Why Did Crane NXT (CXT) Lower EPS Guidance Despite Raising 2025 Sales Outlook?

- Crane NXT recently reported third quarter 2025 results, posting US$445.1 million in sales and US$50.5 million in net income, and announced a quarterly dividend of US$0.17 per share payable on December 10, 2025.

- The company also raised its full-year 2025 sales growth guidance to 9%–11%, citing strong international demand for its micro-optics currency technology, even as it adjusted EPS guidance downward due to softness in the CPI vending segment.

- We'll assess how the increased full-year sales growth outlook and international currency momentum influence Crane NXT's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Crane NXT Investment Narrative Recap

To own Crane NXT stock, I believe you need confidence in its pivotal role supplying anti-counterfeiting and authentication technology for global currencies and physical goods, especially as digital payments gradually expand. This quarter’s raised sales growth outlook is a short-term catalyst, driven by international momentum in micro-optics tech for currency, but the persistent base-case risk remains: potential erosion of long-term demand tied to the ongoing shift toward cashless economies. For now, the updated financial guidance appears incrementally positive, but does not fundamentally alter that risk profile.

The most relevant company announcement is the upgrade to full-year sales growth guidance, now raised to 9%–11%. This update directly ties to the strength of Crane NXT's international order pipeline, reinforcing near-term confidence in the physical currency solutions business. However, sustainable future growth still depends on broader adoption of advanced authentication technologies beyond legacy hardware.

But the threat of accelerating digital payment adoption eroding currency-related demand is still one risk investors should be clear-eyed about, especially if ...

Read the full narrative on Crane NXT (it's free!)

Crane NXT's outlook anticipates $1.9 billion in revenue and $367.2 million in earnings by 2028. This projection requires an 8.1% annual revenue growth rate and a $215.9 million increase in earnings from the current level of $151.3 million.

Uncover how Crane NXT's forecasts yield a $77.33 fair value, a 32% upside to its current price.

Exploring Other Perspectives

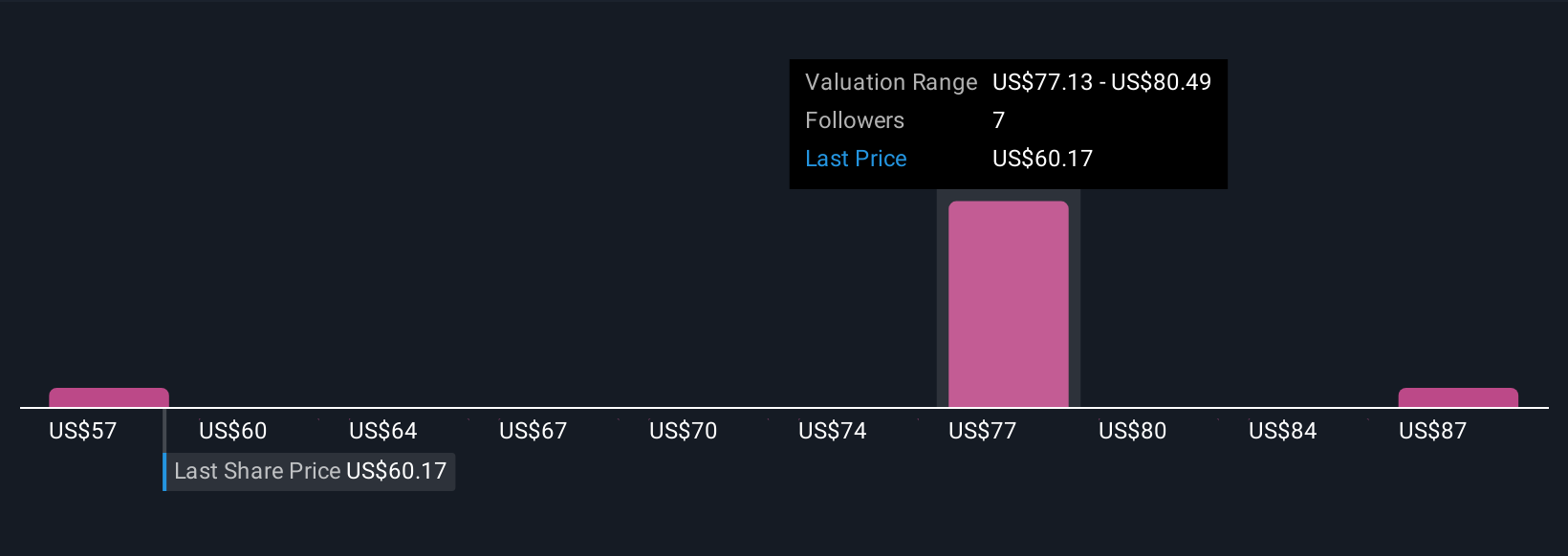

The Simply Wall St Community’s three fair value estimates for Crane NXT range widely from US$57 to US$90.55 per share. While international sales strength supports near-term optimism, investor opinions differ widely on the company’s ability to manage structural risks from the move toward digital payments, explore more viewpoints to see how your assessment compares.

Explore 3 other fair value estimates on Crane NXT - why the stock might be worth just $57.00!

Build Your Own Crane NXT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crane NXT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Crane NXT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crane NXT's overall financial health at a glance.

No Opportunity In Crane NXT?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com