How Olin's (OLN) Strategic Braskem Partnership Could Shape Its Position in Brazilian Vinyls

- On November 11, 2025, Olin Corporation announced a long-term strategic partnership with Braskem to supply ethylene dichloride (EDC), supporting Braskem’s transformation of its Brazilian chlor-alkali and vinyl assets and reinforcing Olin's global vinyls strategy.

- This agreement allows Olin to pivot additional EDC volumes from its dissolved Blue Water Alliance venture to higher-value and structural relationships in the fast-growing Brazilian PVC market, underscoring its approach to expanding value through integrated operations and disciplined partnerships.

- To assess the impact of this partnership on Olin's investment thesis, we will examine how leveraging its EDC cost advantage in Brazil may support growth and margin improvements.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Olin Investment Narrative Recap

Investing in Olin requires confidence in its ability to manage cyclical commodity headwinds, capitalize on demand for chemicals, and execute on cost optimization efforts. The recent EDC supply partnership with Braskem positions Olin to shift volumes into the higher-growth Brazilian PVC market but does not materially change the short-term catalyst of needed structural cost reductions, nor does it immediately mitigate ongoing risks from global EDC overcapacity and price pressure. The agreement supports Olin's long-term vinyls strategy, though persistent oversupply and volatile pricing remain critical issues for revenue and margins.

Of the recent company announcements, Olin’s ongoing structural cost reduction initiatives stand out as most relevant in this context, with operational savings targeted to boost margin quality amid industry supply-demand imbalances. While the Braskem partnership could help Olin lever its cost position, margin recovery still depends heavily on its ability to deliver cost discipline and efficiency across the business as EDC pricing remains under strain.

Yet, investors should not ignore increased regulatory and tariff risks, especially as market access and trade flows can shift unexpectedly…

Read the full narrative on Olin (it's free!)

Olin's outlook anticipates $7.4 billion in revenue and $375.3 million in earnings by 2028. This scenario assumes annual revenue growth of 3.6% and an earnings increase of $389.4 million from the current earnings of -$14.1 million.

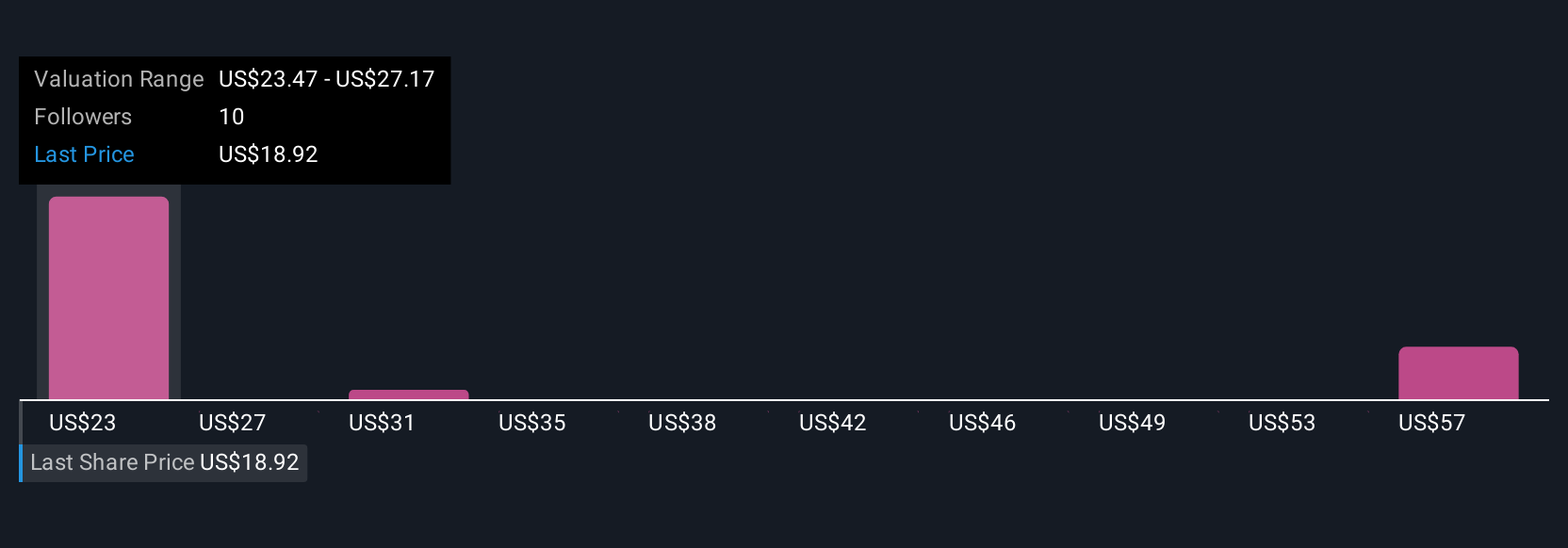

Uncover how Olin's forecasts yield a $24.73 fair value, a 25% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community fair value estimates for Olin range widely from US$24.73 to US$99.71, based on five distinct analyses. While many see future profit growth as a key catalyst for the company, the broad spectrum of opinions highlights just how differently market participants view Olin’s performance outlook, consider exploring several approaches to inform your perspective.

Explore 5 other fair value estimates on Olin - why the stock might be worth over 5x more than the current price!

Build Your Own Olin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Olin research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Olin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Olin's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com