Did Piper Sandler's (PIPR) Private Markets Push with Former Forge Global Team Shift Its Investment Narrative?

- Piper Sandler Companies recently announced the launch of a private markets trading initiative, hiring Patrick Gordon, Kyle Mooney, and David Ilishah as managing directors, all joining from Forge Global to lead this effort.

- This move represents a significant push into trading equity shares of private companies, backed by nearly two decades of private securities experience from the new team.

- We’ll examine how Piper Sandler’s expansion into private markets could influence its overall investment story and future business mix.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is Piper Sandler Companies' Investment Narrative?

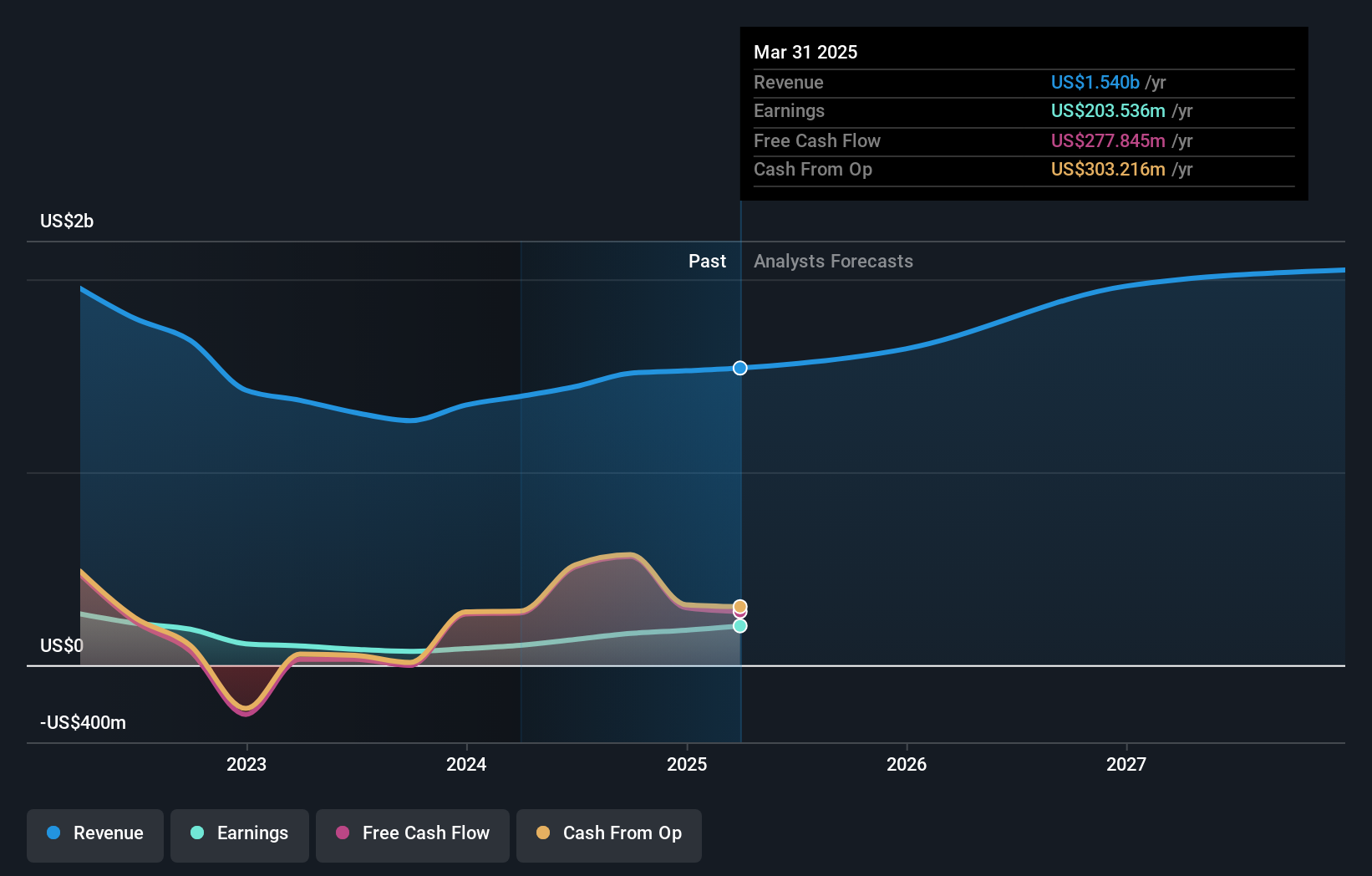

For shareholders in Piper Sandler Companies, the investment thesis often centers on consistent revenue expansion, disciplined profitability, and value signals like a price to earnings ratio below the sector average. The firm's latest move into private markets trading, with a seasoned team from Forge Global, could add a new growth driver and diversify revenue streams if it gains traction. In the short term, though, fundamental catalysts like quarterly earnings momentum and capital management, reflected in recent buybacks and dividends, may remain the primary focus, as the financial impact of the new initiative may take time to become evident. The most important risks likely still involve execution in new business lines and sustainability of profit margins amid competition, but the private markets move brings an element of uncertainty worth monitoring. If the rollout gains speed, it could change perceptions of both risk and reward for Piper Sandler’s current business model.

Yet, the future profitability of new private market operations is still far from certain for investors to watch.

Exploring Other Perspectives

Explore 3 other fair value estimates on Piper Sandler Companies - why the stock might be a potential multi-bagger!

Build Your Own Piper Sandler Companies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Piper Sandler Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Piper Sandler Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Piper Sandler Companies' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com