A Fresh Look at Arlo Technologies (ARLO) Valuation After Surprising Q3 Profit and Cautious Guidance

Arlo Technologies delivered third-quarter earnings that surprised to the upside, marking a return to profitability from a net loss last year. Revenue saw a slight increase. However, future guidance has left some investors cautious.

See our latest analysis for Arlo Technologies.

After a standout turnaround quarter and a strong run earlier in the year, Arlo Technologies' share price has recently cooled, with a 1-month share price return of -19.38%. The bigger picture remains impressive, with a 1-year total shareholder return of 25.91% and a 3-year total return of 251.74%. However, momentum has faded in the short term, likely reflecting investors weighing upbeat earnings against management’s cautious guidance and some recent insider selling.

If you’re looking to spot the next wave of growth stories, now is a great moment to explore See the full list for free.

With shares now trading well below analyst price targets and momentum turning negative, investors are left to wonder if Arlo Technologies is now undervalued or if the market has already factored in its future growth prospects.

Most Popular Narrative: 39.1% Undervalued

Arlo Technologies’ most widely followed narrative sees the stock’s fair value well above its current trading price, highlighting strong earnings growth and an evolving business model. This sets up a compelling case for why the stock could be poised for further upside if expectations play out.

The recently signed strategic partnership with ADT, North America's largest security company, with anticipated impact beginning in 2026, represents a major new channel for unlocking additional services revenue and ARR, contributing to future revenue growth and margin expansion.

Want to know what’s fueling this bullish view? The secret sauce behind this valuation is a daring bet on future profit growth, rising margins, and massive recurring revenue streams. What bold assumptions are driving this high conviction price target? Dig deeper to see what’s really behind these numbers.

Result: Fair Value of $23.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent international weakness and intensifying competition could undermine Arlo's growth story. This situation may put pressure on the bullish long-term outlook.

Find out about the key risks to this Arlo Technologies narrative.

Another View: Looking Through a Different Lens

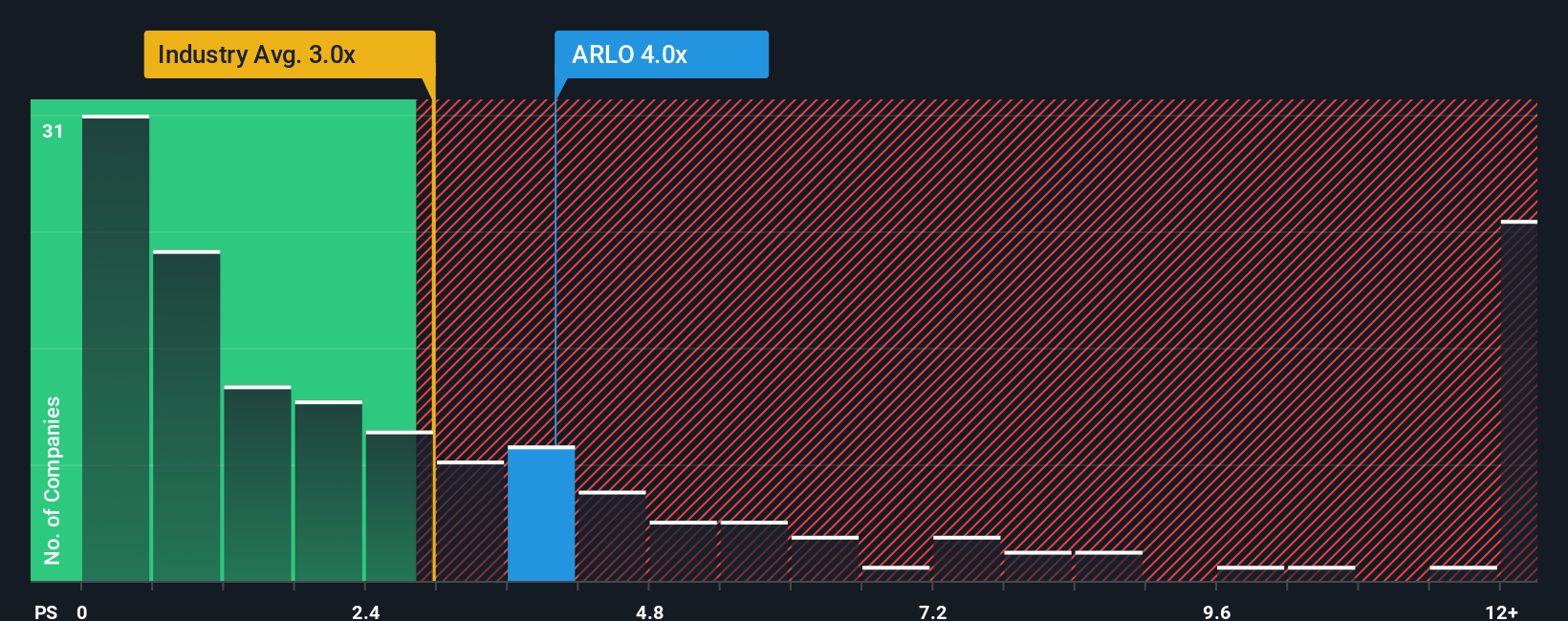

While analysts see upside based on future profit growth, current market pricing tells a story of caution. At 2.9x sales, Arlo trades higher than the US Electronic industry’s 2.6x average and the fair ratio of 2.1x. This gap warns the market could re-rate the stock if optimism fades. Which perspective will prevail?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arlo Technologies Narrative

If you have a different perspective or want to dig into the numbers firsthand, crafting your own story is quick and easy in just a few minutes. Do it your way

A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop at Arlo Technologies? Take advantage of today’s opportunities and uncover your next portfolio winner using these powerful tools from Simply Wall Street.

- Get ahead of the curve and spot tomorrow’s breakout innovators among these 25 AI penny stocks, harnessing artificial intelligence to disrupt industries and redefine what’s possible.

- Boost your income potential by zeroing in on these 16 dividend stocks with yields > 3%, offering yields above 3% and strong fundamentals for sustainable, long-term payouts.

- Seize undervalued opportunities right now by targeting these 901 undervalued stocks based on cash flows, trading below their intrinsic value for a compelling edge in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com