Sonos (SONO): Assessing Valuation After 10-K, Earnings Reveal Losses and Strategic Shift

Sonos (SONO) grabbed investor attention after its recent earnings report and 10-K filing revealed continuing operating losses. The company also announced new restructuring efforts and a focus on direct-to-consumer sales and artificial intelligence integration.

See our latest analysis for Sonos.

Sonos has seen some renewed momentum after a tough stretch, with its 24% share price return over the past 90 days standing out. Still, the one-year total shareholder return of 31% barely offsets a shaky longer-term trend marked by a five-year total return of -23% as the company continues to navigate operational challenges and market shifts.

If Sonos’s strategy refresh has you watching for up-and-coming leaders, now is a great moment to discover fast growing stocks with high insider ownership.

With the share price surge and operational obstacles still looming, investors are left to ask whether Sonos is a bargain set for a turnaround or if the market has already baked in its growth prospects.

Most Popular Narrative: 7.2% Undervalued

At $16.56, Sonos trades just below the narrative fair value estimate of $17.85. This tight gap reflects a market wrestling with future upside versus current obstacles.

Sonos's ongoing platform evolution, where new hardware products compound in value via frequent software enhancements, particularly with integration of AI capabilities, positions the brand for higher household penetration and stickier, more valuable customer relationships. This supports long-term revenue growth and increased gross margins.

Are you curious about the core numbers that fuel this bullish price target? The narrative banks on a big leap in margins, a bold shift in earnings, and a very specific forecast for how Sonos transforms those opportunities into free cash flow. Want a peek into their blueprint for future value? The full narrative lays out the figures that analysts believe will drive the next chapter.

Result: Fair Value of $17.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent headwinds from increased tariffs or delayed hardware cycles could weaken the optimistic outlook analysts now place on Sonos.

Find out about the key risks to this Sonos narrative.

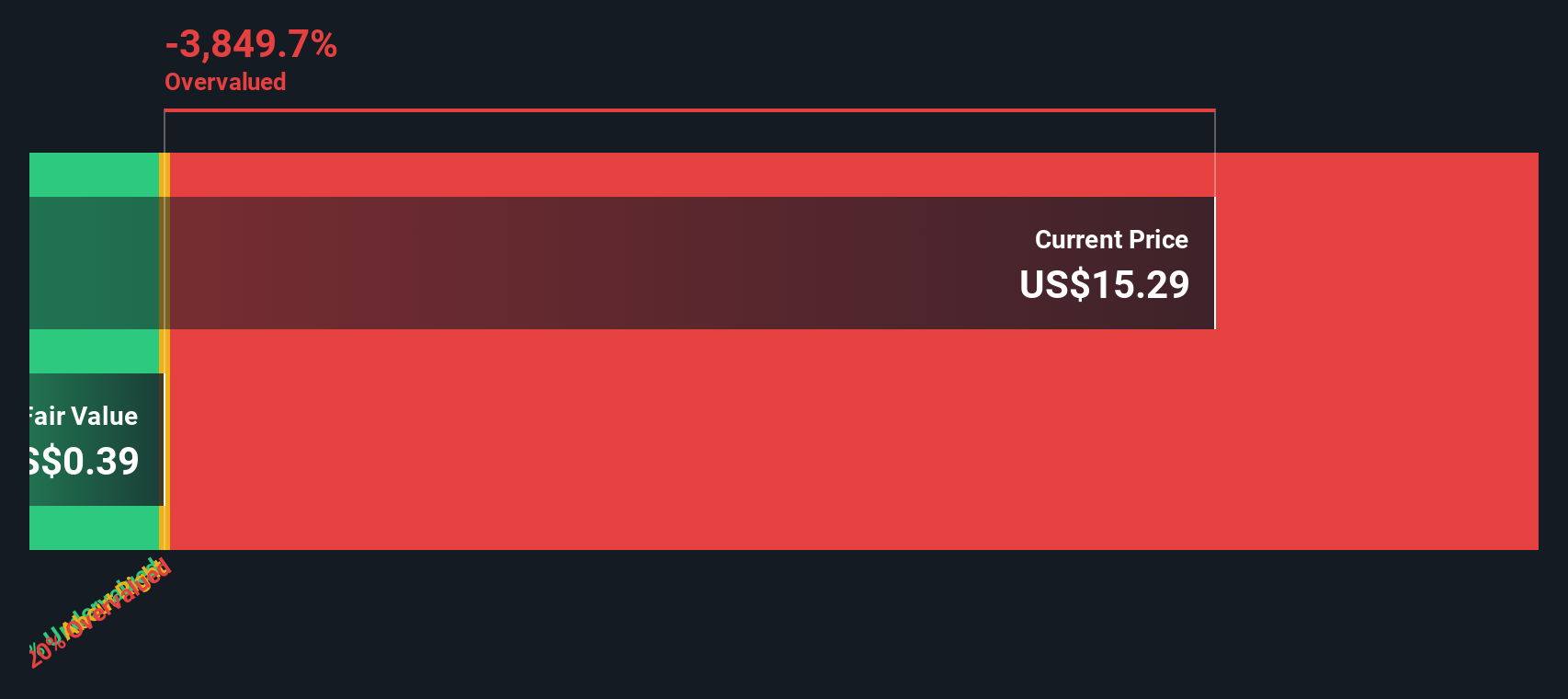

Another View: SWS DCF Model Says Overvalued

While the narrative places Sonos at a slight discount to fair value, our DCF model puts the brakes on that optimism. According to SWS calculations, Sonos's fair value is just $6.23. This means the stock trades well above the DCF estimate. Which method better captures the company's true future potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sonos for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sonos Narrative

Not convinced by the consensus, or eager to dig into the details yourself? You can craft your own view of Sonos’s story in just a few minutes. Do it your way.

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for More Investment Ideas?

If you want to stay ahead of the crowd, now is the time to check out other promising opportunities that match your goals and interests. Don’t let the market move on without you. Smart investing starts with the right tools.

- Take advantage of new tech by reviewing these 25 AI penny stocks, which are powering breakthroughs in artificial intelligence and automation.

- Boost your passive income by seeing these 16 dividend stocks with yields > 3%, boasting attractive yields and steady cash flow in shifting markets.

- Position yourself for tomorrow’s innovations and get a head start on the future of computing with these 26 quantum computing stocks leading major industry transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com