in its Wholesale segment while highlighting ongoing challenges in gasoline distribution and station operations.

- We'll explore how the weaker third-quarter net income influences Global Partners' investment narrative and sector outlook going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Global Partners Investment Narrative Recap

To own Global Partners, you need to believe that core fuel distribution and terminal assets can reliably generate strong cash flows despite increasing headwinds from the energy transition and market volatility in transportation fuels. The third-quarter results, with weaker net income but rising sales, did little to change the main near-term catalyst, the resilience of Wholesale, and had no material effect on the biggest risk: long-term declines in fossil fuel consumption and asset utilization.

The most relevant recent announcement is the company’s maintenance of its cash dividend in the face of lower profits, signaling management's intent to support income-focused investors as the business faces ongoing operational and distribution challenges. While short-term performance remains tied to wholesale fuel demand, continued dividend coverage and cash flows provide a measure of stability for those focused on yield.

On the other hand, investors should watch for evidence that shifting demand for gasoline and diesel is starting to erode site utilization and profitability, as ...

Read the full narrative on Global Partners (it's free!)

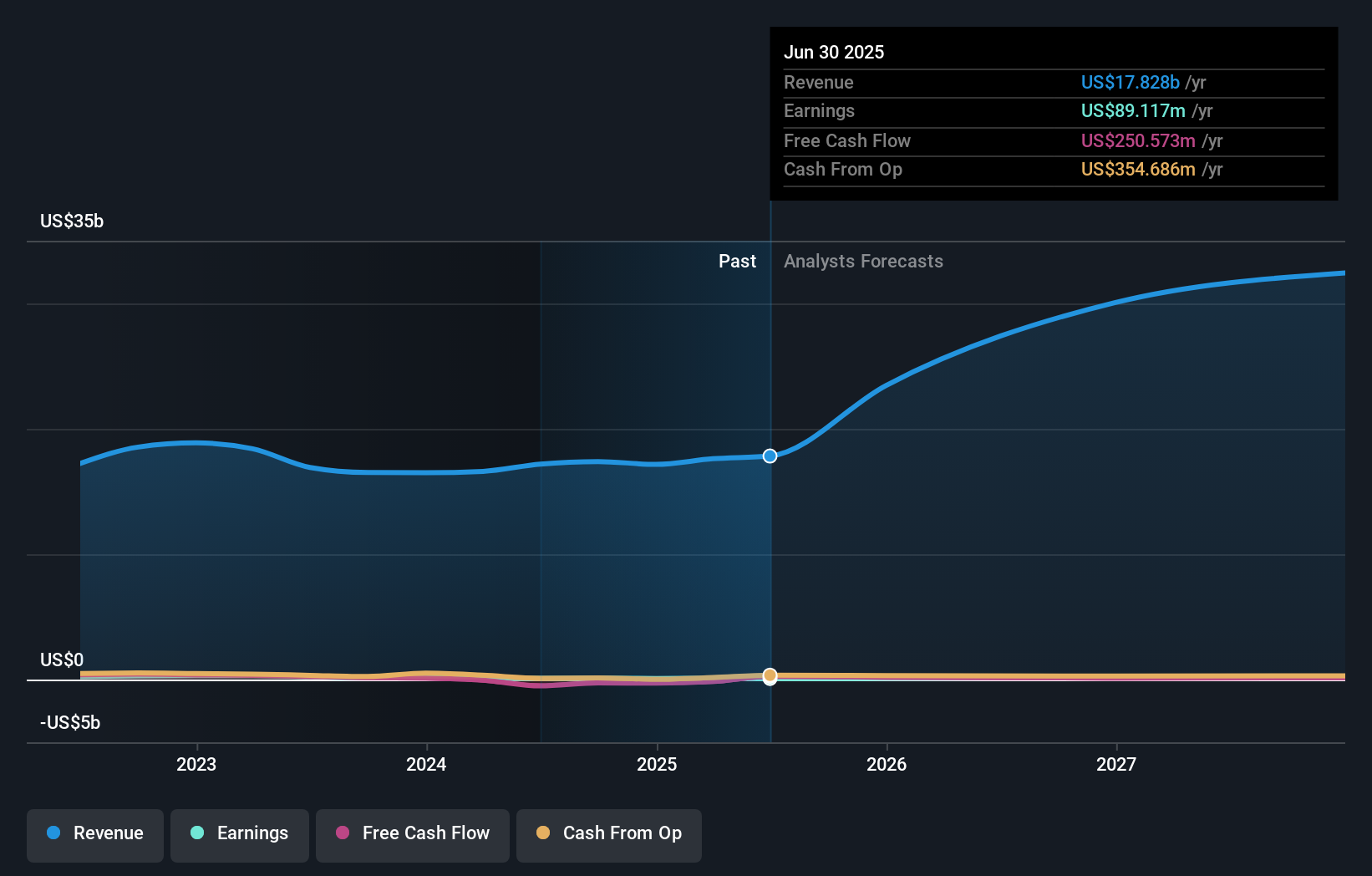

Global Partners’ narrative projects $38.2 billion in revenue and $149.4 million in earnings by 2028. This requires 28.9% yearly revenue growth and a $60.3 million earnings increase from $89.1 million today.

Uncover how Global Partners' forecasts yield a $49.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community place Global Partners’ fair value between US$49 and US$104, based on three distinct forecasts. With fuel volumes at risk from energy transition, you’ll find plenty of contrasting views to consider.

Explore 3 other fair value estimates on Global Partners - why the stock might be worth just $49.00!

Build Your Own Global Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Partners' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com