MSA Safety (MSA): Is the Current Valuation an Opportunity After Recent Share Price Dip?

MSA Safety (MSA) shares moved slightly higher today, rising about 1%. The stock has been on a downward track over the past month, with a 5% dip. This has sparked some curiosity among investors who follow safety equipment makers.

See our latest analysis for MSA Safety.

Despite some short-term bumps, MSA Safety’s share price has edged down nearly 5% since the start of the year, and its total shareholder return over the past year is also modestly in the red. However, the company’s solid three- and five-year total shareholder returns of 16% and 11% suggest that longer-term momentum is still intact, even as near-term sentiment wavers around valuation and recent market trends.

If this shift in momentum has you thinking about what else could be next, consider broadening your search by checking out fast growing stocks with high insider ownership.

With the recent pullback and the stock now trading about 20% below analyst price targets, is this a window for investors to buy MSA Safety at an attractive valuation? Or is the market already reflecting future growth?

Most Popular Narrative: 16.3% Undervalued

According to the most widely followed valuation narrative, MSA Safety's fair value is $187.40, which stands well above the last close price of $156.92. This signals a meaningful gap between current trading levels and where the popular narrative suggests shares could be heading, driven by a blend of growth projections and profitability assumptions.

Strategic R&D investments and fast innovation cycles (with imminent new product launches like the io 6) are allowing MSA to continually upgrade its product portfolio. This supports sustained organic growth rates and higher EBITDA margins due to market-leading offerings and product mix improvement.

Curious what’s behind this bullish valuation? The real takeaway lies in confident calls for stronger margins and accelerating top-line growth, plus a future profit multiple that could shift how Wall Street prices MSA. If you want to see which forecasts and industry assumptions fuel this upside, dig into the full narrative to find out.

Result: Fair Value of $187.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as persistent cost inflation or weaker demand for core products could quickly undermine the bullish valuation case for MSA Safety.

Find out about the key risks to this MSA Safety narrative.

Another View: Is the Market Price Telling a Different Story?

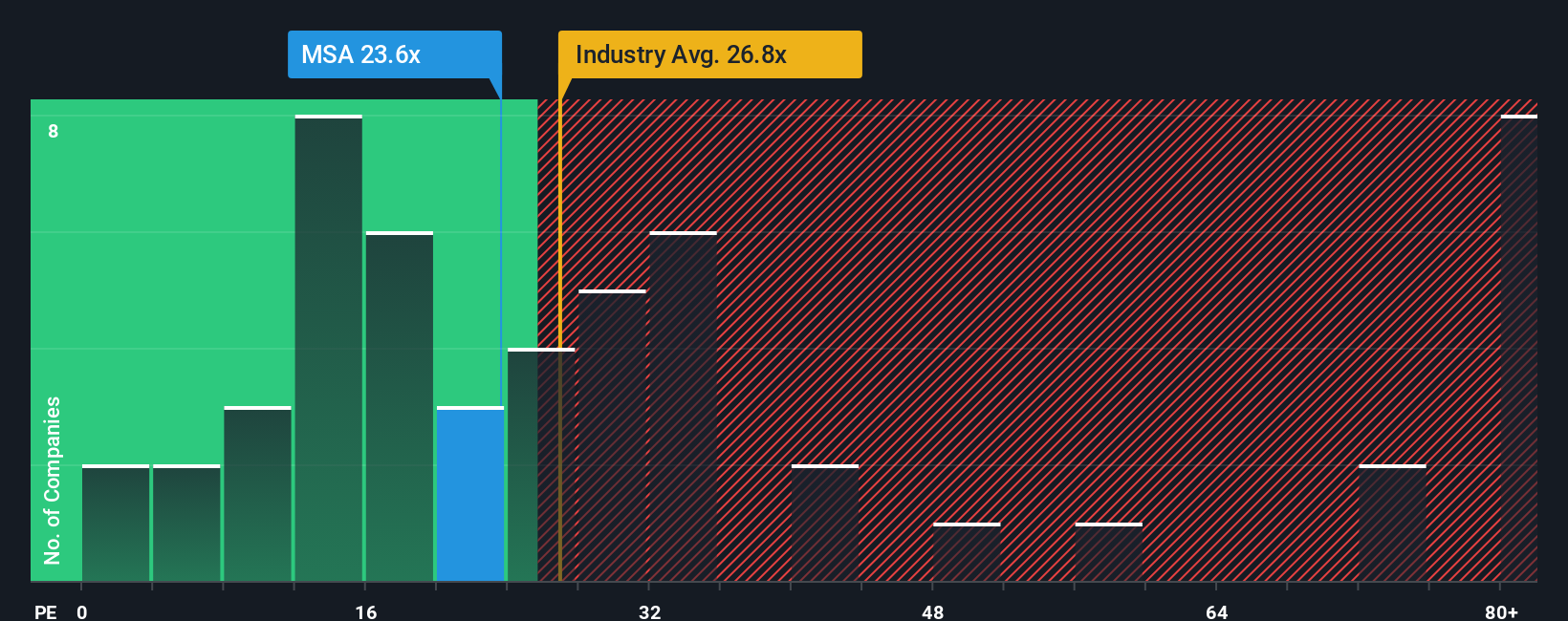

While the popular valuation points to MSA Safety being undervalued, a look at its price-to-earnings ratio brings some caution. The company's current P/E multiple of 22x is slightly above the US Commercial Services industry average of 21.8x and well above the peer average of 16.2x. However, it is still trading below the fair ratio of 23.7x that the market could eventually move toward. This suggests investors are already paying a premium for quality and growth, leaving less room for upside if expectations slip. So, which signals should investors trust most?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSA Safety Narrative

If you see things differently or enjoy putting your own thesis together, the tools are available for you to craft your own narrative in just a few minutes. Do it your way.

A great starting point for your MSA Safety research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock fresh opportunities beyond MSA Safety with three hand-picked stock ideas that could give your portfolio an edge. Don’t let the next breakout pass you by.

- Capture high yields that outpace the market by checking out these 18 dividend stocks with yields > 3% for dependable income opportunities in today’s uncertain climate.

- Ride the AI growth wave with these 27 AI penny stocks fueling breakthroughs in every major sector and setting up for tomorrow’s market leaders.

- Position for future tech booms by seizing your chance with these 26 quantum computing stocks unlocking the next era of disruptive innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com