Is Silicon Motion Technology’s Valuation Justified After This Year’s 59% Surge and M&A Buzz?

- Curious whether Silicon Motion Technology is still a bargain or if its stellar run is approaching a peak? Let’s break down what’s really behind the stock’s value.

- While the share price has surged 58.7% year-to-date and delivered an impressive 74.7% over the last year, it has also pulled back 7.4% this past week, reminding investors that momentum can shift quickly.

- Much of the recent excitement comes after sector-wide optimism for semiconductor stocks and renewed M&A chatter involving major players, which has sent ripples across the industry. Headlines about chip shortages and strategic partnerships continue to add fuel to the debate about where Silicon Motion Technology is headed next.

- The company currently scores a 3 out of 6 on our valuation checks, showing room for improvement and plenty of debate. Let’s look at how traditional valuation tools stack up, and why there might be an even smarter way to assess value later in the article.

Approach 1: Silicon Motion Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and translating them into today’s dollars. This approach prioritizes actual money the company is expected to generate, considering both near-term analyst estimates and longer-term trends extrapolated from what is observable now.

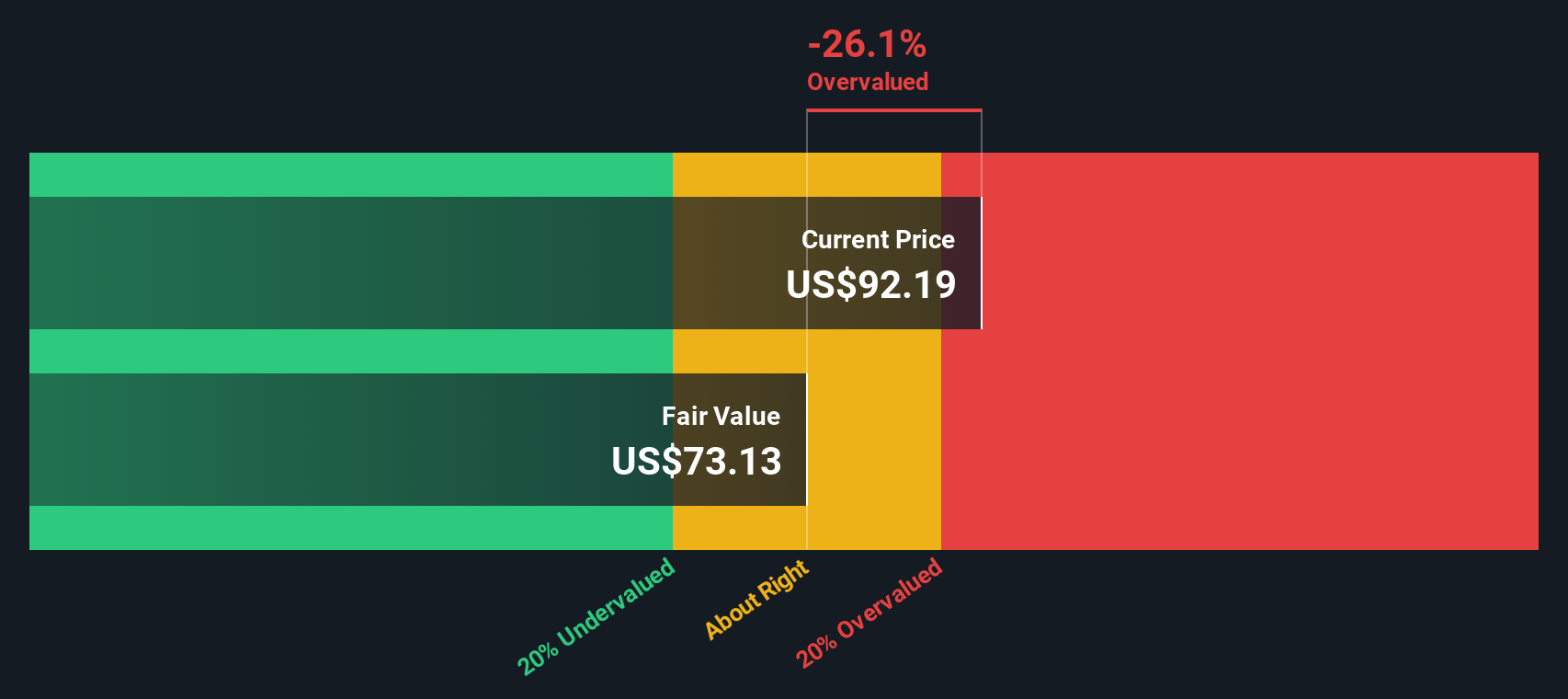

For Silicon Motion Technology, the most recent reported Free Cash Flow sits at $0.49 million. Analysts forecast steady expansion, with cash flows projected to reach $114.5 million by 2027 and further modeled at $148 million by 2035 (based on a blend of analyst and estimated data). These estimates are all denominated in USD to align with the share listing currency.

