US$25 Million Share Buyback Authorization Might Change the Case for Investing in U.S. Physical Therapy (USPH)

- On November 18, 2025, U.S. Physical Therapy, Inc. (NYSE:USPH) announced that its Board of Directors authorized a share repurchase program, allowing the company to buy back up to US$25 million of its outstanding shares.

- This initiative may reflect management's confidence in the company's prospects and is often viewed by investors as a means to support shareholder value.

- We'll explore how the newly authorized US$25 million share buyback could influence U.S. Physical Therapy's investment narrative moving forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

U.S. Physical Therapy Investment Narrative Recap

Shareholders in U.S. Physical Therapy are often drawn by the company's potential to benefit from growing patient volumes, ongoing clinic expansion, and efforts to improve operational efficiency. While the recent US$25 million share buyback announcement may reflect management's positive outlook, it is not expected to materially shift the immediate catalysts of volume growth or acquisition activity, nor does it resolve continuing industry risks such as reimbursement pressure.

Among recent company updates, the November 5, 2025 earnings report stands out, highlighting both year-over-year increases in revenue and net income. These gains underscore the ongoing importance of patient volume growth as a catalyst, even as reimbursement challenges and cost pressures linger in the background.

However, despite the emphasis on rewarding shareholders, it's essential to remember that ongoing reimbursement headwinds may still impact future results...

Read the full narrative on U.S. Physical Therapy (it's free!)

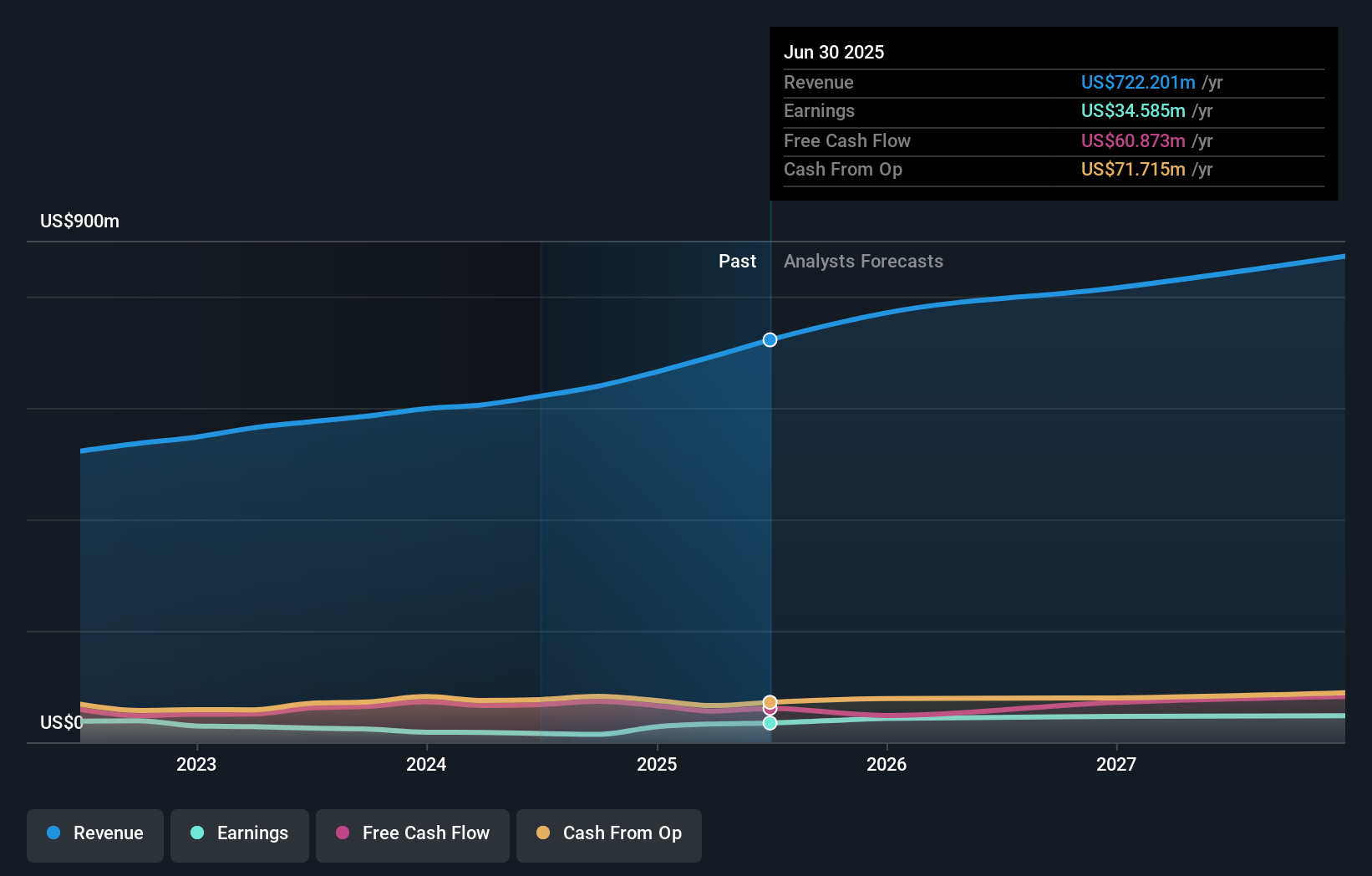

U.S. Physical Therapy is projected to reach $918.4 million in revenue and $52.5 million in earnings by 2028. This outlook assumes an 8.3% annual revenue growth rate and an increase in earnings of $17.9 million from the current $34.6 million.

Uncover how U.S. Physical Therapy's forecasts yield a $106.83 fair value, a 56% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for U.S. Physical Therapy stand at a single point of US$106.83 across one submission from the Simply Wall St Community. While some see strong potential amid rising patient volumes, concerns about ongoing Medicare reimbursement cuts remain top of mind for many market watchers.

Explore another fair value estimate on U.S. Physical Therapy - why the stock might be worth as much as 56% more than the current price!

Build Your Own U.S. Physical Therapy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free U.S. Physical Therapy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U.S. Physical Therapy's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com