Is S&P Upgrade and Major LNG Expansion Changing the Investment Case for Cheniere Energy Partners (CQP)?

- In recent days, S&P Global Ratings upgraded Cheniere Energy Partners to BBB+ following the company’s strong operational performance and close ties with Cheniere Energy Inc, while the company advanced plans to expand LNG capacity by 67% as it secured regulatory filings and long-term agreements for the project.

- This expansion could add approximately 20 million tonnes per annum of LNG production capacity, representing a significant move in the global liquefied natural gas sector.

- We’ll explore how the S&P Global Ratings upgrade amid progress on a major LNG expansion project could impact Cheniere’s investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Cheniere Energy Partners' Investment Narrative?

For shareholders, the core story behind Cheniere Energy Partners rests on confidence in long-term global LNG demand and the company’s ability to finance and execute one of the biggest planned capacity expansions in US LNG. The S&P Global Ratings upgrade to BBB+ brings a tangible boost, reflecting improved financial stability and strong operational ties to its parent, which may ease access to capital for expansion. However, near-term questions remain, especially after recent analyst downgrades and earnings showing revenue growth but declining profit margins. These shifts could weigh on the pace or profitability of the expansion. The upgrade and project news represent a potential catalyst supporting the investment case, but short-term risks around rising debt, profit pressure, and market skepticism are not swept away by this single positive announcement. The biggest variable now turns to whether project execution can keep earnings growth on track. Yet with debt already rising and profit margins under strain, new risks are emerging.

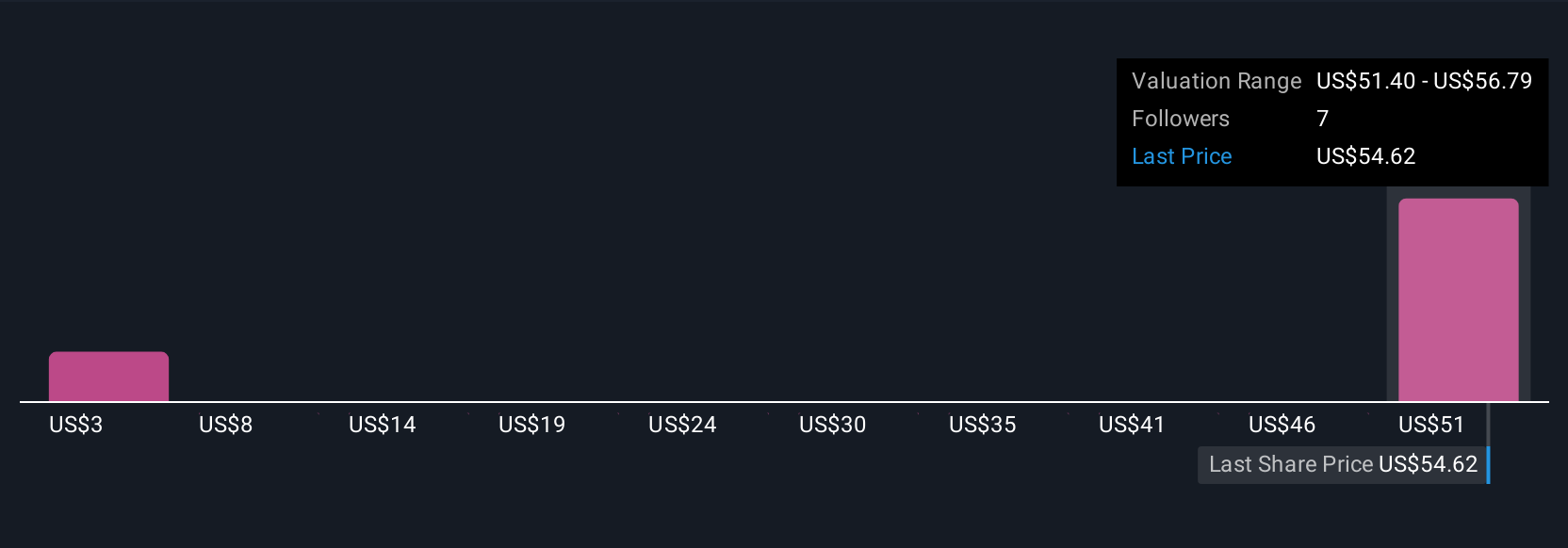

Cheniere Energy Partners' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Cheniere Energy Partners - why the stock might be worth just $50.33!

Build Your Own Cheniere Energy Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy Partners' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com