How Investors Are Reacting To Sonos (SONO) Balancing Improved Q4 Sales With Rising Annual Losses

- Sonos, Inc. recently announced fourth quarter and full-year results, reporting Q4 sales of US$287.9 million with a net loss of US$37.86 million, and full-year sales of US$1.44 billion with a net loss of US$61.14 million, both compared to the prior year.

- While the company showed improved quarterly sales and a narrower Q4 net loss, its full-year figures reflected lower sales and a wider net loss year-over-year, highlighting ongoing profitability challenges.

- We'll assess how Sonos's increased quarterly sales but deeper annual net loss could alter its long-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sonos Investment Narrative Recap

To be a Sonos shareholder, you need to believe in the company’s ability to build household loyalty and drive recurring sales as it evolves its audio platform and broadens its market presence. The latest earnings news, with better fourth quarter sales but a heavier annual loss, doesn't meaningfully change the central short-term catalyst, the need for innovation or new hardware launches to sustain momentum amid intense competition, and the single biggest risk remains potential erosion of demand if tariffs persist or deepen.

Among recent events, the appointment of Tom Conrad as permanent CEO stands out. This leadership change may help shape Sonos’s response to ongoing profitability challenges and the risk of losing market share during the current lull in hardware releases, which is especially relevant given the timing of the latest financial results. In contrast, while quarterly improvements are encouraging, investors should be aware of…

Read the full narrative on Sonos (it's free!)

Sonos' narrative projects $1.6 billion revenue and $120.2 million earnings by 2028. This requires 5.0% yearly revenue growth and a $196.6 million earnings increase from -$76.4 million.

Uncover how Sonos' forecasts yield a $17.85 fair value, a 8% upside to its current price.

Exploring Other Perspectives

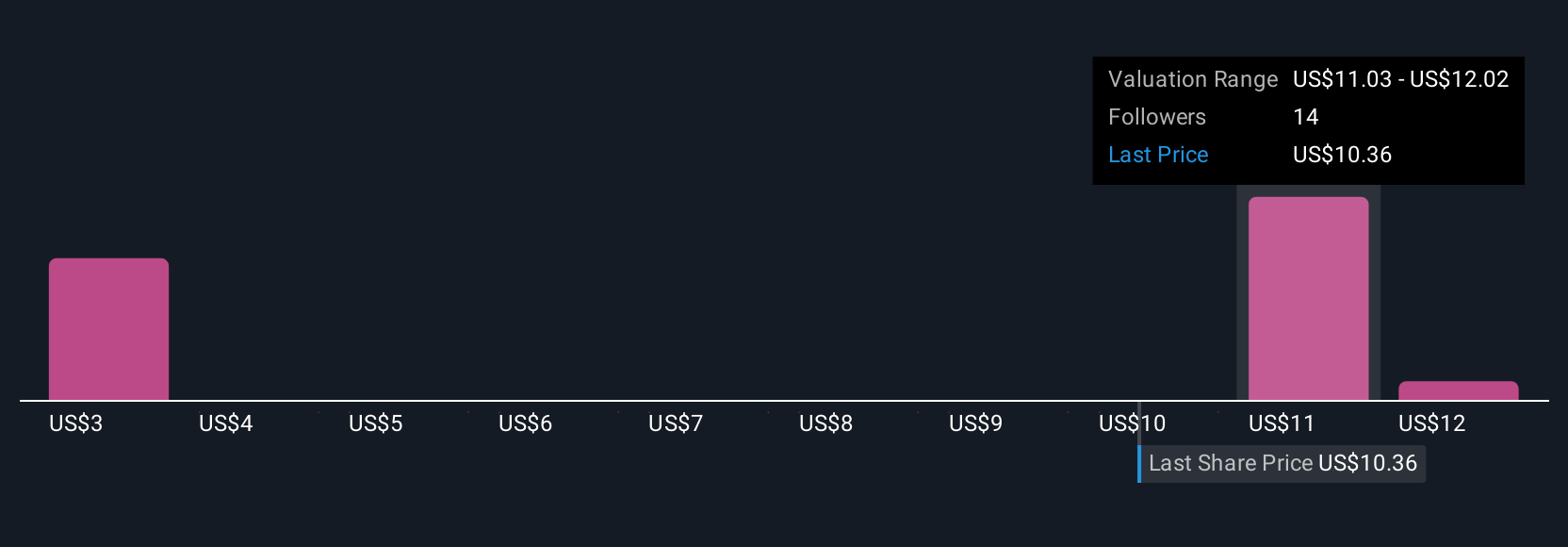

Simply Wall St Community members provided four fair value estimates for Sonos ranging from US$6.20 to US$17.85 per share, revealing a wide spectrum of outlooks. With ongoing concern about Sonos’s reliance on software updates during a product release gap, it’s clear that perspectives on future performance can be highly diverse, consider multiple views as you decide your next steps.

Explore 4 other fair value estimates on Sonos - why the stock might be worth as much as 8% more than the current price!

Build Your Own Sonos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Sonos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonos' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com