How Investors May Respond To Permian Resources (PR) Boosting 2025 Production Guidance Amid Income Decline

- Earlier this month, Permian Resources Corporation raised its 2025 oil and total production guidance following strong well results, while also reporting record quarterly free cash flow per share and increased output across all major product categories for the third quarter ended September 30, 2025.

- Despite higher production and operational efficiency, the company's net income for the third quarter and nine-month period declined year over year, reflecting the impact of market or cost factors even as operational momentum continued.

- We'll explore how Permian Resources' upward revision to production guidance and operational achievements influence its investment narrative and future outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Permian Resources Investment Narrative Recap

To be a shareholder in Permian Resources, you need to believe in the company’s ability to efficiently grow production and maintain strong free cash flow, despite the volatility inherent in oil and gas markets. The recent upward revision to the 2025 production outlook further highlights operational momentum, but with commodity prices as the key short-term catalyst, this news does not fundamentally change the most important risk: ongoing sensitivity to market pricing for oil and gas, which can quickly affect profitability.

Among the latest announcements, Permian Resources' share repurchase program stands out, as the company bought back over 2.2 million shares in the most recent quarter. This capital return signals confidence in operational execution and supports the near-term catalyst of delivering shareholder value, yet it sits alongside the ongoing challenge of commodity price swings.

Yet, even with these positive signals, investors should watch for shifts in oil and gas prices, the key factor that can quickly influence...

Read the full narrative on Permian Resources (it's free!)

Permian Resources' outlook anticipates $6.1 billion in revenue and $1.4 billion in earnings by 2028. This relies on a 6.1% annual revenue growth rate and a $0.3 billion earnings increase from the current $1.1 billion.

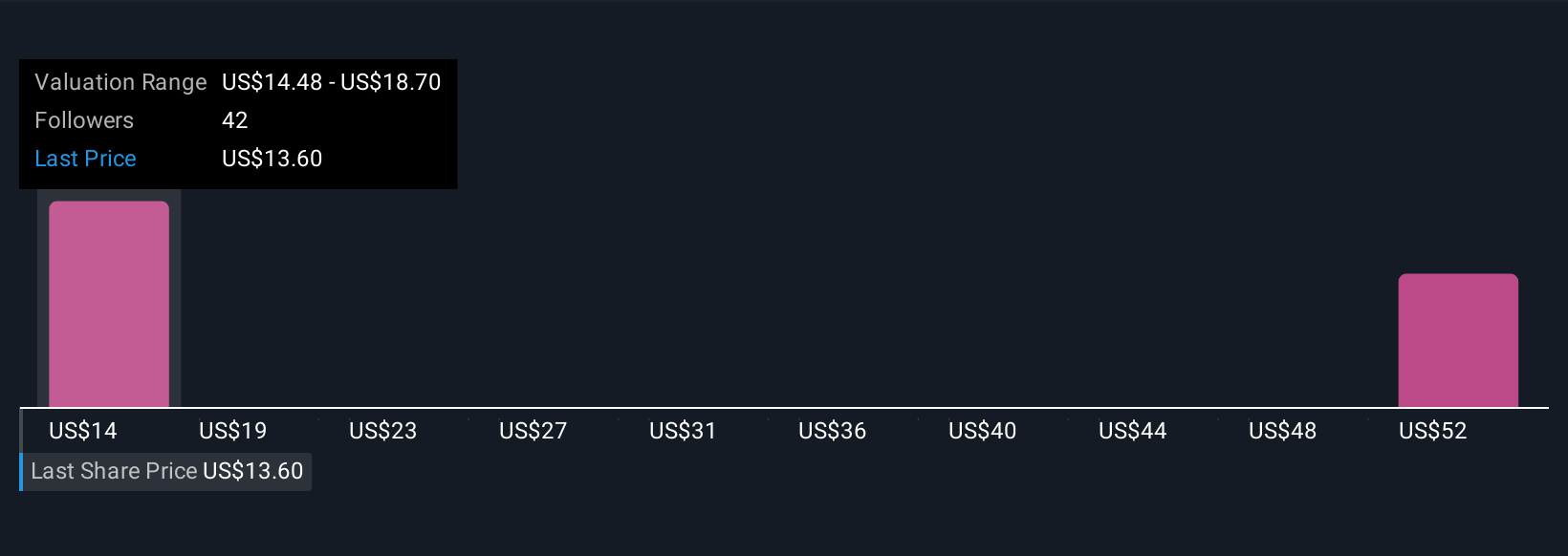

Uncover how Permian Resources' forecasts yield a $18.05 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$11.70 to US$66.43 per share. Community members see big upside, but many also flag ongoing price sensitivity as a risk worth considering.

Explore 5 other fair value estimates on Permian Resources - why the stock might be worth 14% less than the current price!

Build Your Own Permian Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Permian Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Permian Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Permian Resources' overall financial health at a glance.

No Opportunity In Permian Resources?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com