Is Stronger FIHL Profitability Amid Lower Revenue Signaling a Shift in Fidelis Insurance’s Growth Strategy?

- Fidelis Insurance Holdings reported its third quarter 2025 results, showing net income of US$130.5 million on revenue of US$651.9 million, with earnings per share rising year-over-year despite a reduction in revenue.

- An intriguing detail is that while quarterly net income and earnings per share improved, net income for the nine-month period was lower than the prior year, highlighting variability in performance.

- We'll examine how Fidelis's quarter of stronger profitability, despite lower revenue, could influence its future investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Fidelis Insurance Holdings Investment Narrative Recap

Shareholders in Fidelis Insurance Holdings must be confident in the company's ability to grow its specialty insurance and reinsurance business while successfully managing volatility from large, unpredictable events and competitive pricing pressures. The recent third quarter earnings report, revealing a jump in quarterly net income and EPS despite lower revenue, does not materially change the most important near-term catalyst, the company's effort to sustain underwriting profitability in the face of industry headwinds; the pronounced risk remains Fidelis's exposure to outsized losses from natural catastrophes, which continues to drive earnings variability.

Among recent corporate updates, the appointment of William Waddell-Dudley as UK Chief Underwriting Officer stands out as especially relevant, given the group's ongoing emphasis on disciplined underwriting and strategic coordination across geographies. With underwriting quality and pricing adequacy remaining at the heart of Fidelis's investment outlook, this new leadership could influence how successfully the company navigates industry competition and evolving risk conditions, both key to its near-term profitability goals.

However, investors should be aware that even in quarters of strong profitability, exposure to large-scale catastrophe events can quickly change the narrative...

Read the full narrative on Fidelis Insurance Holdings (it's free!)

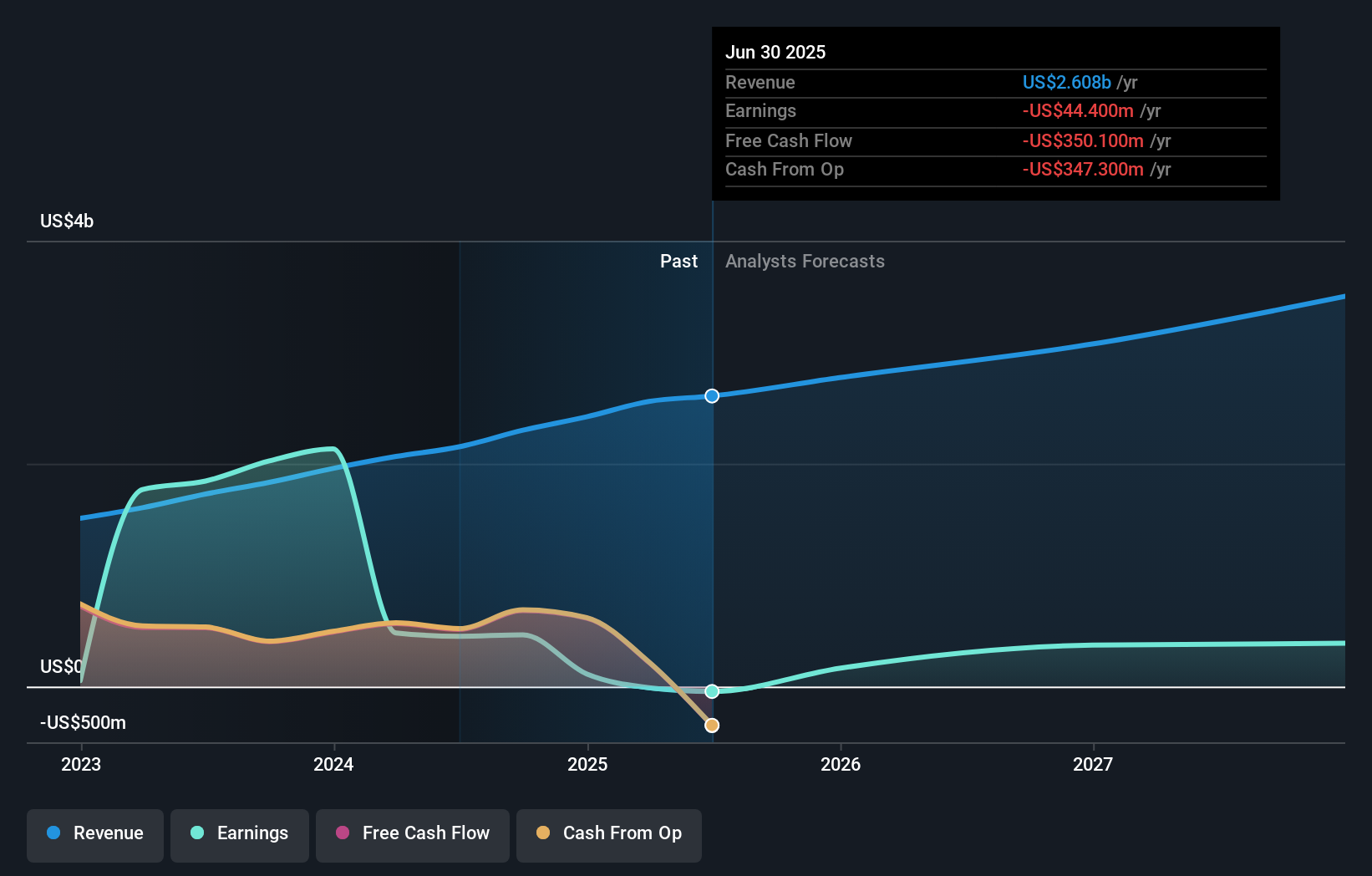

Fidelis Insurance Holdings' outlook suggests revenue of $3.6 billion and earnings of $660.8 million by 2028. This scenario assumes an annual revenue growth rate of 11.1% and a turnaround in earnings, increasing by $705.2 million from the current loss of $-44.4 million.

Uncover how Fidelis Insurance Holdings' forecasts yield a $20.61 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate Fidelis's fair value between US$20.61 and US$63.54 per share. While views differ, the company's exposure to outsized catastrophe losses continues to shape expectations for future earnings swings and overall valuation potential.

Explore 4 other fair value estimates on Fidelis Insurance Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Fidelis Insurance Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelis Insurance Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fidelis Insurance Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelis Insurance Holdings' overall financial health at a glance.

No Opportunity In Fidelis Insurance Holdings?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com