How Strong Q3 Results and Upbeat Guidance at Kirby (KEX) Has Changed Its Investment Story

- Earlier this week, Kirby Corporation reported third-quarter 2025 results, posting an earnings per share of US$1.65 and revenue of US$871.16 million, both above analyst forecasts.

- This performance was accompanied by positive guidance for the fourth quarter, reinforcing expectations for improved revenues and margins across key business segments.

- We'll explore how Kirby's better-than-expected quarterly results and upbeat outlook could influence its long-term growth and margin narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Kirby Investment Narrative Recap

To be a shareholder in Kirby, you need to believe in the company's ability to capitalize on limited barge capacity, secular shifts in domestic manufacturing, and steady power generation demand, while managing margin pressures and earnings volatility. The recent third-quarter beat and positive guidance have boosted sentiment and suggest short-term tailwinds, but do not fully remove ongoing risks from chemical market softness and labor shortages, which remain the most important catalysts and threats for the business at this point.

Among Kirby's latest announcements, the company's ongoing share buyback initiative stands out as particularly relevant after strong earnings and guidance. With more than 15% of total shares repurchased to date and further authorization in place, this move reflects continued confidence in capital allocation and could help support earnings per share, especially if market or margin risks materialize in the near term.

However, despite the improving outlook, investors should watch for signs of chemical market weakness and domestic demand shocks that could impact barge utilization and revenue...

Read the full narrative on Kirby (it's free!)

Kirby's outlook anticipates $3.9 billion in revenue and $445.6 million in earnings by 2028. This implies a 6.1% annual revenue growth and a $142.6 million increase in earnings from the current $303.0 million.

Uncover how Kirby's forecasts yield a $125.33 fair value, a 15% upside to its current price.

Exploring Other Perspectives

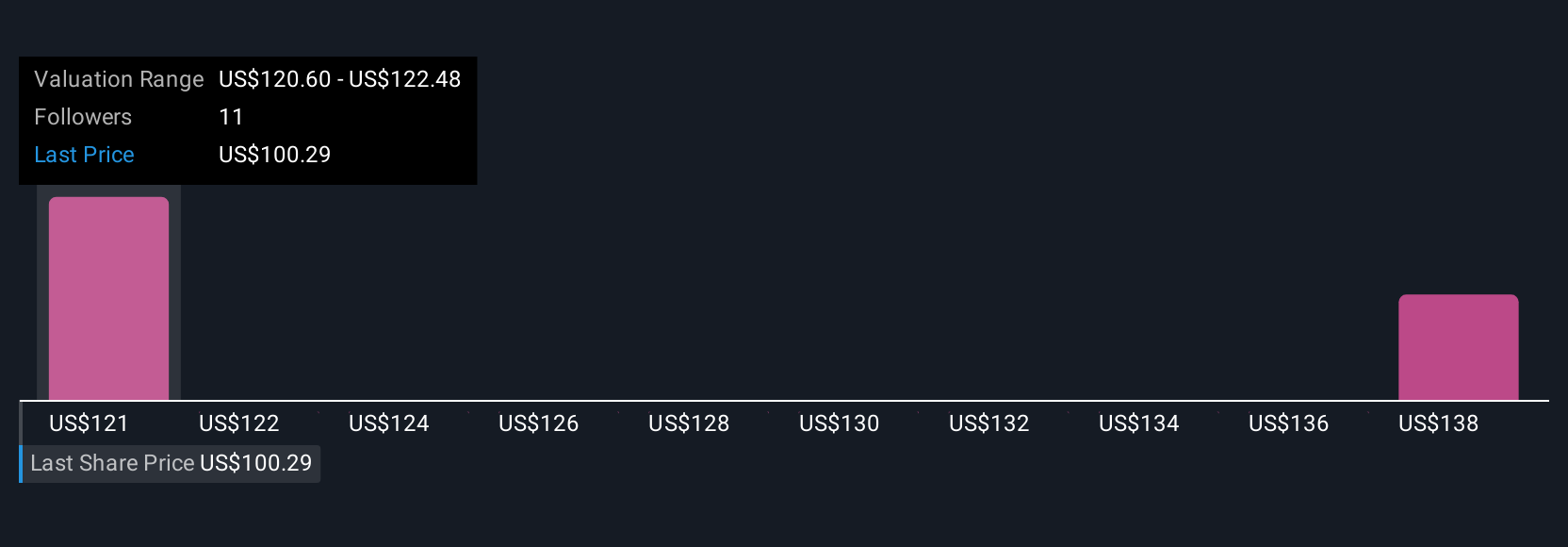

Simply Wall St Community members published two fair value estimates ranging from as low as US$37.17 to as high as US$125.33. With significant exposure to the US inland petrochemical market, Kirby's fortunes could quickly shift if chemical shipping volumes and demand trend lower, so it pays to compare these different opinions before deciding.

Explore 2 other fair value estimates on Kirby - why the stock might be worth as much as 15% more than the current price!

Build Your Own Kirby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirby research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Kirby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirby's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com