Materion (MTRN): Exploring Valuation Potential After Recent Share Price Volatility

Materion (MTRN) has been attracting interest from investors who are examining recent performance trends and underlying fundamentals. The stock saw some movement this week, which has prompted a closer look at where things stand after a volatile month.

See our latest analysis for Materion.

Materion’s share price has continued to see shifts, with momentum slowing after a robust start this year. The year-to-date share price return sits at 22.38%, but a recent one-month dip of 9.66% shows some cooling. Even with this short-term pullback, its long-term record remains strong, as evidenced by a 53% total shareholder return over the past three years and an impressive 99% over five years. Investors seem to be weighing growth potential against near-term uncertainty, given recent volatility.

If you’re interested in discovering what else is gaining traction beyond the materials sector, this could be a prime moment to explore fast growing stocks with high insider ownership

With shares trading below analyst price targets and strong long-term returns, the question remains: is Materion currently undervalued and set for a rebound, or has the market already priced in all of its growth potential?

Most Popular Narrative: 19% Undervalued

Materion’s most-followed narrative sees substantial upside from today’s last close of $116.40, with the fair value pegged at $143.67. This assessment weighs future growth momentum against recent market hesitancy, setting up a deeper exploration of the factors behind the price gap.

"Accelerating demand in the semiconductor sector, driven by increasing wafer starts, growth in data storage and communication devices, and the recent acquisition of Konasol (expanding footprint in Asia), positions Materion to capture a higher share of a rapidly expanding global market. This supports sustained top line revenue growth over the next several years as new capacity ramps by 2026."

Want to know what numbers could turn momentum into a breakout? This narrative is powered by bold assumptions about future earnings, margins, and revenue acceleration. Uncover the projections that shaped this surprising valuation and dive into the full story for the details behind Materion’s price target.

Result: Fair Value of $143.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as ongoing procurement challenges in China and uncertainty around future demand could quickly threaten the positive narrative supporting Materion’s outlook.

Find out about the key risks to this Materion narrative.

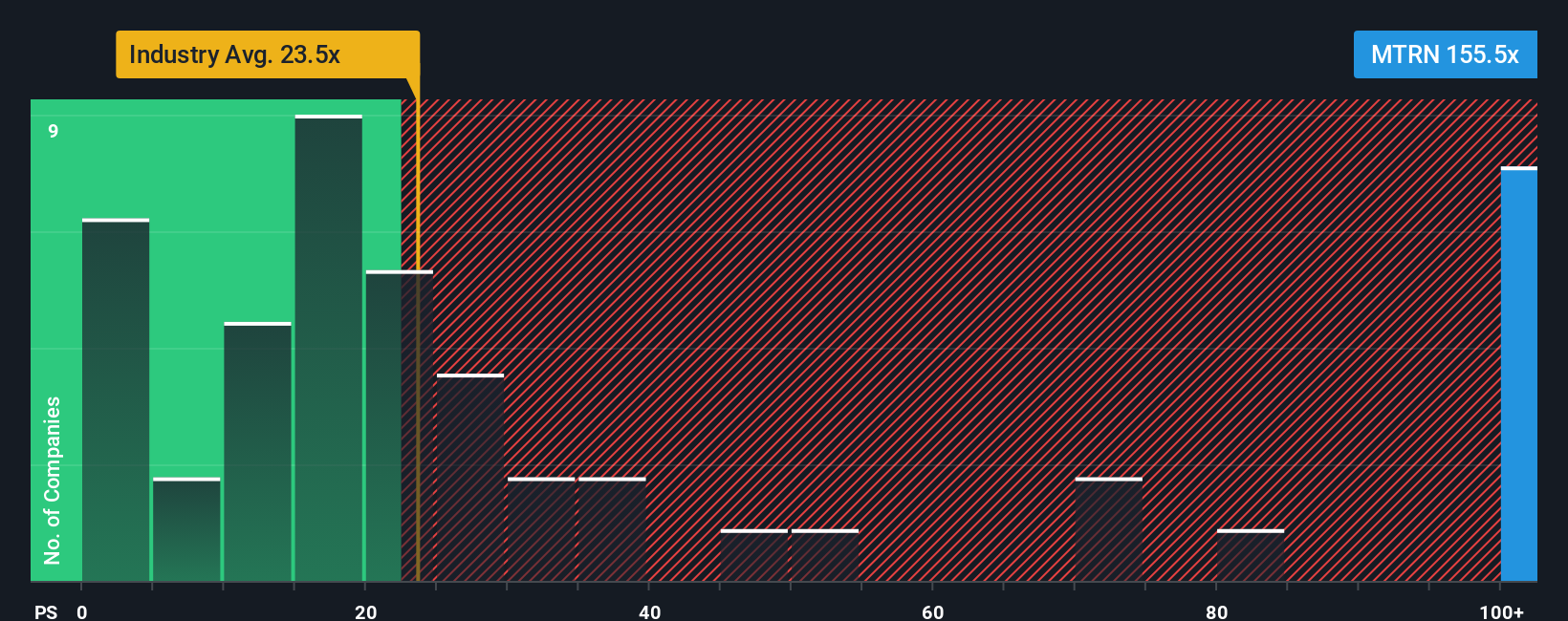

Another View: What Do the Multiples Say?

While our primary model sees Materion as undervalued, a closer look at the price-to-earnings ratio tells a different story. The company is trading at 124.4 times earnings, which is much higher than both its peers at 34.6x and the industry’s 20.5x. Even its fair ratio, calculated at 37x, remains well below the current level. This gap suggests a valuation risk that investors cannot ignore. Could Materion’s story justify such a premium, or is market optimism running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Materion Narrative

If you see the numbers differently or would rather dig into the fundamentals on your own terms, you can shape your own view of Materion’s outlook in just a few minutes: Do it your way

A great starting point for your Materion research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means seizing the right opportunities before they slip away. Use Simply Wall Street’s powerful screener to spot these standout ideas now:

- Jump on the rise of artificial intelligence by checking out these 25 AI penny stocks designed for tomorrow’s disruptive growth.

- Maximize income and stability by reviewing these 16 dividend stocks with yields > 3% offering attractive yields with strong financial health.

- Catch the momentum in digital innovation and future-proof your portfolio with these 82 cryptocurrency and blockchain stocks gaining traction in the accelerating world of blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com