Photronics (PLAB): Exploring Valuation as Investor Sentiment Shifts After Recent Share Price Movement

See our latest analysis for Photronics.

Photronics’ share price has lost ground recently, echoing a cautious mood from investors, but that comes after an impressive few years. The current 1-year total shareholder return stands at -10.7%, while the 5-year total return is still a striking 90% gain. While short-term momentum has faded, those longer-term gains hint that growth potential may keep drawing interest, even as the market weighs changing risks and fundamentals.

If market shifts like this have you thinking beyond a single name, now is a perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with shares currently trading well below analysts’ price targets and growth still in the picture, the central question now is whether Photronics is undervalued or if the market is already looking ahead and pricing in future gains.

Most Popular Narrative: 36% Undervalued

With Photronics last closing at $21.12 and the most widely followed narrative placing its fair value at $33.00, the narrative sees significant upside potential from current levels. The gap sets the stage for an in-depth look at the assumptions driving this optimistic outlook.

Strategic investments in U.S. capacity and cutting-edge production (multi-beam mask writer and Texas facility expansion) position Photronics to benefit as major semiconductor fabrication and reshoring initiatives are realized. These moves support future revenue growth and margin expansion. Ongoing and planned technological upgrades in Asia (extension to 6nm and 8nm nodes) enable Photronics to participate in next-generation chip production for edge AI, automotive, and communications. This creates new high-value growth streams and potential revenue share gains as industry complexity increases.

Curious what financial leap is required to justify that high target? There is a bold set of projections, covering growth, margin expansion, and a much higher future profit multiple, woven into this narrative. Want to see how these ambitious numbers stack up against the company's recent trends? The full story reveals the optimistic blueprint behind the price target.

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade restrictions or delays in end-market demand could quickly weaken the bullish case. This reminds investors that growth is far from guaranteed.

Find out about the key risks to this Photronics narrative.

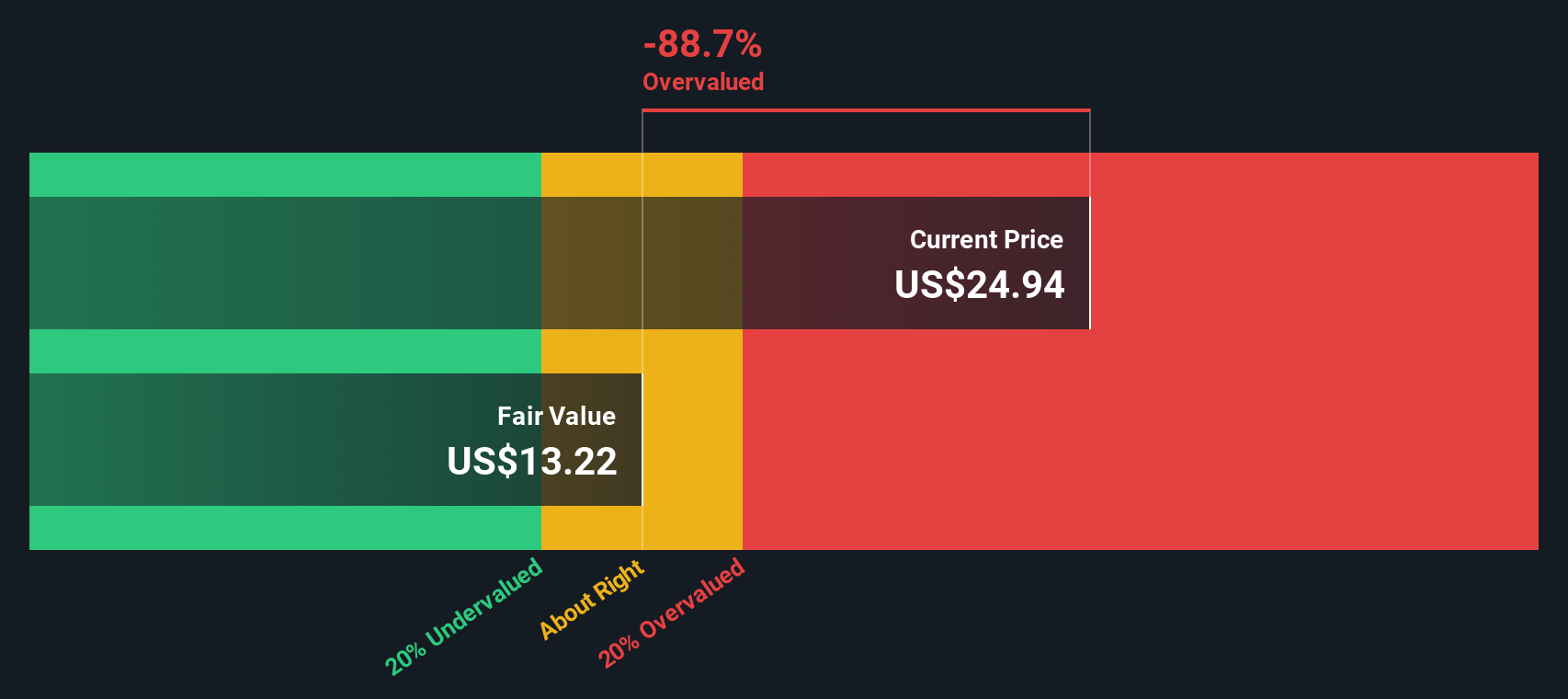

Another View: Discounted Cash Flow Perspective

While analyst price targets suggest upside, our SWS DCF model tells a different story. Based on long-term cash flow forecasts, Photronics appears overvalued, with its current price trading above our fair value estimate. Could the market be relying too heavily on growth expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If you see things differently or want to dig into the numbers yourself, it’s easy to shape your own view of Photronics. Do it in just a few minutes. Do it your way

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Hundreds of unique opportunities are one click away. Let Simply Wall Street’s powerful Screener reveal stocks you might never have considered, tailored to your goals. Don’t let tomorrow’s winners pass you by. See what else is out there right now.

- Unlock growth stories and find hidden gems among these 3585 penny stocks with strong financials offering strong financials and surprising future potential.

- Supercharge your portfolio by targeting future leaders in innovation with these 25 AI penny stocks focused on artificial intelligence breakthroughs.

- Secure steady income and peace of mind with these 16 dividend stocks with yields > 3% featuring yields above 3% from companies committed to rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com