How Goldman Sachs's Upgraded Outlook at MYR Group (MYRG) Has Changed Its Investment Story

- Recently, Goldman Sachs revised its outlook for MYR Group Inc., reflecting increased confidence among analysts in the company’s future prospects.

- This shift follows MYR Group’s continued growth evidenced by outperformance in recent quarters and steady demand, as shown by its expanding backlog.

- We’ll consider how renewed analyst optimism, highlighted by Goldman Sachs’s valuation update, may influence the outlook for MYR Group’s future performance.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

MYR Group Investment Narrative Recap

To own MYR Group stock, one needs to believe in the ongoing electrification trend, robust utility contracts, and the company’s ability to sustainably grow its electric infrastructure and industrial backlog. The recent price target raise by Goldman Sachs, despite maintaining a Neutral rating, does not fundamentally shift the stock’s most important short-term catalyst: ongoing demand for energy infrastructure projects. Short-term risks, like declining renewables contribution and backlog volatility, remain front of mind, and are not materially changed by this news.

Among recent updates, MYR Group’s strong third quarter earnings stand out, underlining substantial year-over-year profit growth and an expanding backlog. These results reinforce investors’ focus on steady project win rates and execution, supporting confidence in future earnings predictability, a trend closely watched given the company’s current valuation and margin pressures.

However, investors should not overlook signs of declining renewables revenue and what it could mean for...

Read the full narrative on MYR Group (it's free!)

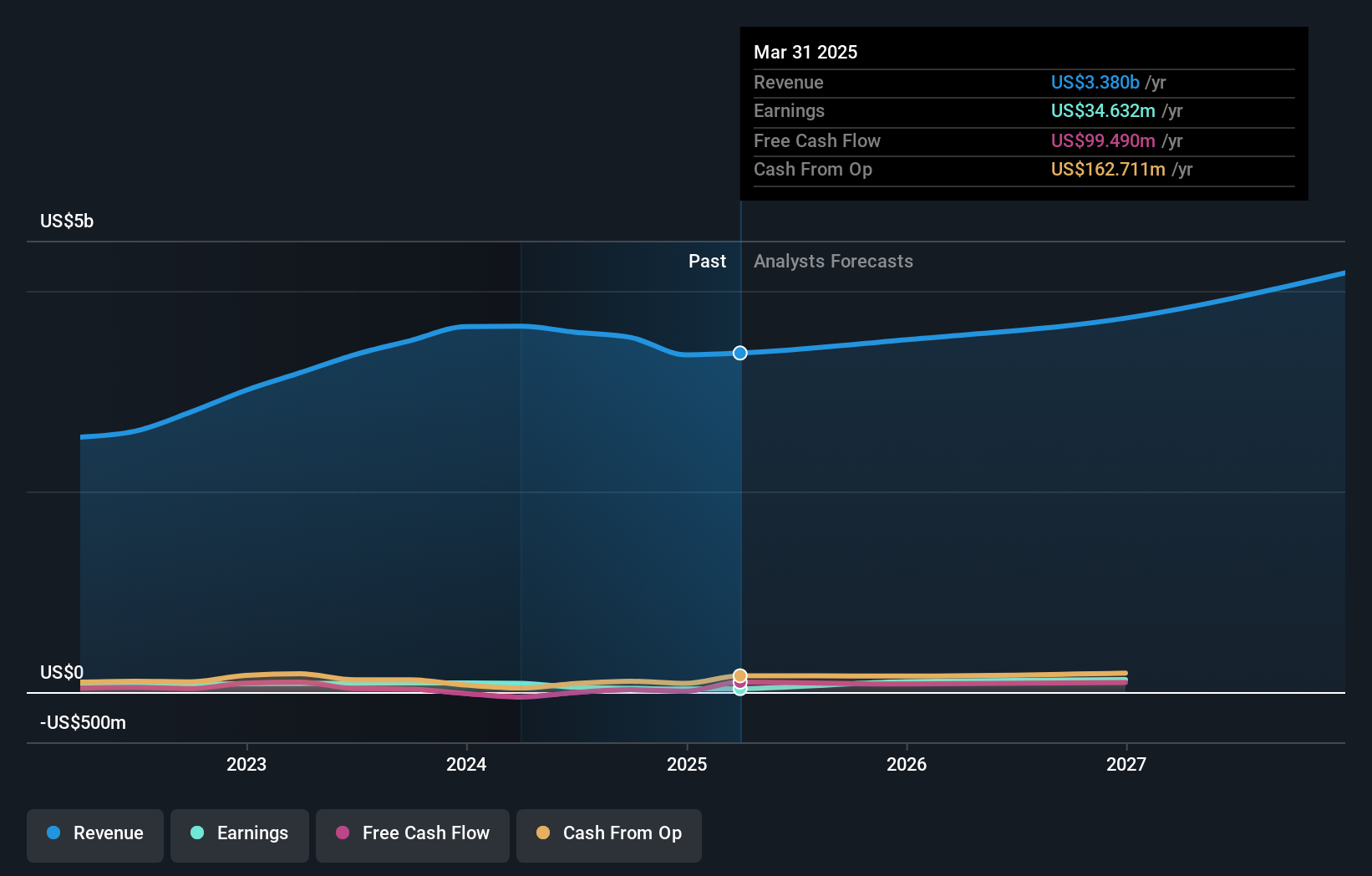

MYR Group's narrative projects $4.3 billion revenue and $157.2 million earnings by 2028. This requires 8.0% yearly revenue growth and an increase in earnings of $80.8 million from $76.4 million today.

Uncover how MYR Group's forecasts yield a $228.00 fair value, in line with its current price.

Exploring Other Perspectives

Two fair value estimates from Simply Wall St Community members place MYR Group between US$216 and US$228 per share. Despite this narrow range, ongoing declines in renewables project revenue may bring different views on future demand, inviting readers to explore several alternative opinions.

Explore 2 other fair value estimates on MYR Group - why the stock might be worth 6% less than the current price!

Build Your Own MYR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MYR Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MYR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MYR Group's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com