Revolve Group (RVLV): Assessing Valuation Opportunities as Share Performance Lags This Year

See our latest analysis for Revolve Group.

Zooming out, Revolve Group shares have trended lower this year, with a year-to-date share price return of -37.54% and a total shareholder return over one year of -36.27%. Momentum appears to be fading as performance remains under pressure. This is occurring despite signs of top-line growth and improving profits.

If you’re looking to spot other fast-moving names while momentum shifts, this is the perfect time to discover fast growing stocks with high insider ownership

With shares trading well below their recent highs while also showing signs of operational improvement, investors may wonder whether Revolve Group is now undervalued or if the market has already priced in all the expected future growth.

Most Popular Narrative: 14.7% Undervalued

With Revolve Group's last closing price of $20.96 coming in well below the narrative fair value of $24.57, the stage is set for debate about whether the market is overlooking the company's future prospects.

Expanding international presence, especially with substantial growth in China and other underpenetrated markets, positions Revolve to capture outsized revenue growth as Millennial and Gen Z consumers in these regions increasingly shift spending online. Ongoing investments in owned and exclusive brands are expected to drive higher gross margins and net margins, supported by better inventory management, tighter markdown algorithms, and diversification of supply chains to mitigate tariff impacts.

Want the secret behind this double-digit valuation edge? The narrative hinges on ambitious global market bets, smarter inventory moves and a margin turnaround story. Hungry to discover the pivotal financial leap that justifies this price target? Unpack the projections that could alter the entire outlook inside the full narrative.

Result: Fair Value of $24.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff volatility and possible declines in average order value could quickly undermine the optimism that is fueling current growth projections.

Find out about the key risks to this Revolve Group narrative.

Another View: Is the Market Paying a Premium?

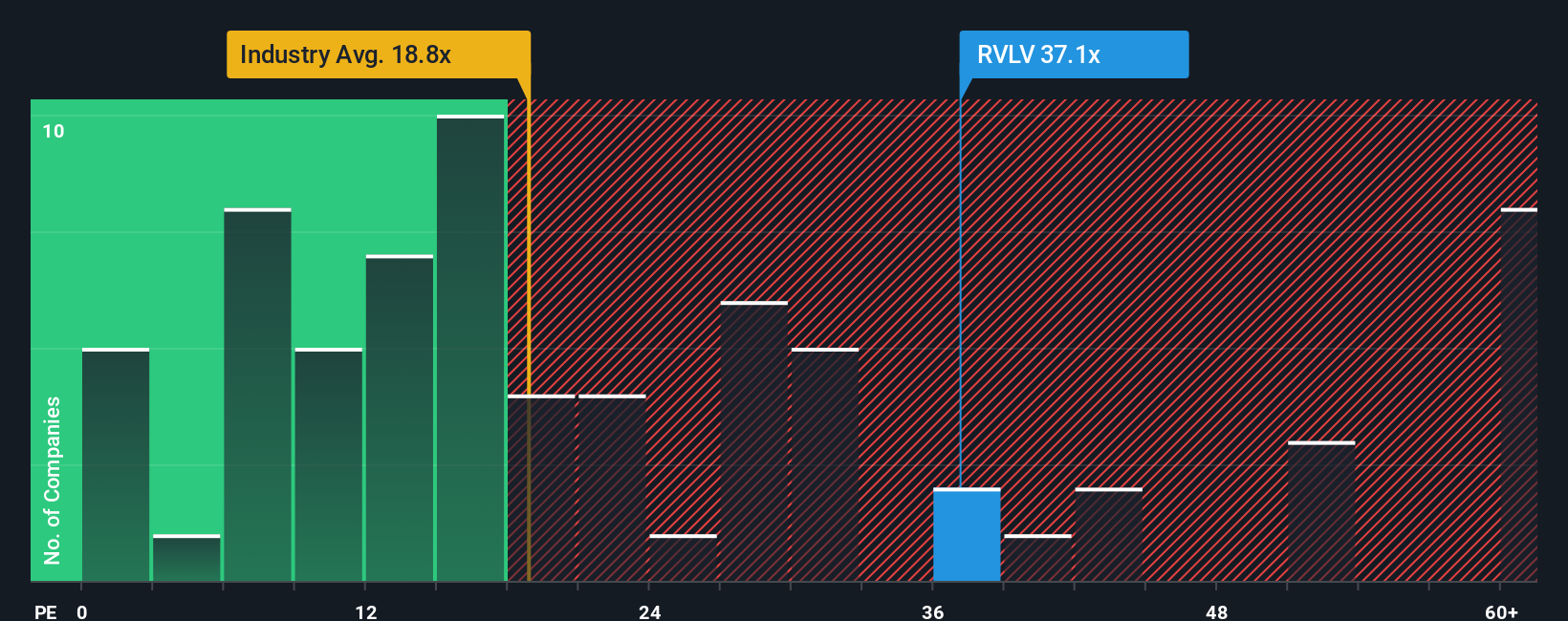

While the fair value narrative points to upside, a closer look at RVLV’s price-to-earnings ratio tells a different story. At 26.9x, the stock trades well above both its industry average of 17.3x and the fair ratio of 15.9x. This premium suggests investors expect superior growth and profitability, but it also means there is little room for error if performance slips. Is this optimism justified, or has the market moved too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Revolve Group Narrative

If you want to challenge these perspectives or dig even deeper into the numbers, you can craft your own story here in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Revolve Group.

Looking for more investment ideas?

If you want the edge on upcoming opportunities, don’t stick to just one story. Use the Simply Wall Street Screener and seize your next big investment early.

- Capture rapid growth potential by checking out these 25 AI penny stocks, which are fueling innovation across industries with artificial intelligence breakthroughs.

- Boost your passive income strategy when you target these 16 dividend stocks with yields > 3%, offering yields above 3% and reliable payout histories.

- Access emerging trends before the crowd by reviewing these 82 cryptocurrency and blockchain stocks, which are at the forefront of blockchain and digital finance evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com