Northwest Natural Holding (NWN): Exploring Valuation After Upbeat Earnings and Upgraded 2025 Outlook

Northwest Natural Holding (NWN) just announced its latest quarterly results, reporting higher sales for the period and notable growth in net income over nine months. The company also raised its full-year 2025 earnings outlook, signaling increased confidence for investors.

See our latest analysis for Northwest Natural Holding.

Northwest Natural Holding’s upbeat earnings update and higher 2025 outlook have clearly boosted sentiment, with the share price climbing 18.3% over the past 90 days and delivering a one-year total shareholder return of 22%. This momentum suggests investors are increasingly optimistic about the company’s growth potential as next year approaches.

If you’re interested in discovering what else is leading the charge in today’s market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares on a tear following strong results and upbeat guidance, investors face a key question: is Northwest Natural Holding still trading at an attractive valuation, or has the market already priced in all the expected growth?

Most Popular Narrative: 9.0% Undervalued

Northwest Natural Holding’s most followed valuation narrative sees the fair value at $52.75, a modest premium over the last closing price of $47.98. The gap between these figures reflects positive expectations for earnings and a supportive regulatory backdrop, which current market pricing may not fully reflect.

Ongoing investments in infrastructure modernization and system upgrades, combined with supportive regulatory outcomes (recent rate increase and higher allowed ROE), are likely to improve net margins, operating efficiency, and future earnings reliability.

Want the full backstory on what could push this stock higher? The calculations behind this attractive narrative hinge on big upgrades to future profits and how the company is expected to outperform typical sector margins. Could these projections justify its premium? The complete narrative lays out the provocative financial logic.

Result: Fair Value of $52.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential regulatory shifts or slower than expected growth in new markets could quickly challenge these optimistic assumptions and test the bull case.

Find out about the key risks to this Northwest Natural Holding narrative.

Another View: Market Multiples Send a Different Signal

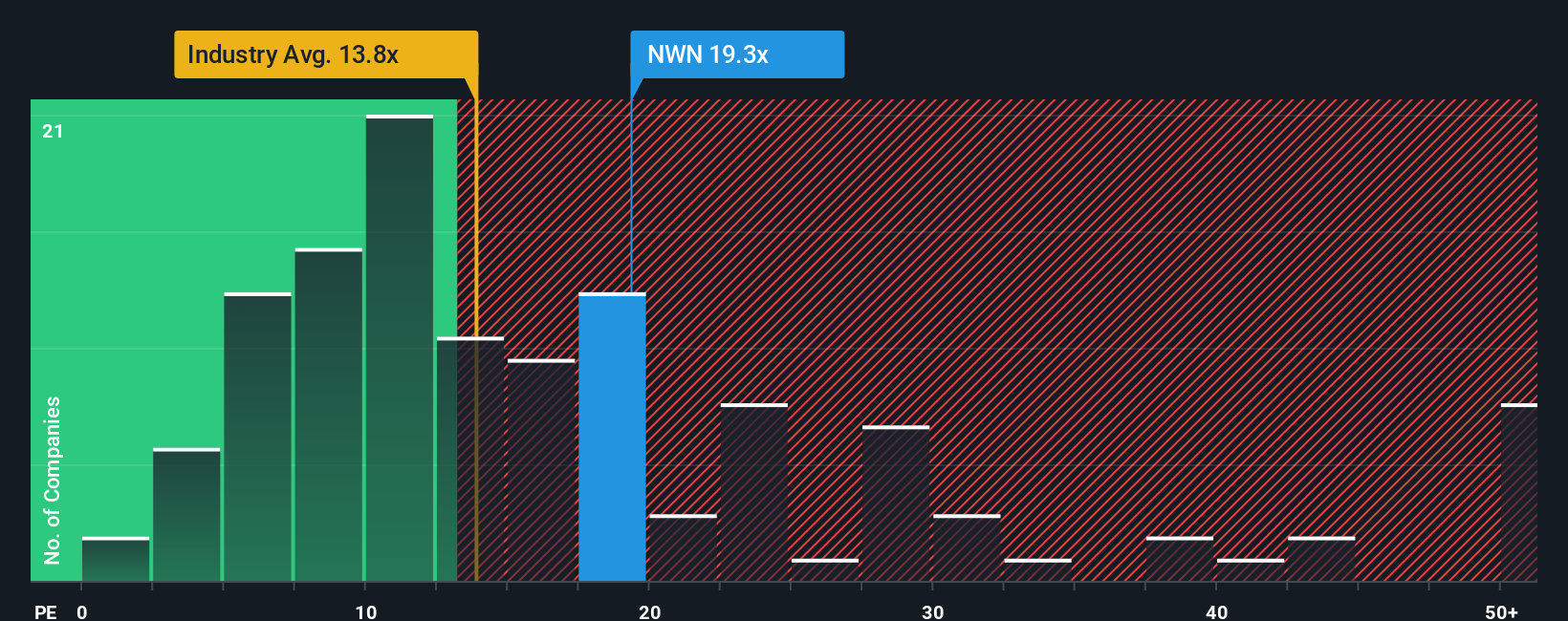

If we set aside the fair value narrative and focus on the price-to-earnings ratio, Northwest Natural Holding looks expensive right now. The company trades at 19.8 times earnings, above both its peer group average of 18.8 and the industry’s average of 14.1. The market is assigning a premium, but how much risk are investors taking on if that sentiment changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northwest Natural Holding Narrative

If you feel the story is missing a key angle or you’d rather run the numbers yourself, it’s quick and easy to map out your own view. Do it your way.

A great starting point for your Northwest Natural Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by checking out exciting opportunities in fast-moving sectors and untapped niches, so you never miss what’s energizing the market right now.

- Capitalize on high-growth potential by researching these 25 AI penny stocks that are transforming industries through artificial intelligence and automation breakthroughs.

- Strengthen your portfolio with steady income streams by uncovering these 16 dividend stocks with yields > 3% featuring yields above 3% and proven payment track records.

- Position yourself ahead of the curve with these 26 quantum computing stocks that are powering advancements in quantum computing and next-generation technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com