Delek US Holdings (DK): Assessing Valuation After Third Quarter Profit Surge and Analyst Upgrades

Delek US Holdings (DK) posted sharply better third quarter numbers. The company swung to a $178 million profit from a loss a year ago. The turnaround has caught investor attention, with analysts voicing increased optimism.

See our latest analysis for Delek US Holdings.

Momentum has been strong for Delek US Holdings, with the company’s share price climbing 19.79% in the past month and surging 77.8% over the last 90 days. The stock’s total shareholder return over the past year stands at an impressive 129.55%, reflecting a powerful turnaround narrative. Buybacks, improving profitability, and community-focused initiatives are drawing renewed interest from the market.

If the rally in Delek’s shares this year has you thinking bigger, this could be a perfect time to broaden your search and explore fast growing stocks with high insider ownership

With such strong gains and bullish analyst commentary following Delek’s turnaround, the key question is whether the market has already priced in further upside or if there could be more room to run for new investors.

Most Popular Narrative: 17.4% Overvalued

Delek US Holdings is currently trading well above the widely followed fair value estimate of $34.64, with its share price last closing at $40.68. This gap signals a disconnect between strong recent momentum and more cautious medium-term profit and margin expectations.

Delek's sustained operational improvements driven by its enterprise optimization program (EOP), which targets structural changes in refinery operations, procurement, and product sales, are expected to deliver $130 to $170 million of annualized cash flow enhancements, with much of the benefit expected to flow through to net margins and free cash flow starting in the second half of 2025.

Ever wonder what gives Delek’s valuation its edge? There’s one core assumption, hidden in plain sight, that could explain the optimism or the risks. Get a glimpse of the bold operational levers and crucial margin bets powering this calculation. Find out how far the numbers might stretch the narrative.

Result: Fair Value of $34.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Delek’s heavy focus on traditional refining and lack of major energy transition strategy leave it exposed if regulatory or industry shifts accelerate.

Find out about the key risks to this Delek US Holdings narrative.

Another View: Value in the Numbers?

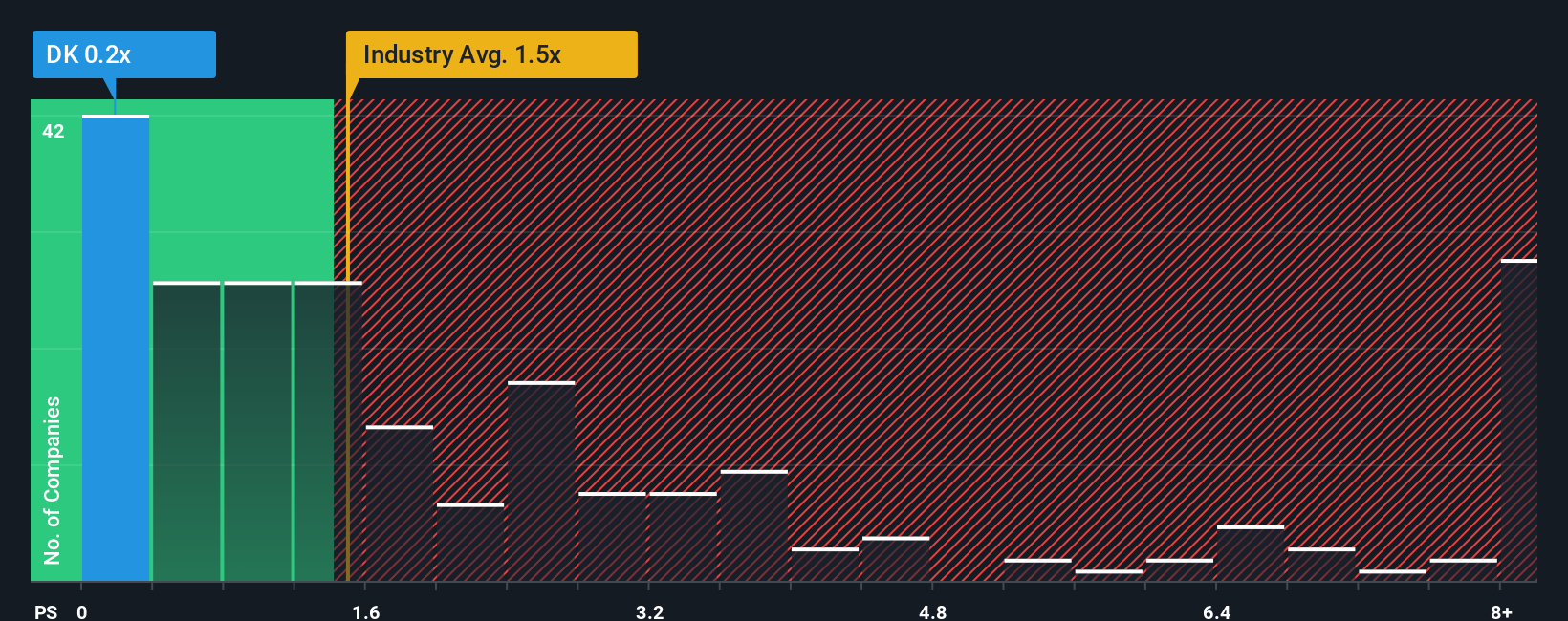

While many focus on fair value estimates, some investors look to price-to-sales ratios for perspective. Delek trades at just 0.2 times sales, matching its peer group and well below the US Oil and Gas industry average of 1.5 times. Its current level is even lower than the calculated fair ratio of 0.4 times.

This big gap can flag either a market opportunity or a warning about future risk. Which side of the story fits best with your outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Delek US Holdings Narrative

If the numbers or outlook presented here do not quite fit your perspective, you can dive into the data yourself and shape a narrative to match your view in just minutes. Do it your way

A great starting point for your Delek US Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

The market is full of hidden gems beyond Delek US Holdings. Don't miss your chance to act ahead of the crowd with ideas tailored to different strategies.

- Uncover potential with these 25 AI penny stocks, which are capitalizing on the explosive growth of artificial intelligence and automation.

- Collect reliable income by finding these 16 dividend stocks with yields > 3%, a selection of companies that consistently deliver yields greater than 3% for your portfolio.

- Get ahead of the trend by checking out these 82 cryptocurrency and blockchain stocks, featuring companies at the forefront of blockchain innovation and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com