By discounting those future inflows back to today under the 2 Stage Free Cash Flow to Equity model, the DCF estimate puts Silicon Motion Technology’s intrinsic value at approximately $40.90 per share. However, with the current market price substantially higher, the analysis indicates the stock is trading 112.1% above its intrinsic value. This suggests considerable overvaluation at today’s levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Silicon Motion Technology may be overvalued by 112.1%. Discover 878 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Silicon Motion Technology Price vs Earnings

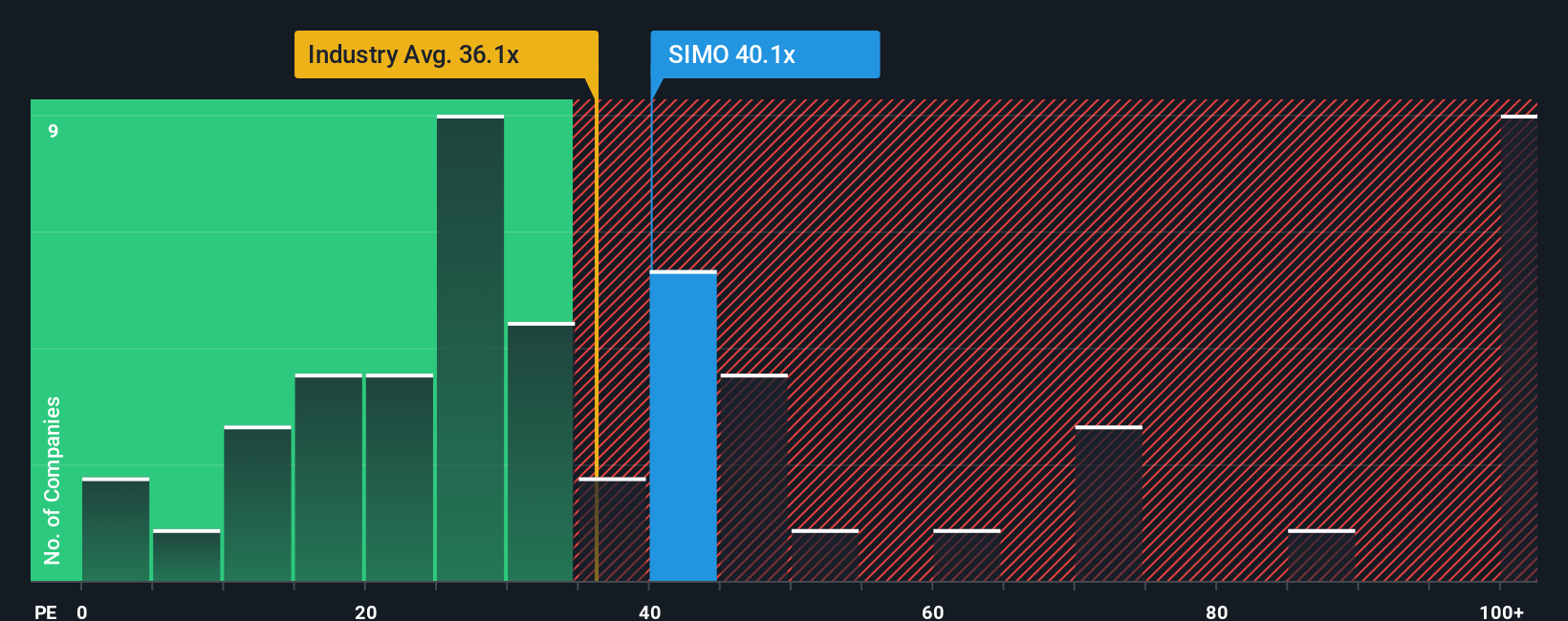

Price-to-Earnings, or PE, is one of the most widely used valuation ratios for profitable companies. It simply compares a company’s share price to its earnings per share, providing a snapshot of how much investors are willing to pay today for a dollar of earnings. This makes it particularly useful for companies like Silicon Motion Technology, which are generating profits and have established earnings records.

The right or “fair” PE ratio for a company depends on factors like expected future earnings growth and perceived risk. Fast-growing and lower-risk companies tend to command higher PE multiples, while slower-growth or riskier businesses typically trade at lower levels.

Currently, Silicon Motion Technology trades at a PE ratio of 30.6x. This is notably below the peer average of 45.0x and the wider semiconductor industry average of 34.2x, positioning the stock as relatively cheaper on this metric alone.

This is where Simply Wall St’s Fair Ratio comes in, which blends multiple factors such as earnings growth, profit margins, market capitalization, and risk profile to generate a more tailored benchmark. Rather than relying solely on industry or peer multiples, the Fair Ratio (29.8x for Silicon Motion Technology) provides a more precise reference point for what the company should be worth based on its unique characteristics.

Comparing Silicon Motion Technology’s actual PE of 30.6x to its Fair Ratio of 29.8x reveals that the stock is valued just a touch above what would be considered ideal. However, with such a narrow margin, the shares look priced about right in the current context.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Silicon Motion Technology Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you combine your unique perspective or story about a company, such as its growth drivers, risks and opportunities, with your own assumptions for future revenue, earnings, and profit margins. Narratives connect a company’s story directly to a detailed financial forecast and, ultimately, an objective fair value. This makes your investment thesis more tangible and actionable.

On Simply Wall St’s Community page, used by millions of investors, anyone can easily create, update, or follow Narratives linked to their favorite stocks. Narratives empower you to make smarter decisions on when to buy or sell. You can instantly see if the stock price is above or below your Fair Value as soon as new news or earnings are released, because Narratives update dynamically in real time.

For example, with Silicon Motion Technology, one investor may see robust technology leadership, margin expansion, and global storage demand as a reason to value the stock as high as $111.50 per share. Another investor, focused on competitive risks and margin pressure, might set a lower Narrative fair value near $80. Each Narrative reflects different forecasts, so you can compare, discuss, and refine your view based on real analysis, not just sentiment.

Do you think there's more to the story for Silicon Motion Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com