Will Herbalife’s (HLF) Flavor Expansion Reveal Lasting Consumer Demand or Just Quench Short-Term Trends?

- Earlier this month, Herbalife expanded its Liftoff energy product line in the U.S. and Puerto Rico, introducing two new soda-inspired flavors, Cola and Ginger Beer, with science-backed ingredients and convenient stick packs, available exclusively through Independent Distributors.

- This move underscores Herbalife’s commitment to tapping into the fast-growing functional beverage market with products tailored to evolving consumer tastes and preferences.

- We'll assess how the Liftoff flavor expansion could influence Herbalife's outlook, especially given the product's strong performance in nutrition clubs.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Herbalife Investment Narrative Recap

To be a shareholder in Herbalife, you need to believe in the company's strategy to innovate across nutrition and energy products, leveraging its robust distributor network and consumer trust. The latest Liftoff flavor expansion positions Herbalife within a fast-growing segment, but the immediate impact on the company's most important catalyst, accelerating North American sales, appears limited, while ongoing regulatory scrutiny of multi-level marketing remains the primary risk to monitor.

Of all recent announcements, Herbalife's updated guidance for 2025 full-year net sales, narrowing expectations but maintaining a forecast for Q4 growth, stands out. This suggests cautious optimism about new product launches, but also reflects the company's current challenges in returning to robust, sustained top-line improvement within a maturing market.

Yet, in contrast to new product launches, the enduring risk from rising global regulatory scrutiny is a key factor investors should keep in mind...

Read the full narrative on Herbalife (it's free!)

Herbalife's narrative projects $5.6 billion in revenue and $152.6 million in earnings by 2028. This requires 4.4% yearly revenue growth and a $172.4 million decrease in earnings from the current $325.0 million.

Uncover how Herbalife's forecasts yield a $9.33 fair value, a 22% downside to its current price.

Exploring Other Perspectives

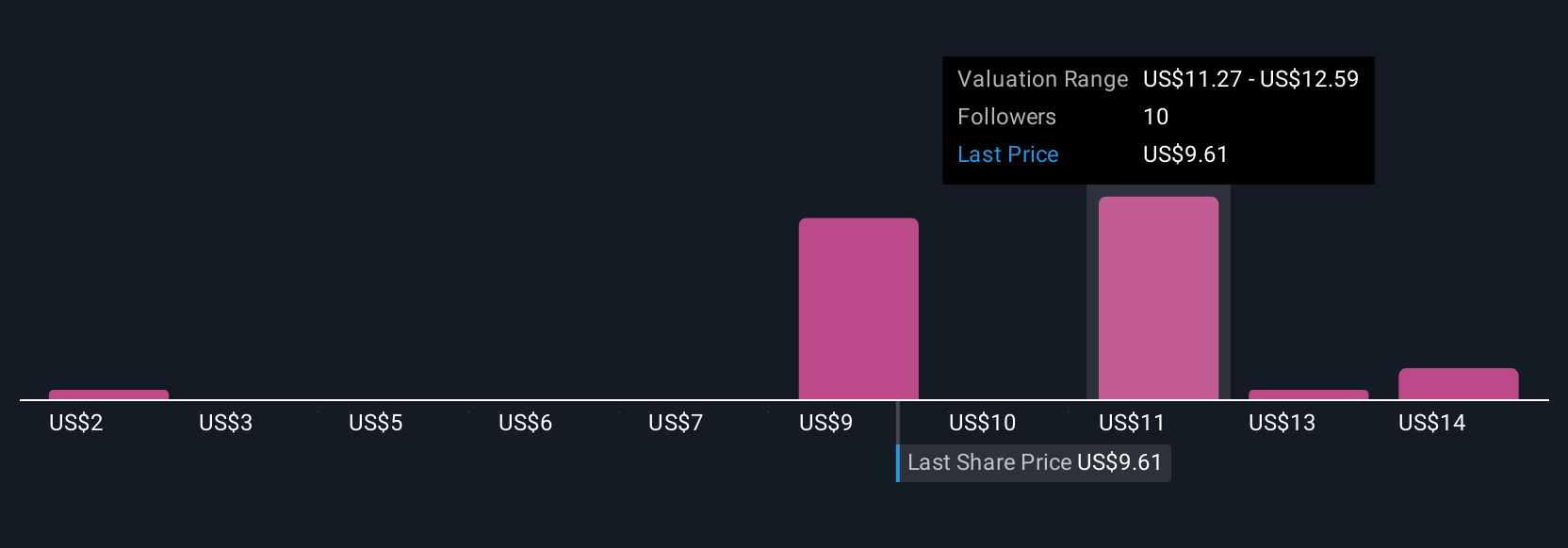

The Simply Wall St Community’s seven fair value estimates for Herbalife range from US$2.06 to US$18.87 per share, showing meaningful differences in outlook. With regulatory scrutiny on multi-level marketing highlighted as a key risk, you may want to explore these varied viewpoints before making your own call.

Explore 7 other fair value estimates on Herbalife - why the stock might be worth less than half the current price!

Build Your Own Herbalife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Herbalife research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Herbalife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Herbalife's overall financial health at a glance.

No Opportunity In Herbalife?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com